On-chain knowledge reveals the Bitcoin long-term holders are promoting. Right here’s whether or not the present degree of selloff is sufficient for a worth high or not.

Bitcoin Lengthy-Time period Holders Have Been Promoting Huge Not too long ago

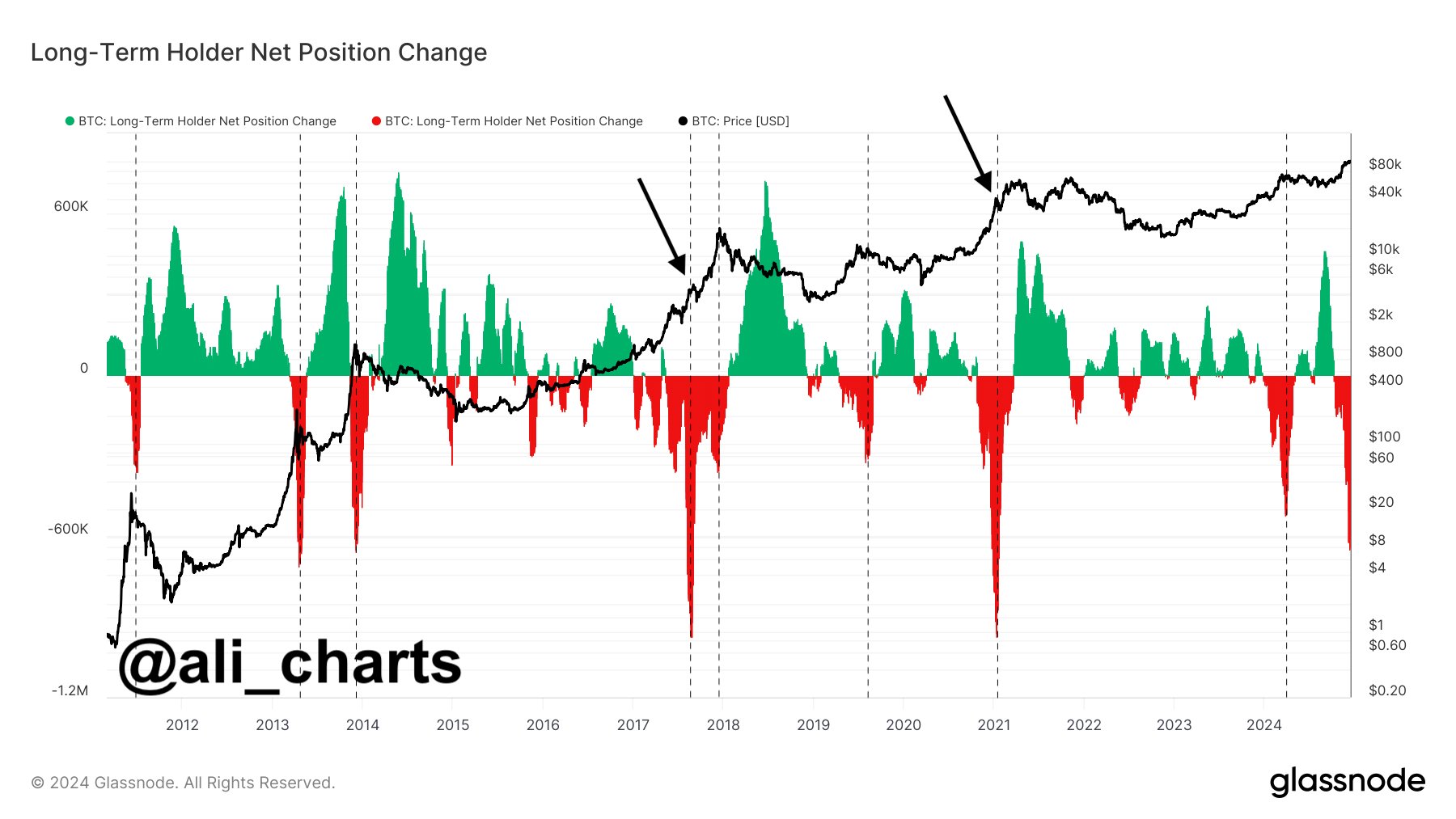

In a brand new publish on X, analyst Ali Martinez has mentioned concerning the historic development within the holdings of the long-term holders relative to the Bitcoin high. The “long-term holders” (LTHs) confer with the BTC traders who’ve been holding onto their cash for greater than 155 days.

The LTHs symbolize one of many two important divisions of the BTC market performed on the idea of holding time, with the opposite group being often known as the short-term holders (STHs).

Traditionally, the latter cohort has confirmed to include the weak arms of the market, whereas the previous is made up of the HODLers who barely react to rallies and crashes within the worth.

As such, promoting from the STHs is often not of any observe, however that from the LTHs might be, because it’s not a very widespread occasion. One approach to maintain monitor of the habits of the diamond arms is thru their Web Place Change.

The Web Place Change is an on-chain metric that measures the full quantity of Bitcoin coming into into or exiting out of the LTH cohort. Under is the chart for the indicator shared by the analyst that reveals the development in its worth over the historical past of the cryptocurrency.

As displayed within the above graph, the Bitcoin LTH Web Place Change has witnessed a pointy decline into the destructive territory in latest weeks, which means a internet quantity of provide has been leaving the cohort.

This isn’t the primary time this 12 months that the indicator has proven this development, as one thing related was additionally noticed again throughout the first quarter of this 12 months. Within the chart, Martinez has highlighted this and the opposite older cases of this development occurring.

It might appear that the foremost selloffs from the LTHs have typically coincided with some kind of high within the cryptocurrency. “Apparently, in 2017 and 2021, their largest sell-offs occurred proper earlier than the ultimate leg up,” notes the analyst.

Thus, if the present bull market goes to point out something related, then it’s doable that the present LTH selloff might in reality solely be the beginning of that closing leg up that’s going to result in the cyclical high for Bitcoin.

The indicator can also be presently not as destructive as throughout the largest pink spikes of the 2017 and 2021 bull runs, which may very well be one other indication that the highest isn’t in simply but. It solely stays to be seen, although, whether or not the identical sample would repeat this time as effectively or not.

BTC Value

Bitcoin is again in all-time excessive (ATH) discovery mode as its worth has simply set a brand new document above the $107,000 milestone.