Blockchain and Crypto have a sophisticated standing in China: Beijing says no to crypto however sure to blockchain. It bans buying and selling but builds infrastructure.

Now, with Hong Kong providing regulated crypto markets, insiders say a loophole is rising.

If China already permits buyers to purchase U.S. shares by means of its Certified Home Institutional Investor (QDII) program, why not bitcoin? The important thing, one skilled argued on stage at Consensus Hong Kong, is management, and Beijing might have simply discovered a technique to preserve it.

In China, there are two methods for mainland buyers to purchase and promote inventory outdoors the nation. First, there’s QDII, which permits choose buyers to purchase U.S. ETFs utilizing RMB.

Then there’s additionally the Shanghai-Hong Kong Join and Shenzhen-Hong Kong Join, which let Chinese language buyers purchase and promote Hong Kong shares by means of mainland securities corporations, with all trades settled in RMB.

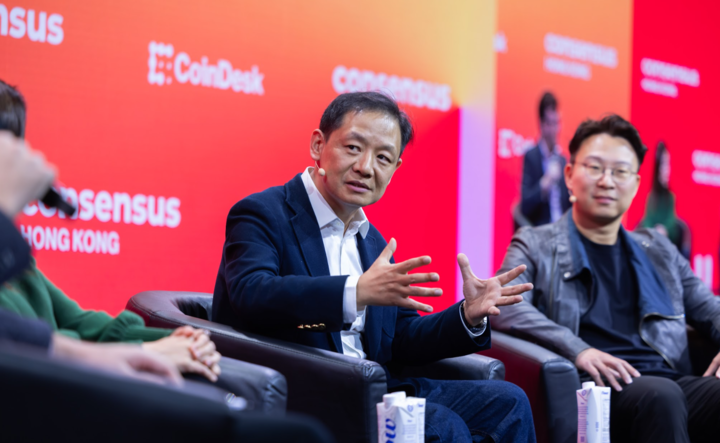

“The important thing [with these systems] is that capital by no means flows freely out of China, and if you happen to apply this identical logic to crypto, there’s no motive it couldn’t work the identical manner,” Yifan He, CEO of Pink Date know-how, stated on stage at Consensus Hong Kong.

He emphasised that the largest regulatory hurdle isn’t crypto itself, however capital controls, making certain that funds don’t transfer freely out and in of China.

These capital controls are in place to stop extreme foreign money fluctuations and capital flight, with a view to preserve the steadiness and worth of the RMB. They’re additionally one of many the explanation why Hong Kong’s crypto ETFs, with their in-kind redemptions, weren’t allowed on the mainland.

“What’s the distinction between a Hong Kong-regulated inventory and a Hong Kong-regulated crypto asset?” He continued. “If they’ve a system so that you can purchase and promote in RMB, however by no means transfer cash outdoors China, then it is simply one other regulated funding product.”

This method wouldn’t enable Chinese language buyers to self-custody their crypto. As an alternative, purchases can be held by an middleman, equivalent to a licensed securities agency.

“They purchase crypto instantly, but it surely’s not like they’re holding it themselves,” He stated, noting that “the safety firm within the center truly holds it for you.”

This mannequin aligns with China’s strategy to inventory and ETF investments.

Simply as mainland buyers can commerce U.S. ETFs by means of QDII however by no means take direct custody, they might achieve publicity to crypto with out proudly owning the underlying property – no cash strikes throughout borders.

For a nation with 200 million retail buyers and an financial system in want of stimulus, regulated crypto entry by means of Hong Kong’s sandbox would possibly supply Beijing a calculated compromise

Blockchain versus Crypto

China has lengthy been a proponent of blockchain know-how, whereas taking a chilly strategy to crypto.

“We do not enable weapons in China, however we are able to nonetheless make metal,” He defined as an analogy. “The know-how isn’t regulated so as to construct every kind of functions. However when some software triggers rules, that’s completely different.”

However primarily based on his conversations with monetary regulators, this may very well be altering.

“I see some sign from monetary regulators,” He stated. “They’re starting to speak about bitcoin, saying we have to pay extra consideration and do extra analysis on digital property.”

Might this result in broader adoption? Two years in the past, He would have stated ‘zero likelihood.’

“Now, I’d say there’s greater than a 50% likelihood in three years,” He concluded.

And you may take these odds to Polymarket, which at present stands at 2% likelihood of China unbanning bitcoin within the nation.