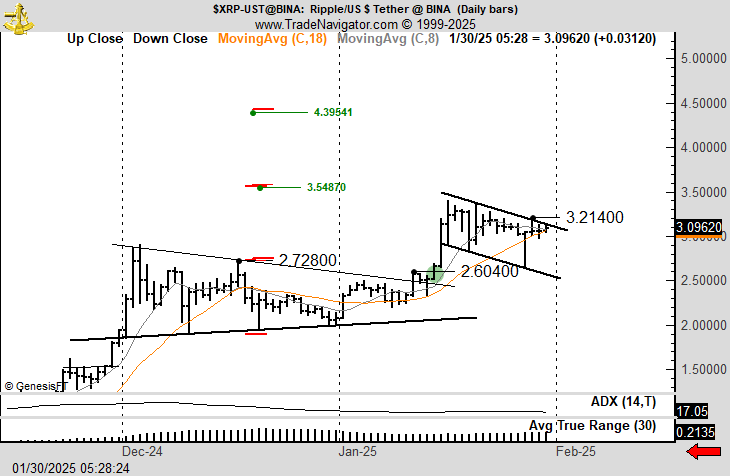

Famend technical analyst Peter Brandt stirred up the XRP neighborhood on January 30 by posting a day by day value chart (XRP/USDT) suggesting a “bull flag” continuation sample. Brandt, whose repute in charting spans many years, highlighted $4.39541 because the higher value goal primarily based on the present market construction.

“Hey XRP_pill_poppers. To be clear: I may care much less what XRP goes to do. If it goes up I need to be lengthy. If it goes down I’ve by no means shorted it, however favor to troll the poppers. No different manner proper now to outline the chart aside from a bull flag. In fact this might change,” Brandt remarked.

XRP Bull Flag Formation

From the analyst’s vantage level, XRP rallied sharply earlier in January, pushing above $2.6040 earlier than topping close to $3.2140. As soon as this peak shaped, the market entered a short pullback, making a collection of decrease highs and decrease lows—visualized by descending trendlines on Brandt’s chart. This consolidation resembles a textbook bull flag, a sample usually interpreted as a pause in an ongoing uptrend.

Brandt’s projected breakout may goal the subsequent distinguished overhead area close to $3.5487, together with his final bullish goal within the neighborhood of $4.39541. These ranges—proven by inexperienced traces on the chart—point out attainable resistance areas if XRP extends its rally upon confirming the flag’s higher boundary.

Two transferring averages are seen on Brandt’s chart: The 8-day transferring common (inexperienced line) is at present hovering simply above $3.00. It’s serving to to outline short-term help ranges. The 18-day transferring common (orange line) is sloping upwards from beneath $2.70 and reinforces the broader uptrend in play.

In the meantime, the ADX studying of 17.05 means that the general development power is average, leaving room for higher momentum if value breaks decisively from the flag. A 30-day Common True Vary (ATR) worth close to 0.2135 underscores the day by day volatility, which has risen in comparison with earlier phases however stays contained relative to some high-beta various cash.

