Based on an X publish by crypto analyst Ali Martinez, Bitcoin (BTC) is witnessing a decline in sell-side strain, indicating {that a} native market backside could quickly kind for the premier cryptocurrency.

Bitcoin Native Backside On The Horizon?

Bitcoin continues to commerce slightly below the psychologically vital $100,000 stage, hovering at $98,650 on the time of writing. Nevertheless, the highest cryptocurrency by market capitalization is witnessing a notable drop in sell-side strain.

Associated Studying

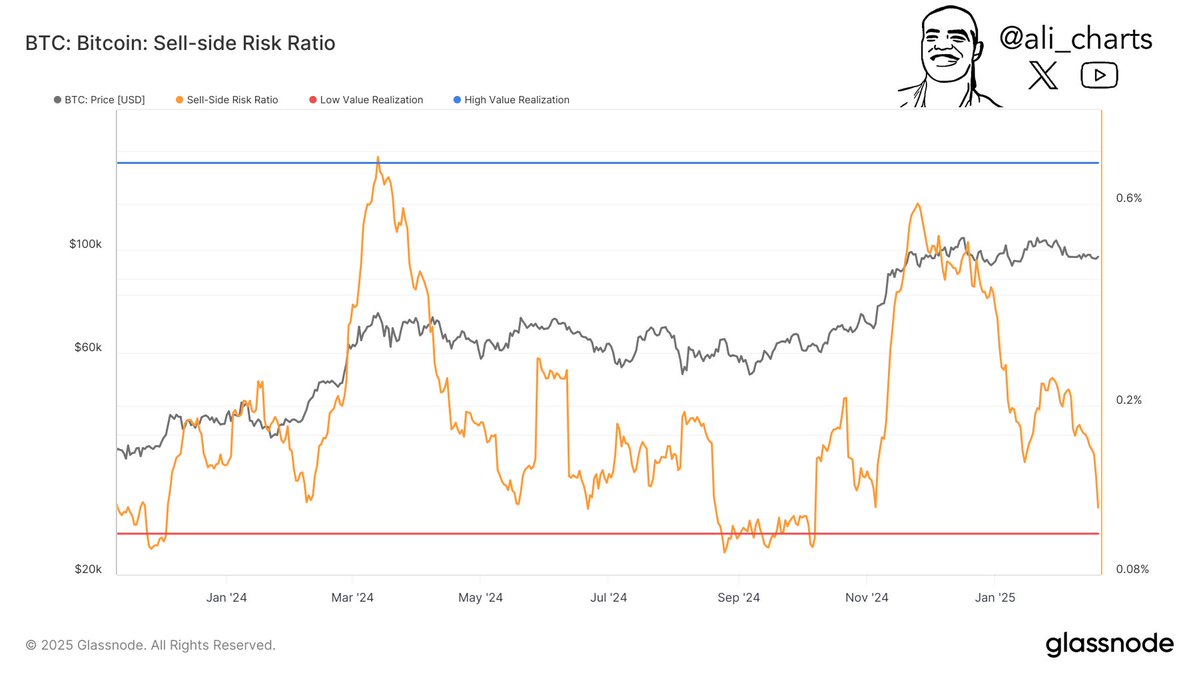

Martinez shared the next Bitcoin Promote-Aspect Threat Ratio chart from crypto analytics platform Glassnode, highlighting a pointy decline within the metric since mid-January 2025. This drop means that BTC could also be forming an area worth backside, probably resulting in a brand new accumulation part.

For these unfamiliar, a declining sell-side danger ratio sometimes signifies that buyers are holding onto their BTC moderately than promoting, signalling the early levels of an accumulation part the place costs could stabilize or start to rise.

Martinez’s evaluation aligns with broader crypto market cycle theories, which recommend that market bottoms are sometimes adopted by an accumulation part. This part, in flip, paves the way in which for a possible worth enhance.

Nevertheless, BTC should maintain above key assist ranges to substantiate this outlook. Crypto analyst Rekt Capital weighed in on Bitcoin’s worth motion, emphasizing the significance of a weekly shut above $97,000 to take care of its greater low as assist.

The analyst shared a Bitcoin weekly chart, noting that whereas BTC has seen a number of wicks beneath its symmetrical triangle construction, the general bullish sample stays intact. Nevertheless, failure to shut above $97,000 on the weekly timeframe might enhance the danger of additional draw back.

Equally, fellow analyst Daan Crypto Trades shared a bullish perspective, stating that BTC not too long ago had a “stable break” from a descending channel construction. The analyst added:

Simply have to see the continuation now into the weekend to get a superb base going into subsequent week. $98K is vital within the quick time period.

Is BTC Primed For A New All-Time Excessive?

Whereas Martinez means that BTC could also be forming an area backside, different analysts consider the cryptocurrency is gearing up for a transfer past $108,000, probably reaching a brand new all-time excessive (ATH). Analyst Kevin, for example, predicts {that a} quick squeeze might propel BTC to $111,000.

Associated Studying

Equally, latest evaluation by Rekt Capital highlights that BTC is exhibiting early indicators of a bullish divergence which might break the digital asset’s bearish worth momentum. At press time, BTC trades at $98,650, up 0.1% up to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com