The Nasdaq 100 closed decrease by round 0.5% throughout Wednesday’s session. Traders, in the meantime, targeted on some notable insider trades.

When insiders promote shares, it could possibly be a preplanned sale, or might point out their concern within the firm’s prospects or that they view the inventory as being overpriced. Insider gross sales shouldn’t be taken as the one indicator for investing or buying and selling choice. At greatest, it might probably lend conviction to a promoting choice.

Beneath is a have a look at just a few current notable insider gross sales. For extra, try Benzinga’s insider transactions platform.

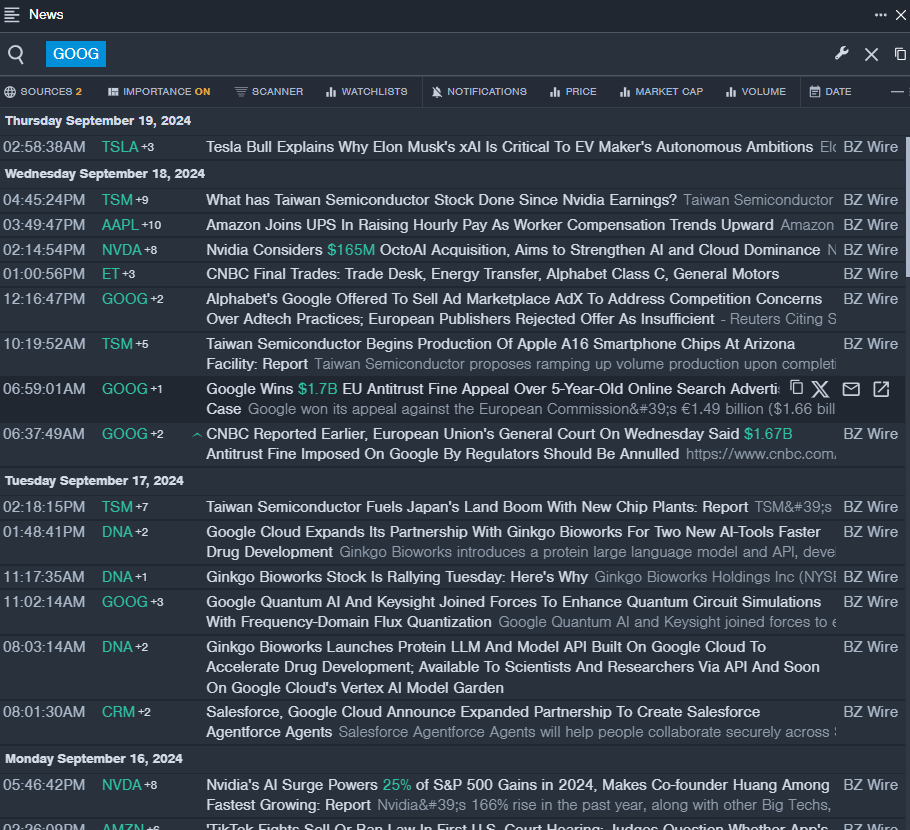

Alphabet

- The Commerce: Alphabet Inc. GOOGL GOOG CEO Sundar Pichai offered a complete of twenty-two,500 shares at a median worth of $160.63. The insider acquired round $3.61 million from promoting these shares.

- What’s Taking place: Alphabet’s Google gained its enchantment in opposition to the European Fee’s €1.49 billion ($1.66 billion) antitrust advantageous for anticompetitive practices involving its on-line search promoting enterprise.

- What Alphabet Does: Alphabet is a holding firm that wholly owns web large Google.

- Benzinga Professional’s real-time newsfeed alerted to newest GOOG news.

Williams-Sonoma

- The Commerce: Williams-Sonoma, Inc. WSM President and CEO Laura Alber offered a complete of 40,000 shares at a median worth of $145.27. The insider acquired round $5.8 million from promoting these shares.

- What’s Taking place: On Sept. 16, TD Cowen analyst Max Rakhlenko maintained Williams-Sonoma with a Purchase and raised the worth goal from $150 to $160.

- What Williams-Sonoma Does: With a retail and direct-to-consumer presence, Williams-Sonoma is a participant within the $300 billion home house class and $450 billion worldwide house market, targeted on increasing its publicity within the B2B ($80 billion whole addressable market), market, and franchise areas.

- Benzinga Professional’s charting software helped establish the development in WSM inventory.

