Every week, Benzinga’s Inventory Whisper Index makes use of a mix of proprietary knowledge and sample recognition to showcase 5 shares which can be slightly below the floor and deserve consideration.

Buyers are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies obtainable to retail merchants, the problem typically lies in sifting by the abundance of knowledge to uncover new alternatives and perceive why sure shares must be of curiosity.

Here is a take a look at the Benzinga Inventory Whisper Index for the week of Sept. 27:

Monolithic Energy Methods MPWR: A chipmaker specializing in energy administration methods noticed shares commerce larger on the week and curiosity improve after a raised worth goal from Stifel.

The analyst maintained a Purchase ranking and raised the value goal from $1,000 to $1,100.

Monolithic reported second-quarter monetary leads to August. Within the second quarter, income was up 15.0% year-over-year to $507.4 million. CEO Michael Hsing highlighted that the outcomes confirmed the corporate’s transformation from being only a chip provider “to a full options supplier.”

Monolithic shares had been up 3.3% over the past 5 buying and selling days, as seen on the Benzinga Professional chart under, and are up 53.5% year-to-date in 2024.

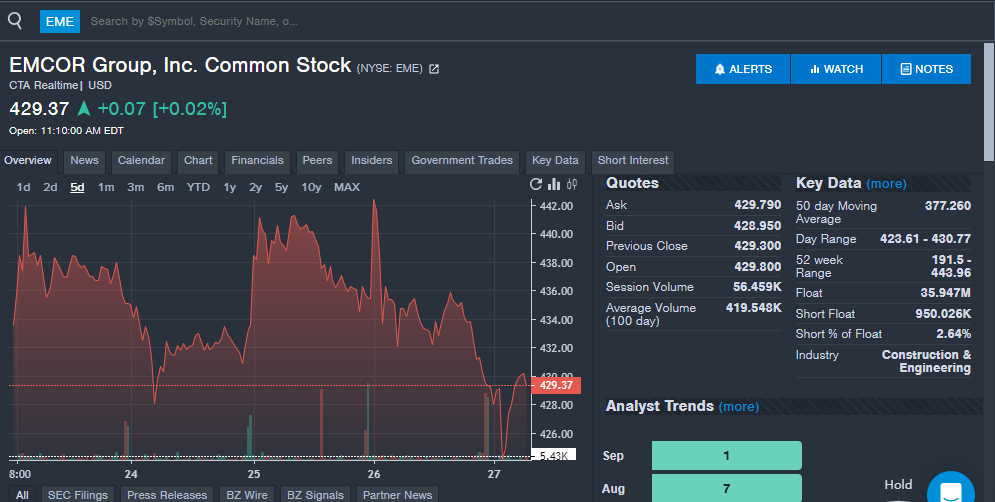

EMCOR Group EME: {The electrical} and manufacturing development and services providers supplier gained curiosity from readers over the week, which could possibly be associated to imminent earnings or the current Fed fee minimize.

The corporate is about to report third-quarter monetary leads to October. Analysts anticipate the corporate to report income of $3.77 billion and earnings per share of $4.98, up from $3.21 billion and $3.61, respectively, in final yr’s third quarter.

EMCOR Group has crushed analyst income estimates in 16 straight quarters and earnings per share estimates in 9 straight quarters. The current rate of interest minimize may show useful to the corporate as this might result in elevated spending by the personal sector.

EMCOR shares had been down 2% over the past 5 buying and selling days, however stay up over 50% year-to-date.

Learn Additionally: EXCLUSIVE: High 20 Most-Searched Tickers On Benzinga Professional In August 2024 – The place Do Tesla, Nvidia, Apple, AMD Inventory Rank?

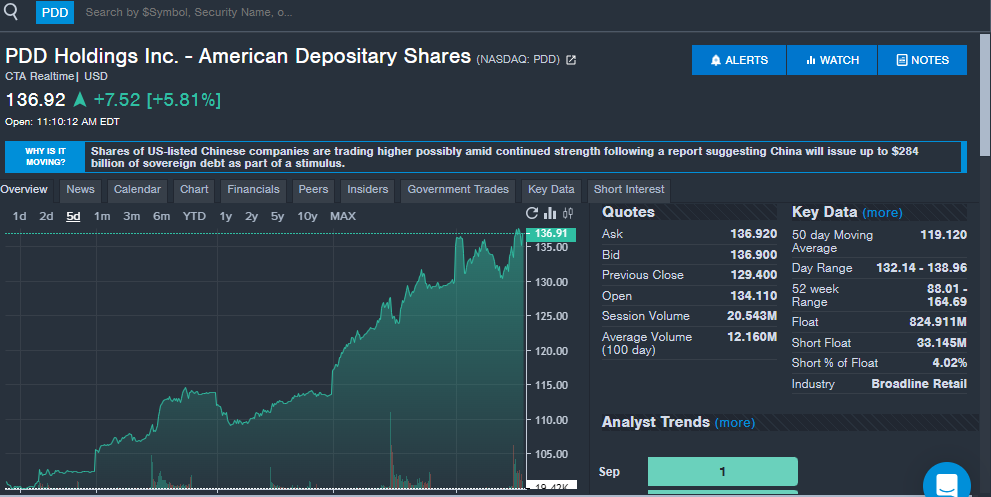

PDD Holdings Inc – ADR PDD: The Chinese language commerce firm was certainly one of a number of to take pleasure in a lift with the nation saying a financial stimulus to residents.

Of the Chinese language shares, PDD Holdings noticed the biggest improve in curiosity from Benzinga readers over the past week.