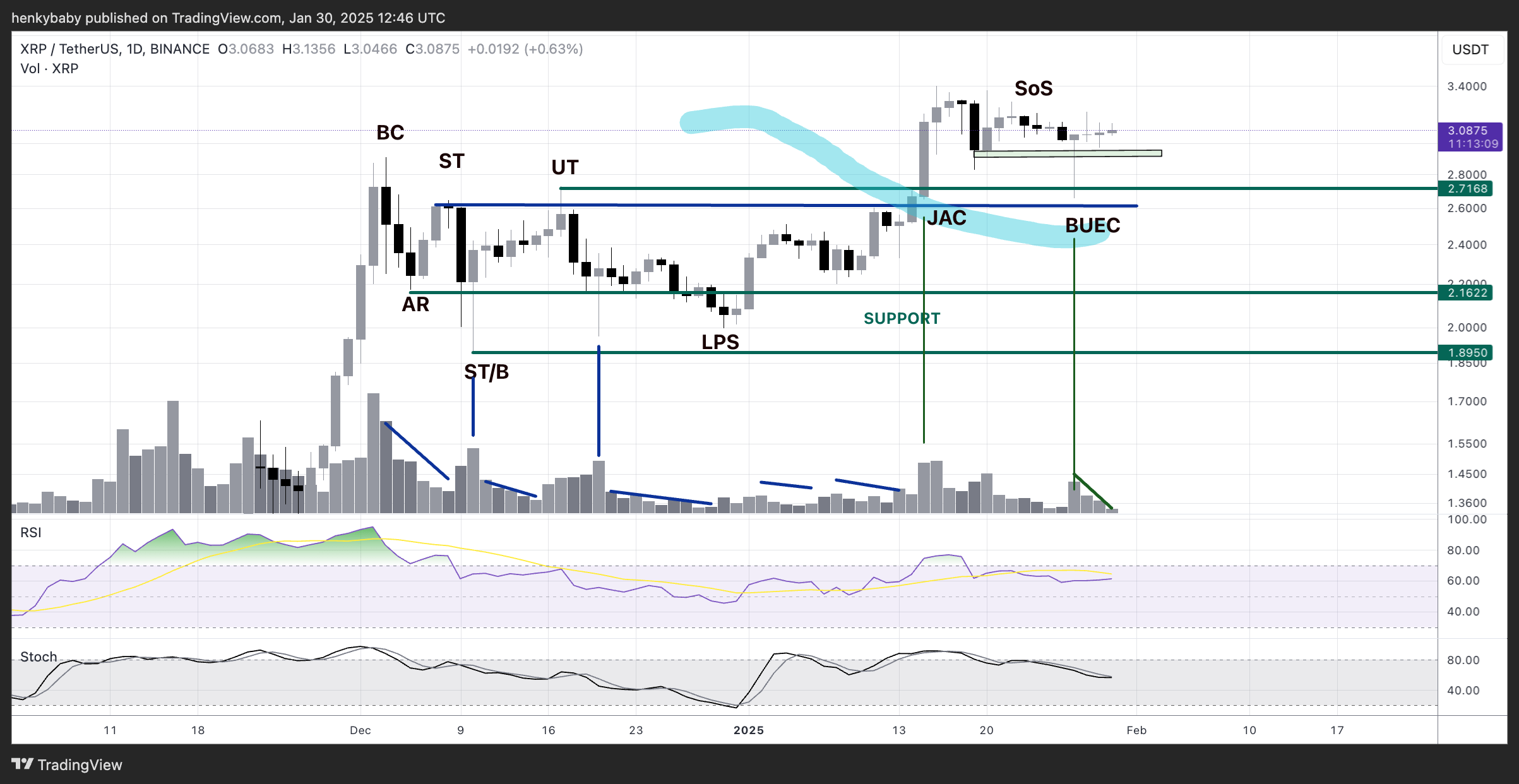

Brandt’s put up sparked dialogue amongst merchants, together with HTL-NL (@htltimor), who famous bullish confirmations utilizing Wyckoff evaluation. “Utilizing Wyckoff, it appears good too. In fact, if $TC takes a dive, all the things suffers, however it’s one of many higher wanting alt charts atm,” he acknowledged. Brandt replied with approval, stating “Good affirmation from a great supply.”

Based on the Wyckoff-based chart shared by HTL-NL, XRP has been tracing a collection of traditional phases—Starting with the Computerized Rally (AR) after a Promoting Climax (SC), adopted by a number of Secondary Checks (ST), and culminating in what seems to be a Signal of Power (SoS). The SoS label usually marks the purpose at which demand decisively overcomes provide, with value pushing above a key resistance stage and sustaining help above beforehand examined zones. This conduct is additional supported by quantity signatures that present curiosity resurging throughout rallies and diminishing on pullbacks.

