Welcome to Cash Diaries the place we’re tackling the ever-present taboo that’s cash. We’re asking actual folks how they spend their hard-earned cash throughout a seven-day interval — and we’re monitoring each final greenback.

As we speak: an accountant who’s at the moment unemployed and who spends a few of her cash this week on a gift from her finest buddy’s child registry.

Should you’d wish to submit your personal Cash Diary, you are able to do so through our on-line kind. We pay $150 for every revealed diary. Apologies however we’re not capable of reply to each e mail.

Occupation: Unemployed

Business: N/A

Age: 34

Location: New Jersey

Wage: $0 (earnings earned from final function: $54,040).

Property: Worker inventory plan: $1,186.60; restricted inventory: $78,570; retirement investments: $64,444.23; EFT investments: $1,307.61; HSA contributions: $36.38; financial savings contributions: $1,978.76

Debt: Bank card debt: $15,213.32; pupil loans: $14,876.

Paycheck quantity: $659 per week, from unemployment.

Pronouns: She/her

Month-to-month Bills

Housing prices: My month-to-month lease is $1,426.56 and I dwell on my own.

Mortgage funds: $0 (I don’t have any month-to-month mortgage funds as a result of my pupil loans are at the moment in deferment and I additionally opted for the income-driven plan, since I’m at the moment not incomes a whole lot of earnings).

Renter’s insurance coverage: $17.01

Automotive insurance coverage: $183.40

Weblog subscription: $23

Disney+: $20.24

Apple iCloud storage: $2.99

Google Cloud storage: $1.99

Adobe: $13.85

Dash telephone invoice: $105.07

Electrical energy: $50

Web: $75

Tithes: $450

Financial savings: $140

Bank cards: $215

Auto/transportation: $300

Life insurance coverage: $152.28 (that is semi-annual).

Was there an expectation so that you can attend increased schooling? Did you take part in any type of increased schooling? If sure, how did you pay for it?

I used to be not anticipated to attend increased schooling. My mom by no means sat me right down to have a dialog about attending school. It was a provided that I wished to go, based mostly by myself notion of the world and success. I believed that to have monetary stability and a profession, increased schooling was a minimal requirement. In my highschool you had been a lame in the event you didn’t go to school. I attended a complete of three totally different colleges. Proper after faculty I went to an in-state HBCU and because it was a personal faculty, that’s the place I incurred most of my pupil mortgage debt. I solely went there for a 12 months after which transferred to an area USC campus for a semester and racked up just a little little bit of pupil mortgage debt there. I solely went there for a semester as a result of I needed to drop out of college since I might now not afford it. I paid for each colleges through monetary support, grants, pupil loans and so forth. After that semester at USC, I moved to NYC to stick with my household to work and lower your expenses to return to high school and ended up graduating with a bachelor’s in accounting from Brooklyn School. I didn’t need to take out any loans whereas attending Brooklyn School. NYC offered a beneficiant quantity of economic support and grants since I used to be thought-about a low-income pupil. Additionally, the associated fee for a CUNY faculty was very reasonably priced for New York state residents.

Rising up, what sort of conversations did you might have about cash? Did your dad or mum(s)/guardian(s) educate you about funds?

I didn’t actually have conversations about cash rising up until my mom offered a proof for why she couldn’t afford to purchase one thing that appeared like an apparent need and never a necessity. My mom couldn’t actually educate me on funds as a result of there was lots she didn’t know and he or she needed to study from her errors as she was elevating me and my sister. Sadly, each of my mom’s dad and mom died when she was younger so there was lots she and her siblings needed to study by trial and error. The teachings I’ve discovered about cash come from watching her errors whereas I used to be rising up. I discovered the significance of credit score when she wasn’t capable of co-sign a pupil mortgage for me to attend faculty out of state. I discovered the significance of all the time saving for a wet day after I needed to work for a 12 months and a half to save cash to return to high school. I discovered about private finance my freshman 12 months in school after I needed to take private finance as a prerequisite course. Anything I’ve discovered was by studying articles and books, listening to podcasts after they grew to become a factor, and being curious sufficient to ask questions of people that appeared educated.

What was your first job and why did you get it?

