Matthew Sigel, Head of Digital Belongings Analysis at VanEck, has lately made feedback relating to the potential of Bitcoin to change into a worldwide financial normal, just like gold, which have sparked controversy. This viewpoint is gathering momentum, notably as the talk relating to a US Strategic Bitcoin Reserve intensifies.

Associated Studying

The Future Of Finance: The Function Of Bitcoin

Sigel said that Bitcoin has the potential to considerably affect the way forward for world finance. He asserts that the institution of a crypto strategic reserve by the US authorities, with an estimated amount of 1 million BTC, might set up the main crypto asset as a brand new type of forex.

This idea is harking back to historic durations by which nations amassed gold with the intention to fortify their financial capabilities. Sigel posits that this might catapult the US to change into the flag-bearer of the brand new period of finance.

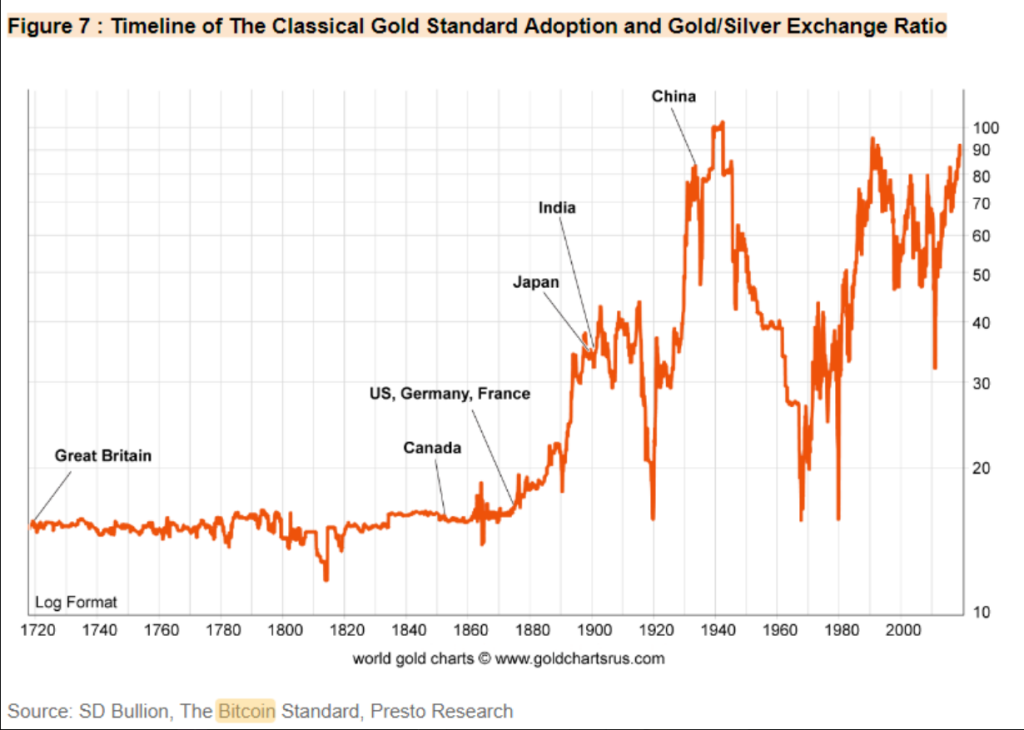

The gold normal as soon as outlined reserve belongings.

Now, Bitcoin presents the chance to converge on a ‘Digital Normal’ for cash.

It might very effectively echo gold’s position in reshaping world finance. pic.twitter.com/e1ogPe947R— matthew sigel, recovering CFA (@matthew_sigel) January 10, 2025

Gold Vs. Bitcoin: Classes From Historical past

The comparability of crypto to gold shouldn’t be new, but it surely has gained traction lately as extra governments experiment with digital currencies.

Gold is usually seen as a protected haven and a dependable retailer of wealth, however Bitcoin presents distinctive advantages that no different commodity does. It’s primarily a digital asset, thus in contrast to gold, transfers are quick and significantly extra moveable. This digital nature makes it much less susceptible to bodily theft and facilitates cross-border transactions.

Whereas mining helps to provide gold, Bitcoin is intrinsically uncommon since its provide is proscribed at 21 million cash. For these making an attempt to offset financial uncertainty and inflation, this deliberate shortage might make BTC a tempting substitute.

World Views & Reactions

There’s a rising world buzz in regards to the potential of Bitcoin. As a consequence of current political shifts within the US, international locations like El Salvador have made Bitcoin authorized tender, and leaders in different nations are attempting to place related insurance policies into place. Nonetheless, given the erratic character of Bitcoin and the regular buying energy of gold, some economists imagine that this motion needs to be rejected.

Associated Studying

Though Bitcoin presents up to date advantages like decentralization and immunity to governmental intervention, its value volatility, in line with critics, could also be a barrier to its widespread adoption as a medium of trade. Consequently, the 2 belongings differ within the essential elements that buyers and decision-makers have to take into consideration.

Sigel’s phrases mirror a brand new curiosity in how Bitcoin may reconfigure monetary techniques all over the world. As conversations proceed about whether or not it’ll ultimately change into a worldwide normal, standing alongside gold, each proponents and detractors will probably be watching how this story develops over the approaching years. Maybe the way forward for cash is dependent upon how these two belongings evolve and work together in an more and more digital economic system.

Featured picture from Pexels, chart from TradingView