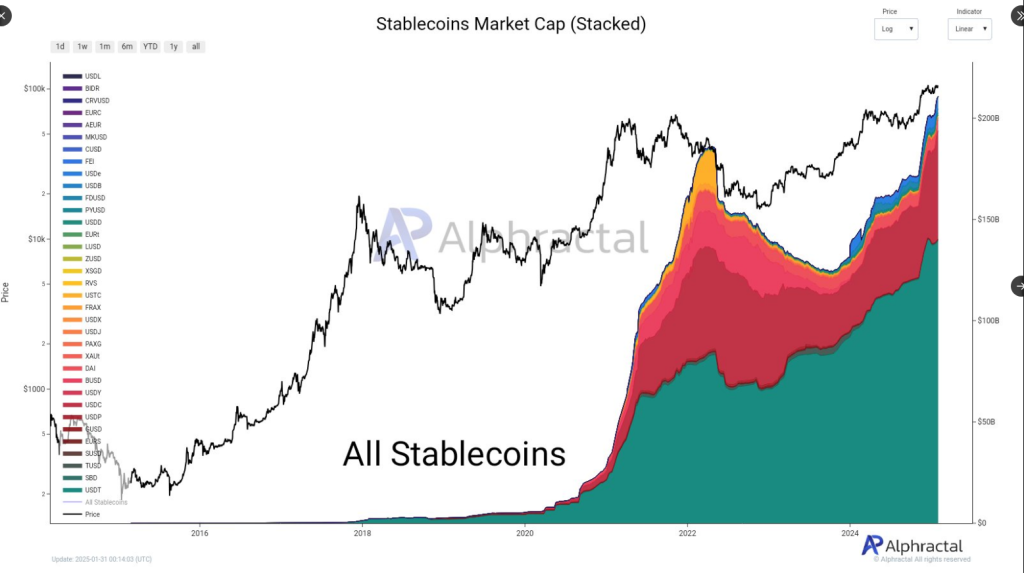

For the previous few months, stablecoins have yielded the highlight to their extra speculative counterparts, together with tokens impressed by politicians. Nevertheless, latest on-chain knowledge means that stablecoins are again and have surpassed the $200 billion market cap.

Associated Studying

Based on the info shared by Alphractal, the section’s capitalization has surged to $211 billion, a report excessive, due to months of secure progress, which began in mid-2023.

Stablecoins‘ market capitalization grew by 73% from its August 2023 worth of $121 billion, up to date knowledge launched on January thirty first present. The first driver of this section’s progress remains to be Tether’s USDT, nevertheless, USDC has been gaining floor just lately, which is fascinating.

🚨 Stablecoin Market Cap Surpasses $211B – USDC Good points Momentum!

Since 2023, the stablecoin market has grown considerably, primarily pushed by USDT (Tether). Nevertheless, just lately, USDC has been gaining an edge over different stablecoins.

This development is going on because of the latest drop in… pic.twitter.com/IRKrQErmCE

— Alphractal (@Alphractal) January 31, 2025

Tether’s USDT Stays Major Driver Of Progress

Since 2023, the stablecoin market has grown regular, principally attributable to Tether’s USDT. As of now, stablecoins are value $223 billion, which is a 0.2% improve from yesterday.

Apparently, USDT and USDC are the current progress drivers of stablecoins. Other than the numbers from each cash, the stablecoins group hasn’t modified a lot since 2023 and has proven regular and common values. Proper now, Tether’s USDT is valued at virtually $140 billion, and USDC is at $53 billion.

USDC Slowly Good points Floor On Different Cash

Alphractal’s publish on Twitter/X reveals that USDC has been gaining floor over different stablecoins out there. Based on the publish, that is occurring attributable to a drop in altcoin costs and since a considerable a part of the sell-offs have been swapped into USDC.

The publish additionally confirmed that USDC’s dominance on this section has hit a key resistance degree, the identical quantity noticed in 2021. This was the beginning of the bear market in 2022 when Bitcoin’s worth dropped to as little as $15,500. If this metric persists, it could function the market’s bearish sign, impacting traders’ shopping for selections. Nevertheless, if this metric declines, it may be USDC’s leaping board to assert new highs.

Associated Studying

What To Count on From The Stablecoins Phase In The Quick-Time period

Within the final bull run, USDC’s provide elevated in Could, then reached its excessive in March 2022. The stablecoin’s market cap elevated by 170% from April 2021 to March 2022. If the present coin provide continues to develop however worth begins to dip, then the stablecoin market might hit its peak in a couple of months.

Historically, a rising market cap for stablecoins displays rising traders’ confidence, which indicators a rise in capital inflows.

Quite the opposite, a rising stablecoin market cap is normally related to rising investor conviction, signaling the potential for boosted capital inflows. This means that the bullish momentum may proceed for a couple of extra months.

Featured picture from Gemini Imagen, chart from TradingView