My first job was as a gross sales affiliate on the Banana Republic Manufacturing unit retailer after I was 16. I received the job to assist at residence with payments and to complement upcoming bills for my junior 12 months in highschool.

Did you are worried about cash rising up?

I frightened about cash lots rising up. Earlier than I might even consider asking my mom for one thing, I needed to resolve if it was a need or a necessity and contemplate the time-frame through the month I used to be asking. I’ve all the time understood the idea of when lease is due and the way usually utilities are paid as a result of my mom could be very clear. I’m unsure if it was a superb or unhealthy factor. I assume it was good, in a way, that she wished to elucidate why she needed to inform me ‘no’, so I might perceive prioritizing requirements and never take it personally. However alternatively, it did create a degree of fear and concern at an early age that I nonetheless form of cope with as an grownup.

Do you are worried about cash now?

Sure, I fear about cash on a regular basis. It consumes a whole lot of my ideas as a result of I’m at the moment in search of work and never in a financially secure place in the intervening time. Plus I’ve this cloud of bank card debt over my head that feels very overwhelming to consider at instances and makes me query the choices I’ve made alongside my journey — however all I can do is take the teachings I’ve discovered and do higher going ahead. I take into consideration my monetary future lots and query if I’ll ever get forward, as an alternative of feeling like I’m all the time catching up. Don’t get me incorrect, the requirements are all the time taken care of; what issues me is the debt that I’ve amassed over time to complement not sufficient earnings.

At what age did you turn out to be financially accountable for your self and do you might have a monetary security web?

I’d say I grew to become financially accountable for myself after I turned 16, which was after I received my first part-time job working in retail. I bear in mind one summer time I had two part-time jobs to verify I had sufficient saved for senior 12 months and to arrange to go to school and dwell on campus. From that time on, when it got here to my cellular phone, garments, meals or no matter bills I had, I used to be fully accountable for paying the invoice. Not as a result of I wished to however sadly my mom might solely afford to pay for requirements like lease, electrical energy and meals. I bear in mind in highschool when me and my sister received our first automotive that we shared: We put up the cash for the down fee, break up the month-to-month funds and paid for insurance coverage, gasoline and maintenance. My mom couldn’t afford to do this since she was a single mom of dual women not incomes sufficient to supply outdoors of what we wanted. Proper now, I’ve an exceedingly small security web: It’s not as a lot because it was once however it’s higher than nothing. Sadly, I had to make use of all of it after I stop my job through the pandemic with out a backup plan. Since then, I’ve been working contract/freelance roles and it’s been laborious to maintain an honest security web through the gradual months.

Do you or have you ever ever obtained passive or inherited earnings? If sure, please clarify.

Sure, I obtain passive earnings on a quarterly and annual foundation. I beforehand labored at a fintech firm for nearly six years and was awarded inventory choices with my annual bonus every year. I exercised these choices after I left the corporate so I obtain quarterly and annual dividend funds.

Day One

10:30 a.m. — I get up so drained from getting residence late from a buddy’s cookout final night time. As we speak seems like a day that I need to take pleasure in doing completely nothing. I lie in mattress watching YouTube movies till about 12 p.m, then I stand up and bathe. It’s a ravishing time out so I need to go seize one thing to eat.

1:45 p.m. — I am going to select up my meals at this native vegan restaurant. I’m not vegan however I really like their candy potato burger and am within the temper for one thing good and wholesome. The burger comes with a aspect salad and I even have a aspect order of candy plantains. After consuming I sit in an area park to calm down and benefit from the views of NYC from northern New Jersey. $21.11

4:30 p.m. — It begins to rain so I go away and head again residence. Round 5 p.m. could be thought-about dinnertime for me however I’m not that hungry, so I skip dinner and luxuriate in watching a sitcom on Hulu.

7:30 p.m. — I chat on the telephone to an in depth buddy, catching up and listening to about her weekend and newest courting tea.

10:30 p.m. — I go to sleep as a result of I’m nonetheless drained from not getting sufficient sleep over the previous couple of days.

Each day Whole: $21.11

Day Two

9:30 a.m. — I stand up and begin my day. I’ve oatmeal and peanut butter for breakfast.

