Bitcoin is marching larger, easing previous $70,000 and $72,000 prior to now two days, sparking a wave of demand. Though costs are shifting inside a decent vary at spot charges, the uptrend stays. Whereas there are pockets of weak spot, no less than seen earlier right this moment, candlestick formation within the day by day and weekly charts level to power.

Is Bitcoin Making ready For A 6X Surge To $462,000?

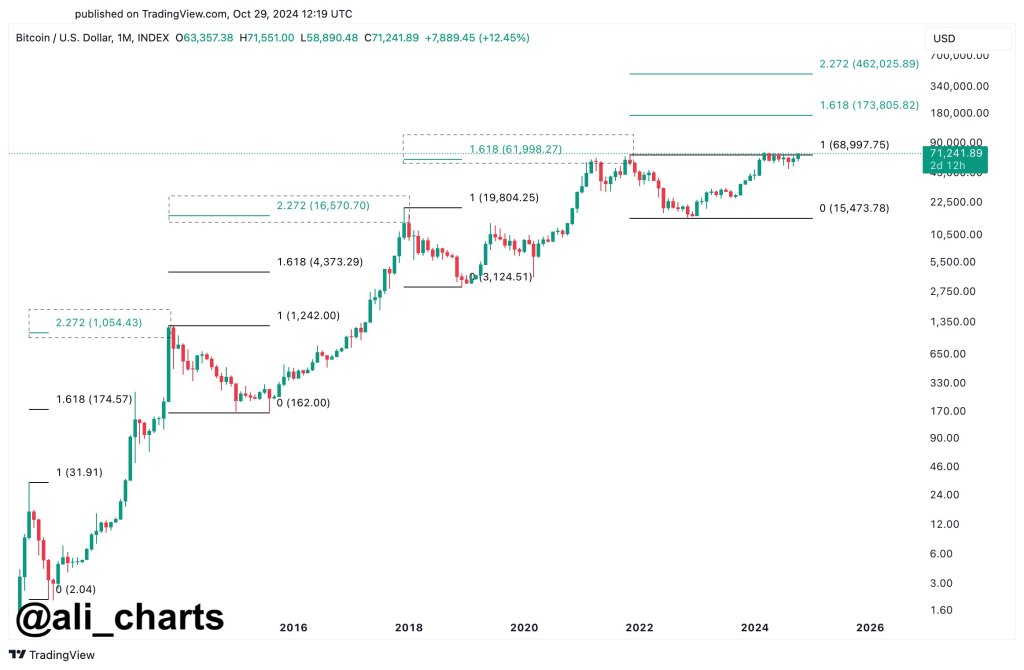

In a put up on X, one analyst thinks Bitcoin is not going to solely break above its all-time excessive at $74,000 however can simply 6X to over $462,000 within the coming classes. To help this outlook, the analyst stated the coin is breaking out above key resistance ranges, and Fibonacci extension ranges mirror this shift in development after the Q3 2024 plunge.

Primarily based on the analyst’s evaluation, historic worth motion reveals that BTC peaks between the 1.618 and a couple of.272 Fibonacci extension ranges. Technical analysts use this device to challenge how briskly costs will rally or drop primarily based on a given vary.

If historical past guides and the Fibonacci extension ranges stay legitimate, making use of the identical sample to the present cycle might simply see Bitcoin soar to between $174,000 and $462,000. These two ranges mark the extension ranges’ decrease and higher limits that outline previous cycles’ peak zone.

As bullish as this forecast is, it needs to be identified that the vary anchoring any Fibonacci extension is subjective. For that reason, it would change relying on the analyst, that means potential peaks will shift accordingly.

Regardless of the whole lot, the consensus is that Bitcoin might break and attain new all-time highs in This fall 2024. Taking to X, one other analyst stated Bitcoin is already inside a bullish breakout formation, easing above a descending channel or bull flag. On the identical time, costs are breaking above the resistance of a “cup and deal with” sample.

Establishments Shopping for As BTC Recovers

If bulls take over, pushing costs larger, the evolution would verify features of Q1 2024. Subsequently, it might mark the resumption of bulls, an encouraging improvement following the 30% drop from March highs.

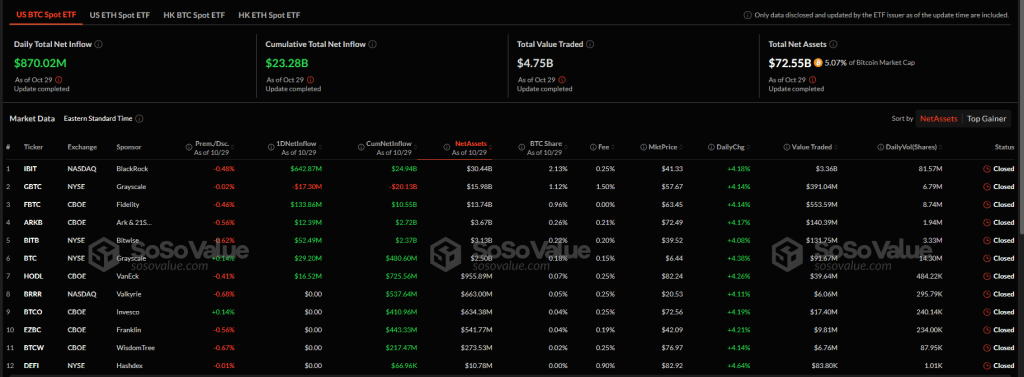

Amid this wave of optimism, establishments are additionally pouring in, getting publicity by way of spot Bitcoin ETFs. In line with SosoValue, there are large inflows as establishments purchase extra shares on behalf of their shoppers.

On October 29, spot Bitcoin ETF issuers in the USA purchased $870 million value of shares backed by BTC for his or her shoppers. BlackRock’s IBIT obtained $642 million, pushing their BTC beneath administration to over $24.9 billion.