After testing the low $90,000 worth stage a number of occasions over the previous two months, Bitcoin (BTC) briefly broke out of its tight buying and selling vary earlier this week, reaching a brand new all-time excessive (ATH) of $108,786. Nonetheless, a current report by Glassnode means that the sustained consolidation noticed in current months could also be nearing its finish, with the main cryptocurrency primed for its subsequent important transfer.

Bitcoin Revenue-Taking Declines Sharply

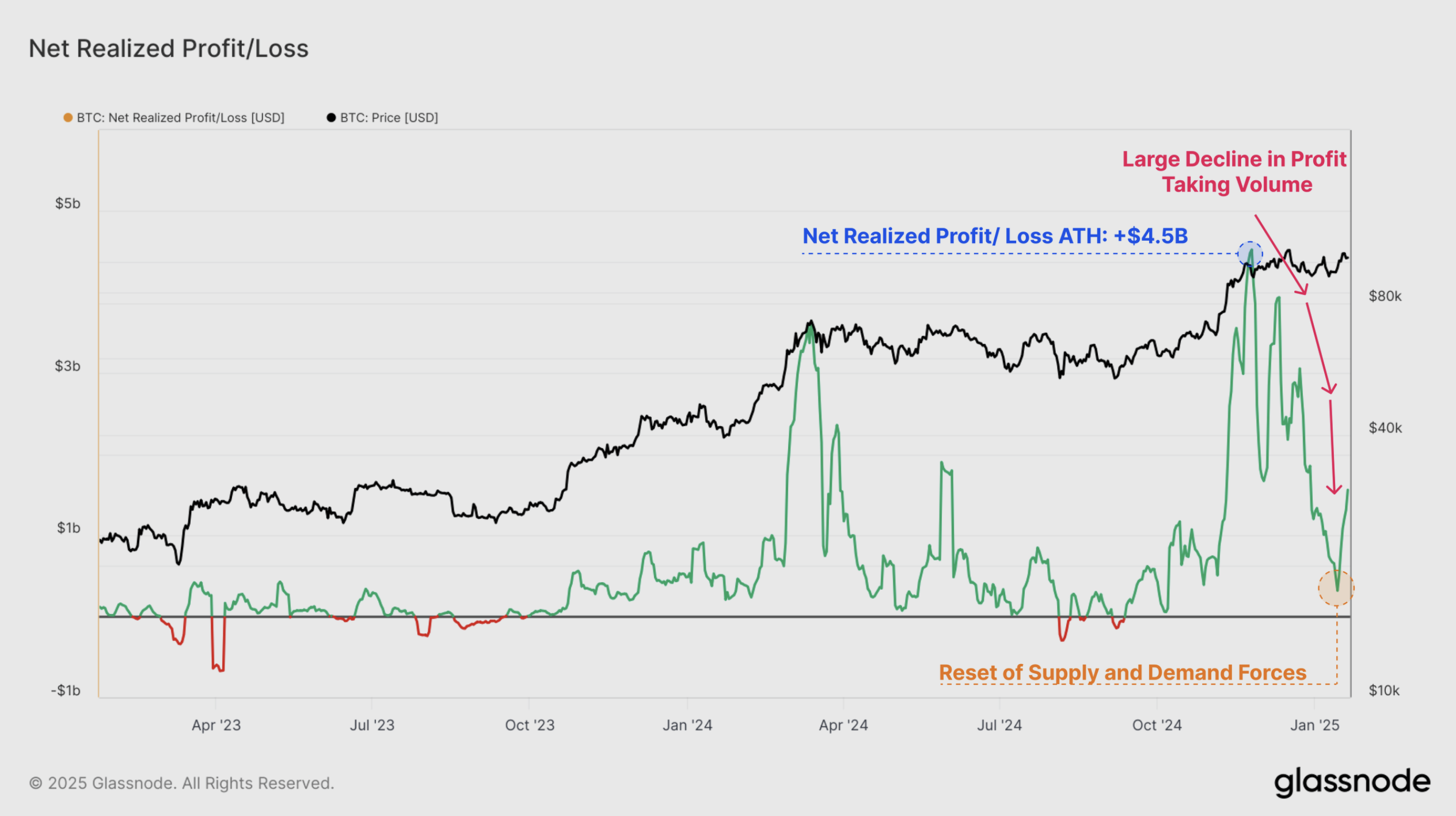

In keeping with the most recent version of Glassnode’s ‘The Week On-Chain Report,’ BTC profit-taking volumes have dropped considerably, falling from a peak of $4.5 billion in December to roughly $316.7 million – a pointy decline of 93%.

This drop in profit-taking alerts a considerable discount in sell-side stress for Bitcoin. At the moment, BTC is buying and selling inside a good 60-day worth vary, a sample that has usually preceded important market volatility.

Associated Studying

When Bitcoin trades in a slender worth vary, it both alerts the start of a bull market rally or the ultimate levels of a bear market capitulation. One key metric highlighted within the report is the Realized Provide Density, which measures Bitcoin’s provide focus across the present spot worth inside a 15% vary, each up and down.

At the moment, roughly 20% of Bitcoin’s provide is inside this worth band, indicating heightened worth sensitivity. Small worth actions inside this vary might considerably affect investor profitability, thereby fueling market volatility.