11:30 a.m. — I am going over my to-do listing for the week and create a listing of jobs that I need to apply for this week.

12:30 p.m. — I make a name to my automotive insurance coverage firm to grasp why my month-to-month premium has gone up (it went from $183 to $196 monthly). I’m advised it’s on account of a lower in my driving rating that the insurance coverage app tracks to obtain a reduction.

1 p.m. — I am going on the web site for pupil loans to finish a mortgage deferment request since I’m at the moment unemployed, and my mortgage deferment is up for recertification.

2 p.m. — I eat lunch: a frozen orange hen that I received from Dealer Joe’s just a few weeks in the past.

2:30 p.m. — I work on an software/essay for a venture administration apprenticeship that I need to apply for.

5:45 p.m. — I am going to select up my sister so we are able to go for a three-mile stroll at a close-by park.

7 p.m. — I notice that I’ve some rewards factors for Chick-fil-A so I am going to get a spicy hen sandwich at no cost.

8:15 p.m. — After I drop my sister off, I am going to Complete Meals to get some vanilla vegan cupcakes and salad. I get residence and eat one of many cupcakes, then return to engaged on the essay for the apprenticeship software. $12.98

11:30 p.m. — I head to mattress.

Each day Whole: $12.98

Day Three

4 a.m. — I get up randomly. I begin reviewing funds since my direct deposit hit my account. At about 5 a.m. I begin scrolling by numerous apps out of boredom as a result of I can’t return to sleep.

9:30 a.m. — I stand up and take a bathe. Over the weekend I made a decision I wished to do a religious quick so I gained’t be consuming from 5 a.m. to five p.m. every day for the following two days, to deal with spending extra time studying the Bible and constructing religious self-discipline. I don’t eat breakfast; as an alternative I spend time studying scripture, praying and writing in my prayer journal.

1 p.m. — I resolve I need to go to an area park to take a seat out within the solar and browse earlier than it begins raining. At about 4:15 p.m. I go away the park to go to my mom’s home.

5 p.m. — Whereas at my mom’s home, I make a salad and eat a banana. Since I’m at my mother’s home, I don’t need to pay for it.

5:45 p.m. — I meet up with a buddy to attend an area Bible examine that lasts for just a little over an hour.

8 p.m. — I head residence to eat a few of the salad I purchased from Complete Meals on Monday.

9:30 p.m. — I learn some scriptures and journal for about an hour earlier than going to mattress at about 10:45 p.m.

Each day Whole: $0

Day 4

8 a.m. — I get my day began — bathe, brush my enamel and so forth. Afterwards I spend time in prayer, devotion and journaling.

10:15 a.m. — I head to fulfill up with pals at an area espresso store to cowork. I spend $7.20 on native avenue parking for about six hours. Since I’m fasting, I don’t order any meals whereas on the cafe. $7.20

1 p.m. — I take a break to spend a while on prayer and devotion.

1:45 p.m. — I spend the remainder of the afternoon researching and making use of for jobs.

5 p.m. — I go away the cafe to go residence and eat. I’ve a salad with caesar dressing and cashews and drink loads of water.

7 p.m. — I calm down on the sofa and FaceTime with my sister for a bit (we do day by day check-ins).

8 p.m. — I keep in mind that I’ll be driving to Queens on Friday to attend a funeral so I add $23.59 to my E-ZPass, since I must pay tolls to go from New Jersey to New York Metropolis. $23.59

8:30 p.m. — I watch a dwell podcast on YouTube and go to mattress round 11 p.m.

Each day Whole: $30.79

Day 5

8 a.m. — I get up to get my day began. I learn devotional, pray and spend time journaling in my prayer journal since I’m nonetheless fasting.

9:30 a.m. — I get within the bathe and do the standard morning routine of brushing my enamel and getting out my garments for the day since I will likely be coworking once more with my pals. This time we will likely be coworking inside my buddy’s residence constructing since they’ve a delegated workplace house.