The proprietor of a number of commerce platforms in China and Temu within the U.S. may benefit from the stimulus and elevated spending in China because it additionally appears to be like to develop in different worldwide markets.

PDD Holdings shares are up 35% over the past 5 days, however stay down on a year-to-date foundation.

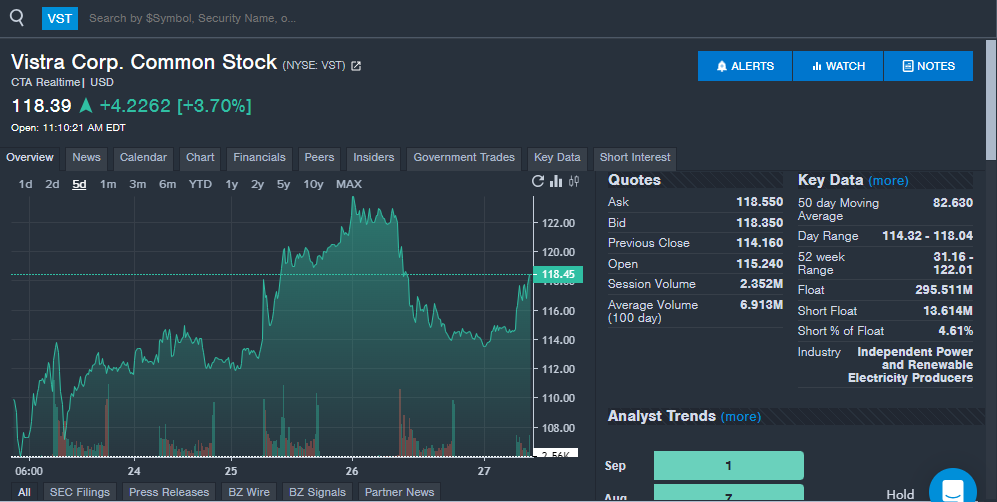

Vistra Corp VST: Vistra was certainly one of a number of power associated corporations to see a elevate in share worth and curiosity associated to a big deal between Constellation Vitality and Microsoft. The power sector, particularly corporations with publicity to nuclear power, are seeing rising curiosity because of the rising demand for knowledge facilities and AI infrastructure. Vistra has been getting elevated consideration from analysts in September.

Jefferies initiated protection of the inventory with a Purchase ranking and $99 worth goal, solely to lift its worth goal to $137 a number of weeks later. BMO maintained an Outperform ranking and raised the value goal from $120 to $125. Morgan Stanley maintained an Obese ranking and raised the value goal from $110 to $132.

Vistra inventory was up 8% over the past week. With a year-to-date achieve of over 209%, Vistra is likely one of the best-performing shares in 2024.

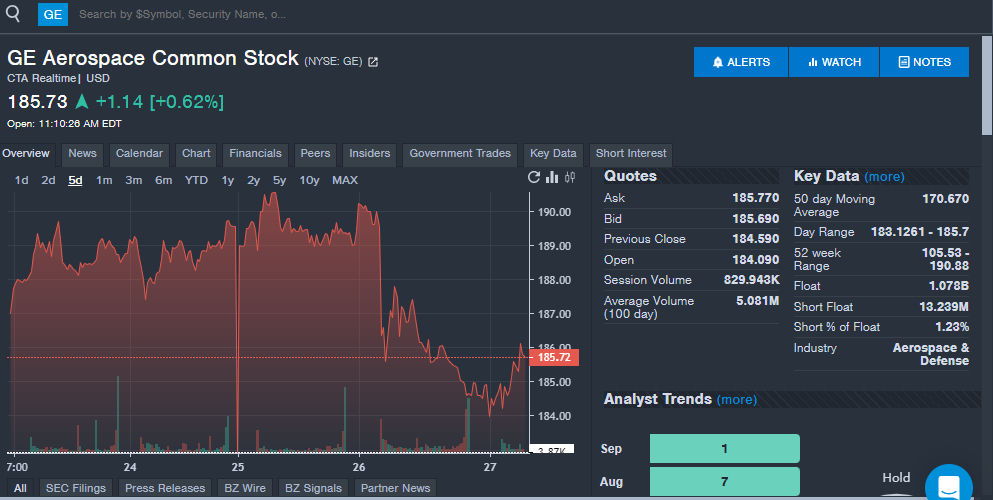

GE Aerospace GE: The aerospace large noticed elevated curiosity from readers through the week as shares commerce close to 52-week highs. The corporate introduced the launch of AI Wingmate in collaboration with Microsoft through the week, an initiative that might enhance worker productiveness.

“The launch of AI Wingmate will rework worker productiveness, permitting our folks to spend extra time fixing our prospects’ hardest issues,” GE Aerospace Chief Info Officer David Burns mentioned.

GE Aerospace beforehand appeared on the Inventory Whisper Index because of elevated curiosity within the protection sector forward of the 2024 presidential election. Freedom Capital Markets Chief International Strategist Jay Woods beforehand advised Benzinga the protection inventory could possibly be a winner whether or not its Donald Trump or Vice President Kamala Harris that wins the election.

The aerospace firm is about to report third-quarter monetary leads to October. The corporate has crushed income estimates from analysts in 10 straight quarters and crushed earnings per share estimates from analysts in seven straight quarters.

GE Aerospace shares are up over 80% year-to-date in 2024, with the chart under displaying the dip on the week.

Keep tuned for subsequent week’s report, and comply with Benzinga Professional for all the newest headlines and prime market-moving tales right here.

Learn the newest Inventory Whisper Index stories right here:

Learn Subsequent:

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.