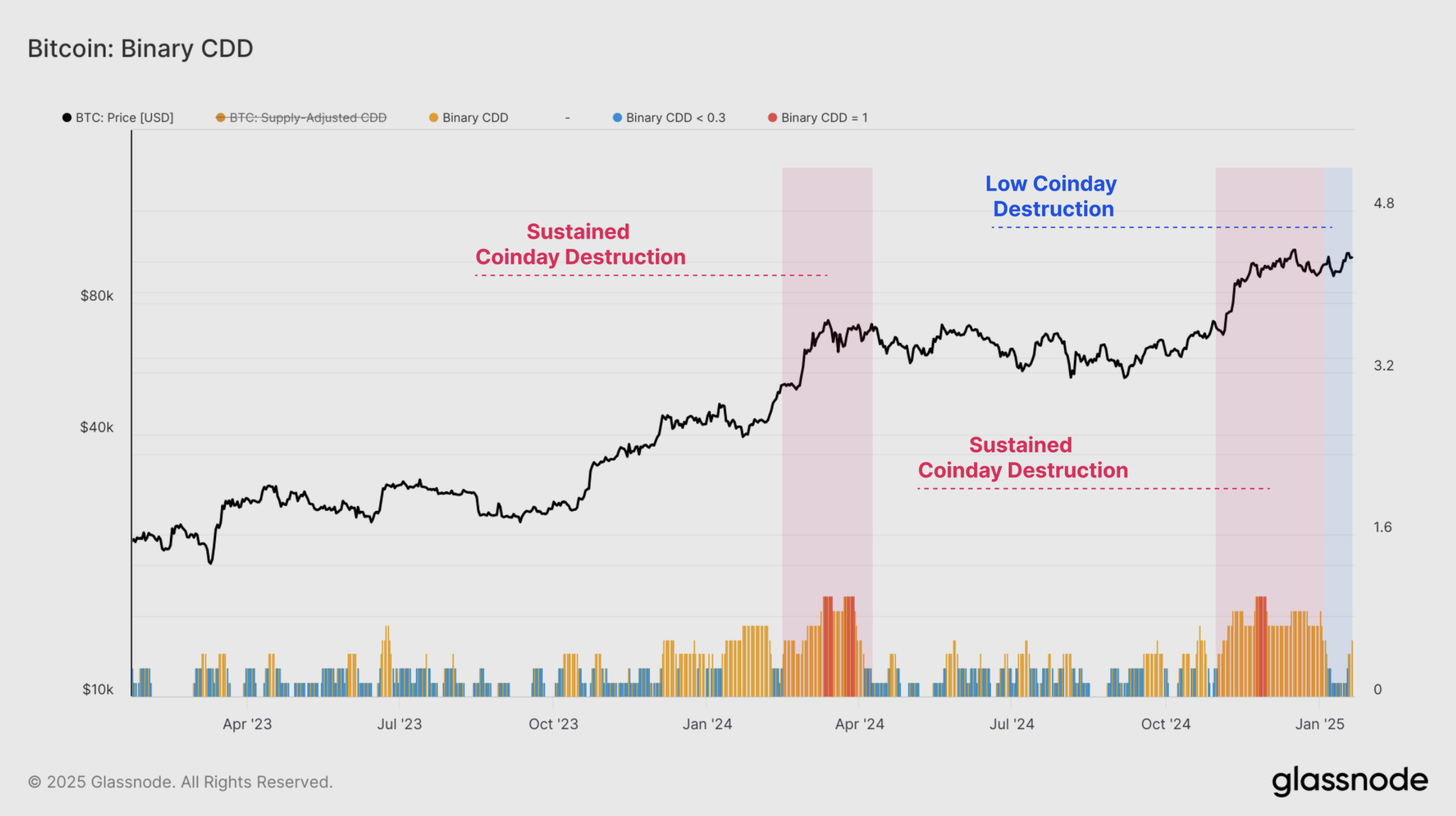

The report additionally factors to a key metric, CoinDay Destruction (CDD), as additional proof of declining sell-side stress. Throughout late December and early January, CDD values have been notably excessive, reflecting elevated exercise by long-term holders. Nonetheless, the metric has cooled off in current weeks.

For the uninitiated, CDD measures the financial exercise of spent BTC by monitoring how lengthy cash have been held earlier than being moved. It multiplies the variety of cash by the variety of days they remained idle, highlighting whether or not long-term holders are spending their cash.

The current decline in CDD means that many BTC traders who deliberate to take income have already completed so throughout the present worth vary. Because of this, the market could enter a brand new worth vary to unlock the following wave of provide and liquidity.

Lengthy-Time period Buyers Return To Accumulation Mode

The report additionally highlights the Lengthy-Time period Holder (LTH) Binary Spending Indicator, a key metric that tracks Bitcoin held by long-term traders. The report notes:

Aligned with the heavy profit-taking volumes from earlier than, we are able to see a major decline within the complete LTH Provide because the market reached $100k in December. The speed of LTH Provide decline has since stalled out, suggesting a softening of this distribution stress in current weeks.

Moreover, LTH inflows to crypto exchanges have fallen sharply, dropping from $526.9 million in December to simply $92.3 million. That stated, the entire LTH BTC provide is exhibiting indicators of development, indicating that long-term traders are returning to accumulation mode.

Associated Studying

In the meantime, retail demand for BTC stays sturdy. Buyers holding lower than 10 BTC collectively bought roughly 25,600 BTC prior to now month. Compared, Bitcoin miners minted solely 13,600 BTC throughout the identical interval. At press time, BTC trades at $104,207, up 0.5% prior to now 24 hours.

Featured picture from Unsplash, Charts from Glassnode and TradingView.com