In Wyckoff phrases, a profitable SoS inside a re-accumulation construction usually paves the best way for continued upside. The blue line labeled “BUEC” (Again As much as Fringe of the Creek) suggests XRP has already retested its final main resistance as help. Ought to it maintain these ranges and make sure the SoS, Wyckoff analysts would anticipate a drive towards greater targets, aligning with Brandt’s bullish flag projection.

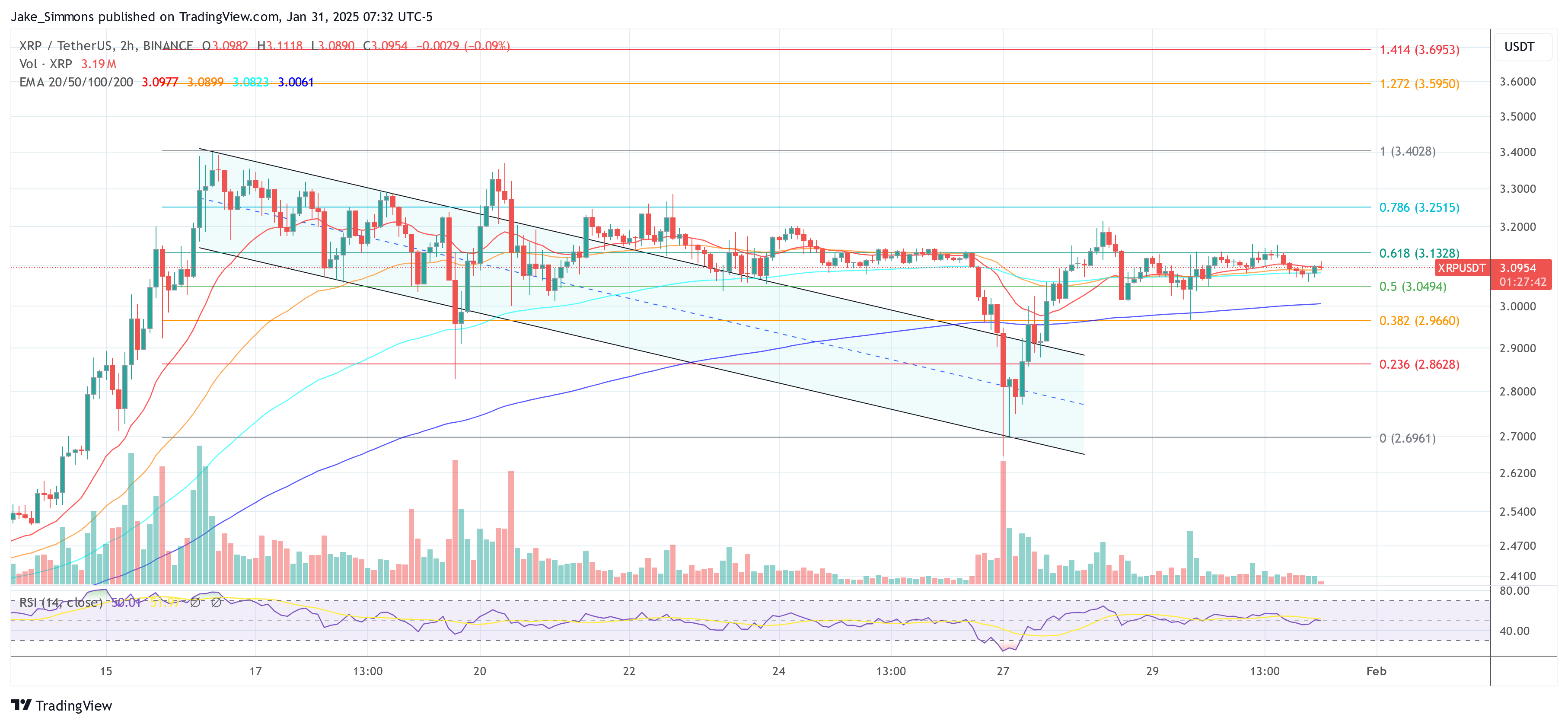

At press time, XRP traded at $3.09.

Featured picture created with DALL.E, chart from TradingView.com