Bitcoin has noticed a plunge below the $93,000 degree through the previous day. Right here’s what the development in an indicator suggests about what might be behind this downturn.

Bitcoin Coinbase Premium Hole Has Gone Chilly

As identified by CryptoQuant neighborhood analyst Maartunn in a brand new submit on X, the Coinbase Premium Hole has returned to impartial ranges not too long ago. The “Coinbase Premium Hole” right here refers to an indicator that retains monitor of the distinction between the Bitcoin value listed on Coinbase (USD pair) and that on Binance (USDT pair).

This metric primarily tells us about how the shopping for or promoting behaviours differ between the person bases of the 2 cryptocurrency exchanges. Coinbase’s important site visitors is made up of American traders, particularly giant institutional entities, whereas Binance serves traders all over the world.

When the Coinbase Premium Hole has a optimistic worth, it means the US-based whales are collaborating in a better quantity of shopping for or a decrease quantity of promoting than the Binance customers, which is why the asset is dearer on Coinbase. Equally, it being damaging implies a internet increased shopping for stress on Binance.

Now, here’s a chart that exhibits the development within the Bitcoin Coinbase Premium Hole over the previous couple of days:

As displayed within the above graph, the Bitcoin Coinbase Premium Hole had been at notable optimistic ranges earlier, however through the previous day, its worth has declined to the impartial zero mark.

In accordance with Maartunn, the supply of the optimistic premium was Microstrategy’s newest shopping for spree. Certainly, the cooldown within the indicator matches up with the timing of the completion of the $5.4 billion buy by Michael Saylor’s agency. The numerous accumulation from the corporate had helped the cryptocurrency keep its current highs, however with the shopping for stress depleted, Bitcoin has retraced to cost ranges below $93,000.

BTC and the Coinbase Premium Hole have held a detailed relationship all through 2024, so the metric might be to regulate within the close to future, as the place it goes subsequent might as soon as once more foreshadow the asset’s subsequent vacation spot. Naturally, a decline into the damaging area may spell additional bearish motion for its value.

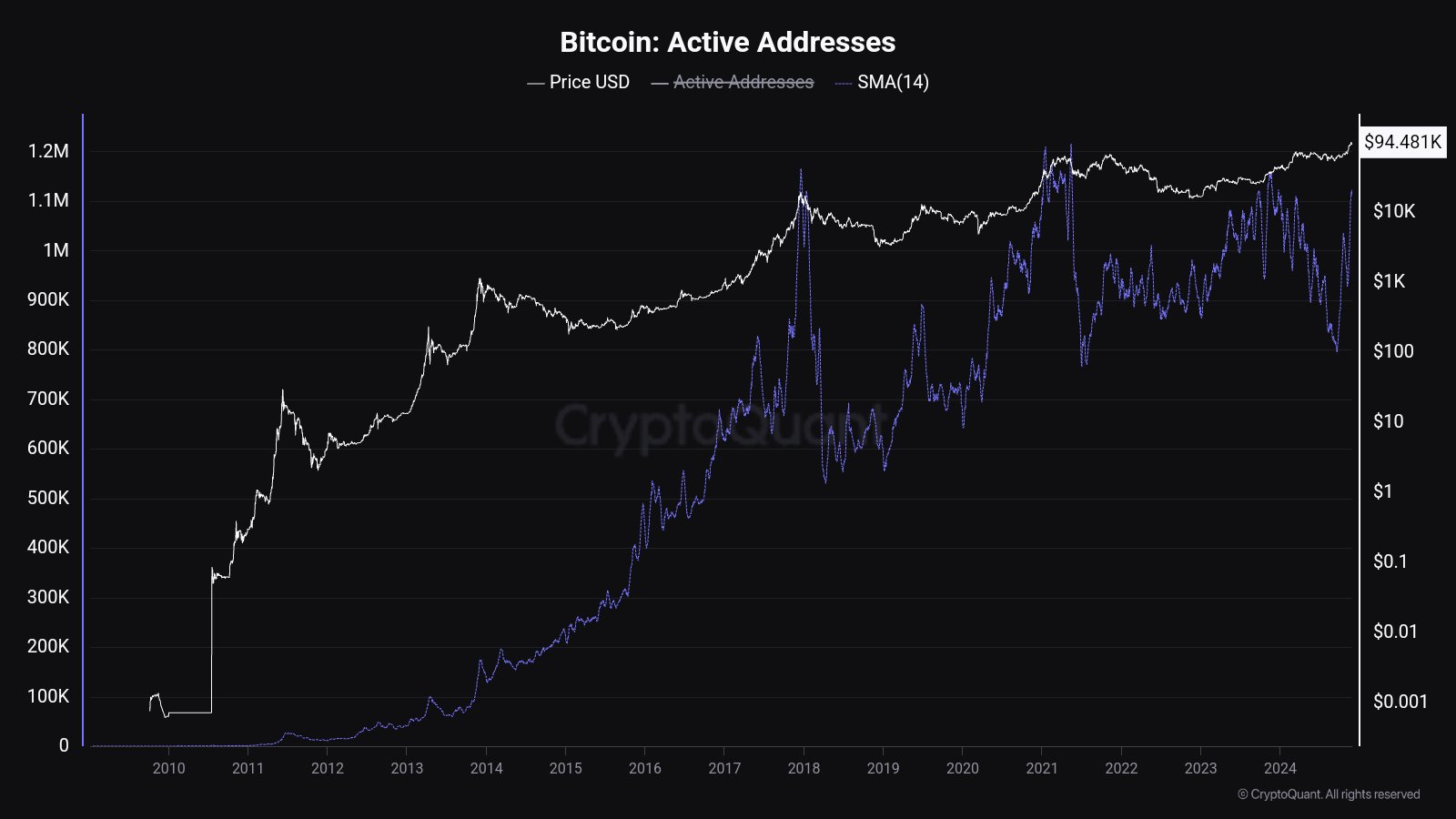

In another information, the Bitcoin Energetic Addresses indicator has noticed a pointy soar not too long ago, as Maartunn has shared in one other X submit. This metric retains monitor of the each day variety of addresses which can be collaborating in some form of transaction exercise on the community.

Under is the chart shared by the CryptoQuant analyst for the 14-day easy shifting common (SMA) of the Energetic Addresses:

With this newest surge, the 14-day SMA of the Bitcoin Energetic Addresses has reached its highest level in eleven months. This implies that loads of exercise has not too long ago occurred on the community. Provided that the asset has gone down up to now day, although, the newest person curiosity has actually not come for getting.

BTC Worth

On the time of writing, Bitcoin is floating round $92,400, down virtually 6% during the last 24 hours.