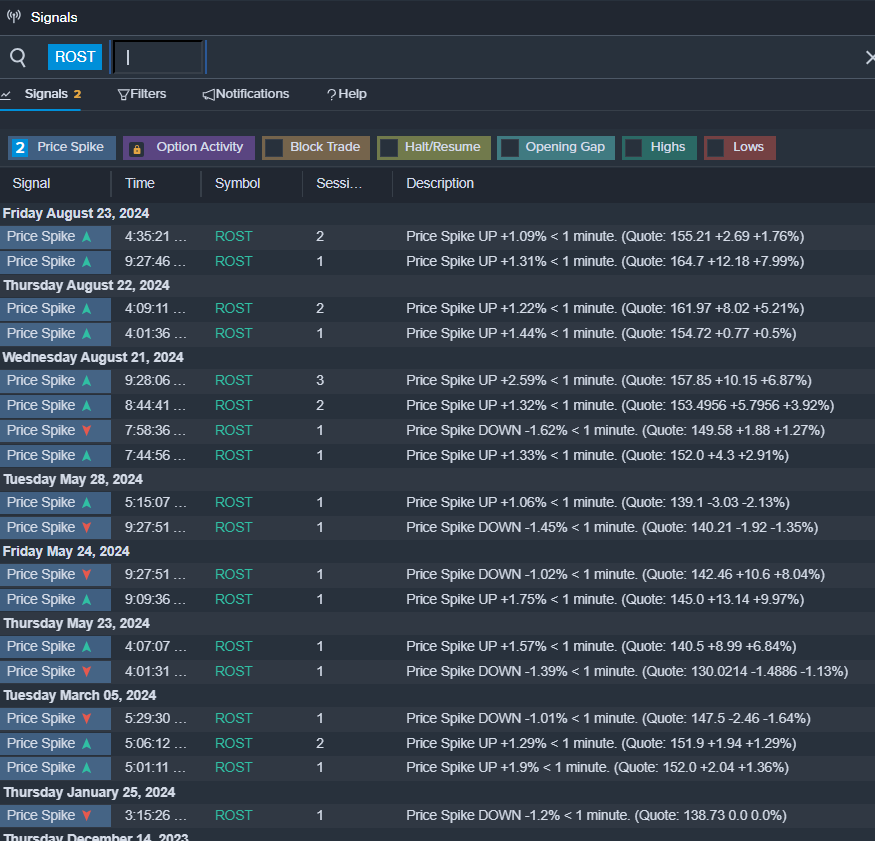

Ross Shops

- The Commerce: Ross Shops, Inc. ROST Group President, COO Michael J. Hartshorn offered a complete of 8,366 shares at a median worth of $155.64. The insider acquired round $1.3 million from promoting these shares.

- What’s Taking place: On Aug. 22, Ross Shops reported better-than-expected second-quarter monetary outcomes and raised its FY24 EPS steering with its midpoint above estimates.

- What Ross Shops Does: Ross Shops operates as an off-price attire and equipment retailer with the vast majority of its gross sales derived from its Ross Gown for Much less banner.

- Benzinga Professional’s indicators characteristic notified of a possible breakout in ROST shares.

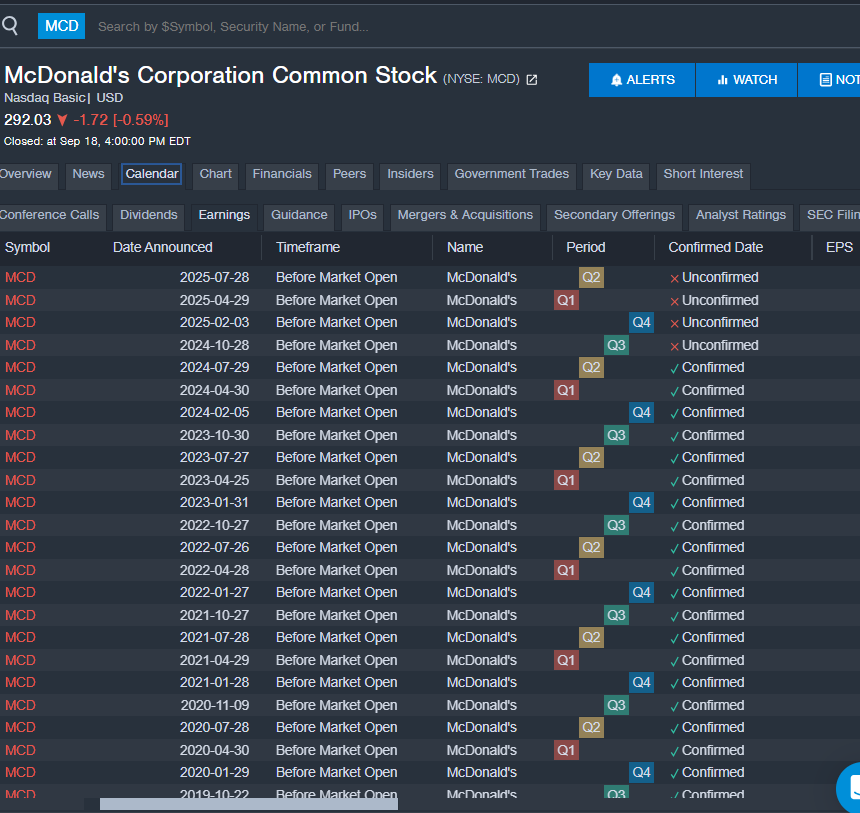

McDonald’s

- The Commerce: McDonald’s Company MCD Chairman and CEO Christopher J Kempczinski offered a complete of three,934 shares at a median worth of $300.00. The insider acquired round $1.2 million from promoting these shares.

- What’s Taking place: On Sept. 16, JP Morgan analyst John Ivankoe maintained McDonald’s with an Chubby and raised the worth goal from $270 to $290.

- What McDonald’s Does: McDonald’s is the biggest restaurant owner-operator on the earth, with 2023 system gross sales of $130 billion throughout almost than 42,000 shops and 115 markets.

- Benzinga Professional’s earnings calendar was used to trace upcoming MCD’s earnings reports.

Learn Subsequent:

Market Information and Knowledge delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.