10:05 a.m. — I lastly go away the home and it’s raining cats and canine. I debate if I ought to take the prepare and stroll over to my buddy’s home because it’s inaccessible by transit. I resolve to not take the prepare because it’s raining so laborious and it doesn’t appear to be it’s going to let up. At 10:40 a.m. I get to my buddy’s home after rolling round in search of parking a bit (I discover a spot close by and pay $7.10 for all the day). $7.10

11:15 a.m. — As soon as I get settled into the coworking house, I keep in mind that I’ve to pay a parking violation that was due final month — if I miss one other deadline I must seem in courtroom. I pay the parking ticket, which features a late payment and a processing payment. $53.56

11:15 a.m. — I analysis and apply for jobs.

1:45 p.m. — I take a break to learn scripture and journal. At 4 p.m. I finish my day. Me and my pals head upstairs to my buddy’s residence for a “comfortable hour” besides I don’t take part since I’m fasting.

5 p.m. — My buddy makes me veggies for dinner (since they’re her groceries, I don’t need to pay). I’ve potatoes, asparagus and broccoli. We watch the Olympics till about 7:30 p.m. after which I head residence.

8 p.m. — I get residence and begin to unwind from the day and to arrange for tomorrow, since I’m going to have an early begin.

9 p.m. — I learn scripture, pray and journal. After that I eat one other salad, drink water and head to mattress at 10 p.m.

Each day Whole: $60.66

Day Six

6:30 a.m. — I get up to spend time in prayer, devotion and journaling. Yesterday was the final day of my religious quick however I need to proceed beginning and ending my day with prayer, devotion and journaling.

8:05 a.m. — I go away the home to move to NYC for a funeral. I’m operating behind so I don’t have time to make breakfast. I arrive in Queens at about 9:15 a.m. and cease at a Walgreens to purchase some chewing gum and mints to carry me over till I can eat. After shopping for this stuff, I head to the funeral residence for the service. $8.51

10:30 a.m. — I go away the funeral residence to attend the burial after which I head to Brooklyn to drop off a buddy who got here with me to the burial.

1 p.m. — I head to my aunt’s home whereas I’m in Brooklyn to test on her and see if she wants something whereas I’m within the space. She says she must go decide up her prescription so we drive downtown to the pharmacy after which I cease at Complete Meals to select up a few objects for her (regardless of her protests). I purchase her some veggies and hen and purchase myself one thing from their sizzling meals bar. $51.31

3:30 p.m. — We head again to my aunt’s residence. My gasoline gentle comes on since I forgot to gasoline up earlier than I left Jersey. I’ve greater than sufficient to get residence however don’t need to likelihood it in case I get caught in site visitors so I get $10 price of gasoline at an area gasoline station. I don’t fill it up as a result of gasoline prices much more in NYC than in Jersey — I put in simply sufficient to get me the place I must go then I’ll cease to get gasoline as soon as I get again residence. $10

4 p.m. — I get again to my aunt’s home and eat lunch, then go away to move again to Jersey as a result of I’m attending a live performance later tonight.

6:15 p.m. — I get again to Jersey and park close to my buddy’s home. They dwell inside strolling distance of the live performance venue so we’re preparing right here then going collectively. I attempt to pay for parking however the parking app doesn’t cost me for some cause so I don’t query it. We’re going to a hip-hop and R&B live performance that we purchased tickets for again in Might — they price about $196.

7:30 p.m. — We arrive on the venue and don’t purchase something whereas we’re there for the reason that live performance truly begins on time. We go away at 11 p.m. and I sit at my buddy’s home for a bit to recap the live performance. At 12 a.m. I head residence and see I’ve obtained a ticket for not feeding the meter (I used to be parked in an space that requires you to pay for parking when there’s an occasion happening). The ticket is $45, which I’ll in all probability attraction for the reason that app wouldn’t enable me to pay. I get residence at 12:15 a.m. and head straight to mattress.

Each day Whole: $69.82

Day Seven

8 a.m. — I’ve signed as much as do a park cleanup for a nonprofit group I volunteer for by offering mentorship to a mentee. I’m nonetheless drained from final night time so I’m shifting a bit slowly. I’ve so as to add $20 to my E-ZPass since I went by extra tolls than anticipated yesterday. $20

9 a.m. — I go away my home to go decide up my mentee; we arrive on the park at about 10:05 a.m. I don’t arrive on time as a result of I make a incorrect flip alongside the best way.

