Bitcoin spent the weekend buying and selling inside a comparatively slim vary of $91,700 to $88,700, demonstrating sturdy worth motion. Regardless of the shortage of great worth motion, the constant capacity to carry inside this vary underscores Bitcoin’s present power and rising market confidence.

Key information from CryptoQuant provides additional optimism, revealing a notable discount in promoting stress. The information signifies fewer sellers available in the market, aligning with the broader bullish sentiment that has fueled Bitcoin’s current momentum. With the provision aspect constrained, demand may propel BTC increased, reinforcing the robust worth motion seen over the weekend.

Associated Studying

This optimistic backdrop has sparked predictions of aggressive surges within the coming months as Bitcoin stays well-positioned to capitalize on favorable market dynamics. Analysts recommend that with promoting stress restricted and demand persevering with to develop, Bitcoin might be gearing up for its subsequent vital breakout.

Buyers are watching carefully to see if this power will result in a brand new section of upward momentum, probably pushing BTC into uncharted territory because the market anticipates the subsequent main transfer on this bullish cycle.

Bitcoin Circulate To Exchanges Helps Bulls

Bitcoin has had an exhilarating few weeks, surging 39% in simply 9 days and marking considered one of its most aggressive upward strikes this cycle. The current rally has left analysts and buyers each excited and cautious as Bitcoin continues to point out resilience above key ranges. Whereas many count on BTC to keep up its bullish trajectory, alternatives to purchase at decrease costs have gotten more and more scarce.

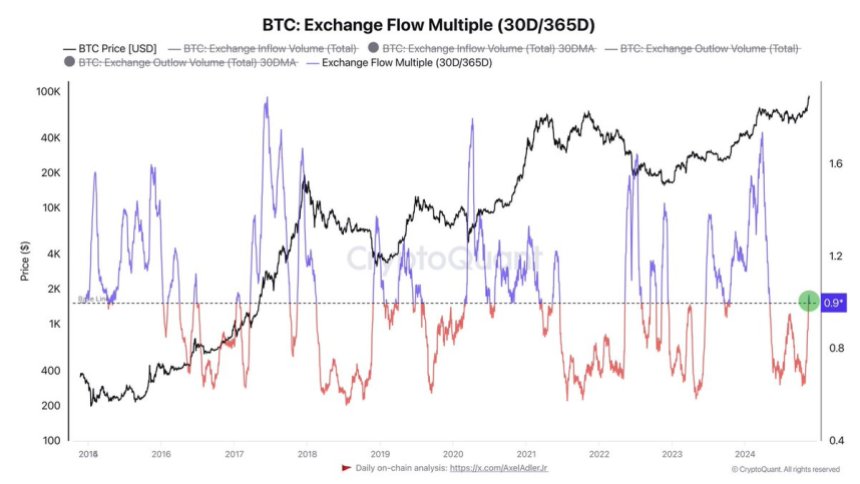

Information from CryptoQuant analyst Axel Adler provides precious perception into the present market dynamics. Adler notes that the common circulate of Bitcoin to exchanges over the previous 30 days has not surpassed the common quantity over the past twelve months.

This means a scarcity of great promoting stress, suggesting that present holders are extra inclined to retain their Bitcoin than promote into the rally. With fewer sellers available in the market, Bitcoin’s worth has the potential to climb additional as demand will increase.

Associated Studying

Nonetheless, analysts agree that consolidation across the present worth vary could be a wholesome step earlier than the subsequent leg up. Consolidation may enable the market to stabilize, appeal to contemporary demand, and set up stronger help ranges for the subsequent development section.

BTC Much less Than 2% Away From ATH

Bitcoin is buying and selling at $91,700, slightly below 2% away from its all-time excessive (ATH) of $93,483. This proximity to record-breaking ranges has fueled optimism amongst buyers, with the value showing poised to push above the ATH once more this week. Bitcoin’s worth motion stays sturdy, supported by rising demand and bullish sentiment available in the market.

The sustained power of BTC’s worth has been attributed to its capacity to keep up key ranges in periods of consolidation. This resilience signifies patrons proceed to dominate, reinforcing the opportunity of one other breakout above the $93,483 mark. Analysts count on breaching this degree would probably spark one other wave of aggressive shopping for, probably driving Bitcoin additional into uncharted territory.

Associated Studying

Nonetheless, warning stays warranted. A breakdown under $87,000 would sign a retrace for Bitcoin, probably initiating a short-term correction within the coming days. Such a transfer may present a more healthy basis for the subsequent development section, permitting BTC to consolidate and appeal to contemporary demand.

Featured picture from Dall-E, chart from TradingView