In its latest evaluation, market intelligence agency Messari has supplied a complete overview of the NEAR Protocol’s efficiency in This fall 2024. Regardless of dealing with headwinds within the broader crypto market, NEAR has demonstrated notable resilience by elevated exercise and strategic developments.

Drop In Market Cap Rating However Resilience By means of Elevated Exercise

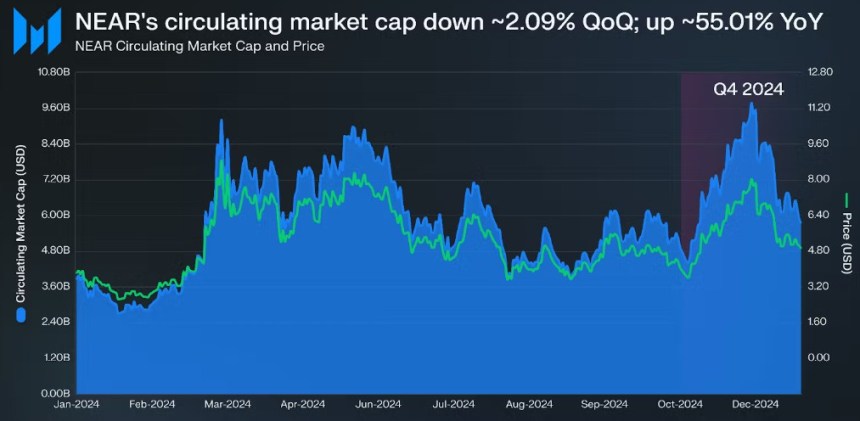

Throughout This fall, NEAR Protocol initially surged, reaching a token value excessive of roughly $8.19 in December earlier than retracing to round $4.91 by the quarter’s finish.

This decline mirrored a major drop in market cap, which fell to roughly $5.73 billion—marking a 2.09% lower quarter-over-quarter (QoQ).

Consequently, NEAR dropped ten spots in market cap rankings, now sitting at twenty first total, indicating a efficiency lag in comparison with different main property.

Regardless of the challenges in market pricing, NEAR’s income, derived from community transaction charges, noticed a considerable enhance. The income grew to about $2.11 million, representing a 26.81% QoQ rise. This progress may be attributed to heightened transaction volumes and decentralized trade (DEX) exercise.

The typical transaction price in the course of the quarter was roughly $0.0031, a 15.91% enhance from the earlier quarter, additional highlighting the community’s operational effectivity.

Associated Studying

The NEAR token performs a multifaceted position throughout the ecosystem, being important for staking, transaction charges, and storage charges. The protocol maintains a versatile provide mannequin, characterised by an annual inflation fee of 5%.

Of the inflationary rewards, 90% are allotted to validators, whereas the remaining 10% helps the protocol’s treasury. As of the tip of This fall, roughly 95.12% of NEAR’s complete provide was in circulation, with about 49.08% actively staked.

The annualized nominal yield from staking was reported at round 8.95%, with an actual yield of 4.55%, offering engaging incentives for holders to stake their tokens.

NEAR loved a surge in tackle exercise and transaction quantity throughout This fall. The typical each day lively returning addresses rose by 15.82% QoQ, reaching 3.55 million, whereas the common each day new addresses surged by 29.05% to 361,046.

Nonetheless, the protocol confronted a decline in developer exercise, with weekly lively core builders reducing by 13.95% to 159 and ecosystem builders falling by 30.34% to 129.

NEAR Balances Market Setbacks With Promising Improvements

NEAR’s DeFi complete worth locked (TVL) concluded This fall at roughly $240.16 million, reflecting a 4.48% decline from the earlier quarter. The Liquid Staking TVL additionally skilled a lower of round 10.32% QoQ, settling at about $250.81 million.

Notably, the LiNEAR Protocol’s TVL was roughly $132.41 million, down 8.77%, whereas Meta Pool’s TVL declined by 11.78% to round $111.70 million.

Associated Studying

On a optimistic notice, NEAR’s common each day DEX quantity reached roughly $8.45 million, marking a 25.40% enhance from the earlier quarter. Ref Finance emerged because the main DEX on the platform, accounting for a median each day quantity of $8.35 million.

This fall additionally noticed an uptick in NEAR’s stablecoin market cap, which grew to about $683.69 million—a rise of 1.88% QoQ and a staggering 880.71% year-over-year (YoY).

As of now, the NEAR’s value stands at $3.52, recording a considerable 10% surge previously two weeks. But, nonetheless 82% under its all-time report excessive.

Featured picture from DALL-E, chart from TradingView.com