10:05 a.m — Me and my mentee stroll across the park with different attendees choosing up trash. I’ve all the time wished to do a park cleanup so that is form of cool and my mentee enjoys the expertise as nicely. She didn’t have breakfast and by the point we go away it’s lunchtime so I head to Chick-fil-A to get her one thing to eat. I spend $10.87 on a nugget meal for her. I drop her off at her home at 12:30 p.m. $10.87

1 p.m. — I head over to select up my mom to run errands. I cease to get gasoline first and spend $48.83 to replenish my tank since I’m nonetheless on empty from yesterday. $48.83

2 p.m. — I head over to Goal in order that I can decide up some toiletries I would like ($45.56). I’m hungry after, so my mother treats me to Cava since I’ve been her chauffeur for the day. I drop her off at residence at about 3:30 p.m. and go straight residence to take a nap. I get up from my nap at 5 p.m. and spend the remainder of my night time watching Hulu. $45.56

9:30 p.m. — Earlier than going to mattress, I keep in mind that I would like to purchase just a few objects from my finest buddy’s child registry. I head to mattress at 10 p.m. after such a protracted day. $260.62

Each day Whole: $385.88

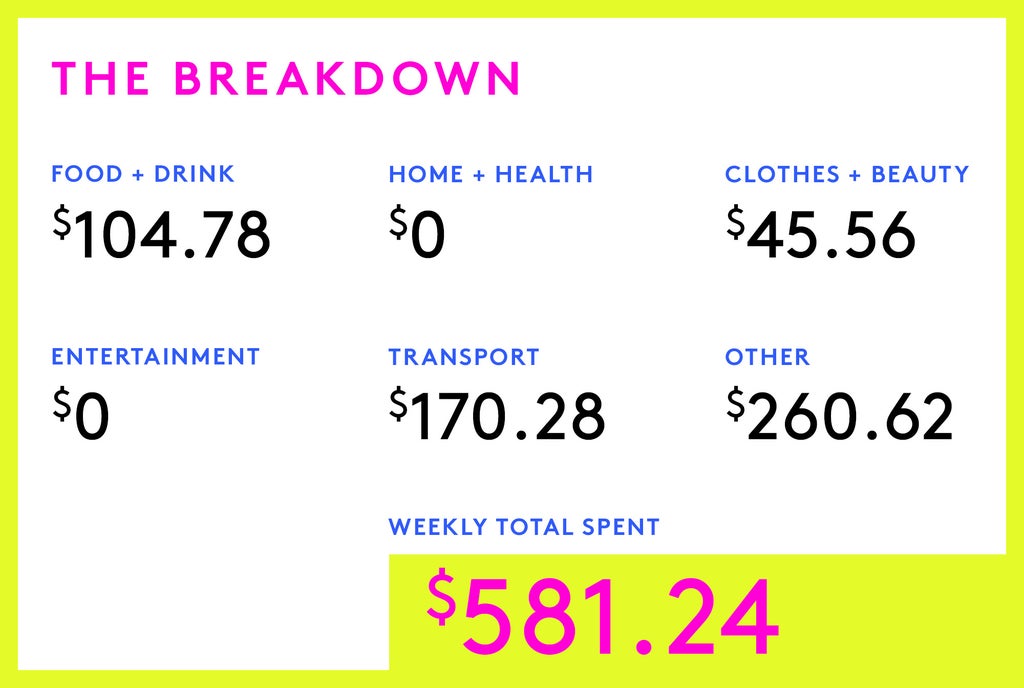

The Breakdown

Cash Diaries are supposed to replicate a person’s expertise and don’t essentially replicate Refinery29’s standpoint. Refinery29 under no circumstances encourages criminality or dangerous conduct.

Step one to getting your monetary life so as is monitoring what you spend — to strive by yourself, take a look at our information to managing your cash every single day. For extra Cash Diaries, click on right here.

Do you might have a Cash Diary you’d wish to share? Submit it with us right here.

Have questions on how you can submit or our publishing course of? Learn our Cash Diaries FAQ doc right here or e mail us right here.

Like what you see? How about some extra R29 goodness, proper right here?

A Week Between Jobs In The Bay Space