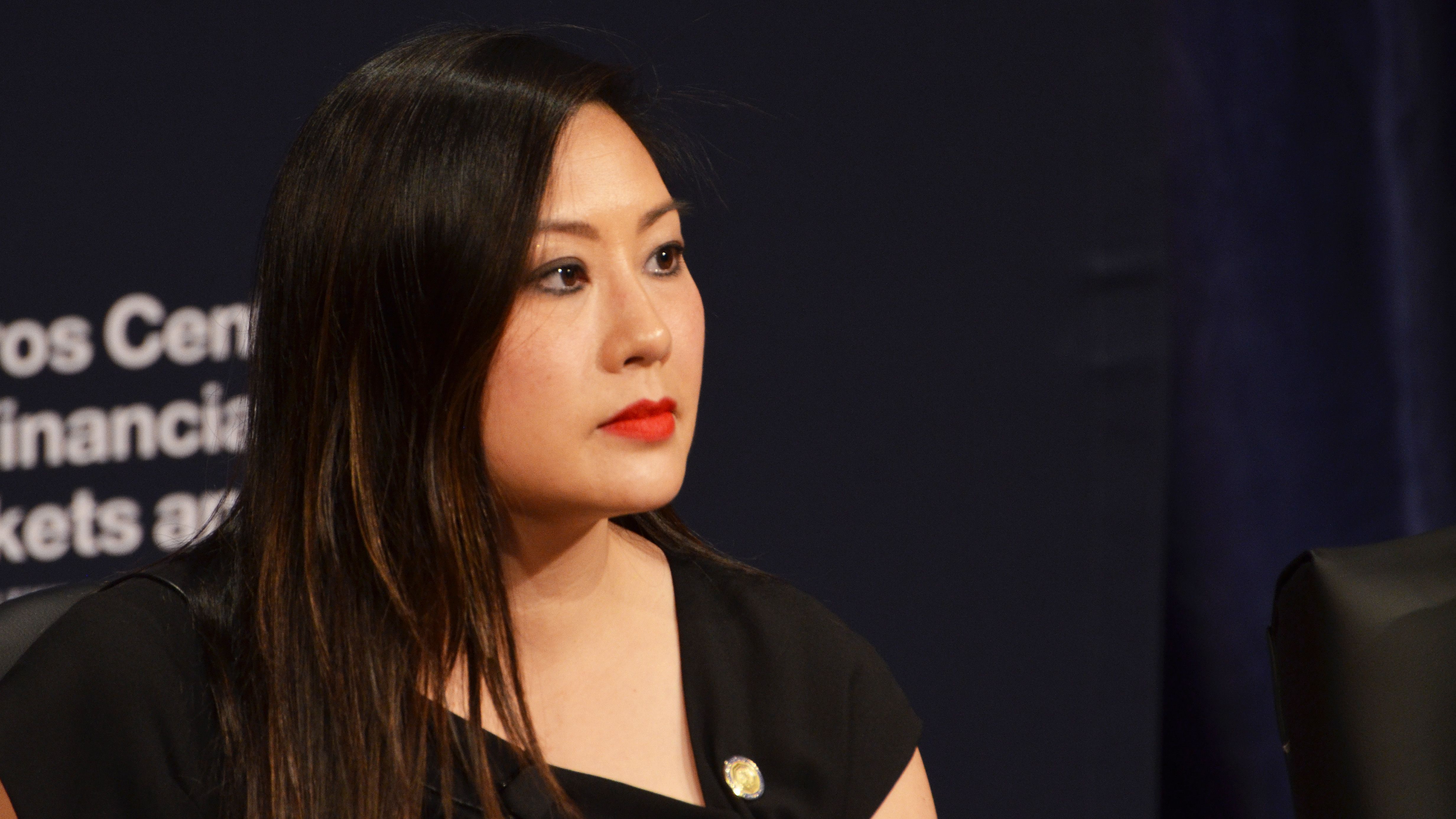

Caroline Pham, who’s working the U.S. Commodity Futures Buying and selling Fee on an performing foundation, is pursuing a stablecoin-backed tokenization pilot program, and an upcoming summit will embody the heads of Coinbase, Ripple, Circle, Crypto.com and different digital belongings corporations.

Pham had instructed the thought for a so-called regulatory sandbox on tokenization by means of her advisory committee, the International Markets Advisory Committee, in November, however that hadn’t been embraced by the company’s earlier management.

“I’m excited to announce this groundbreaking initiative for U.S. digital asset markets,” Appearing Chairman Pham mentioned in an announcement on Friday. “I sit up for partaking with market members to ship on the Trump Administration’s promise of making certain that America leads the best way on financial alternative.”

The concept, based mostly in what Pham known as “accountable innovation,” would push into the usage of non-cash collateral “by means of distributed ledger expertise,” in response to the company.

MoonPay’s CEO, Ivan Soto-Wright, will even be amongst these attending.

“All through her tenure as commissioner of the CFTC, we’ve all the time held Caroline Pham’s opinions on how the ecosystem can evolve within the highest regard,” he mentioned in an announcement on Friday. “She is a rational, honest and progressive thinker, and it’s our honor to take part on this discussion board.”

The November suggestion from Pham’s advisory committee had anticipated permitting market members to check out non-traditional collateral.

“By bettering the operational infrastructure for belongings already eligible to function regulatory margin, blockchain or different distributed ledger expertise (“DLT”) may help scale back or remove a few of these challenges with out requiring any modifications to collateral eligibility guidelines,” the advice instructed. “Market members also can use their present insurance policies, procedures, practices, and processes to determine, assess, and handle dangers to utilizing DLT, like they do for different types of market infrastructure and applied sciences.”

A date and additional particulars for the discussion board of digital belongings CEOs hasn’t but been set.

As performing chairman, Republican Commissioner Pham has made some dramatic modifications on the U.S. derivatives watchdog in only a few weeks after she started standing in for the earlier Chairman Rostin Behnam, a Democrat appointed by former President Joe Biden. These modifications have included a wide-ranging substitute of senior officers on the company, and one personnel matter involving a former human-resource chief sparked an unusually open and detailed response on Thursday from the CFTC. Spokespeople for the regulator argued that “false allegations” had been made in opposition to Pham by “disgruntled people” the company linked to inner misconduct investigations.

Learn Extra: Trump’s CFTC Choose Clears Prime Ranks of Key US Crypto Regulator

UPDATE (February 7, 2022, 16:40 UTC): Provides the CFTC advisory committee’s earlier suggestion.

UPDATE (February 7, 2022, 19:36 UTC): Provides remark from MoonPay.