Clint and Rachel Wells had causes to think about shopping for an electrical automobile when it got here to changing certainly one of their vehicles. However that they had much more causes to stay with petrol.

The couple stay in Regular, Illinois, which has loved an financial increase from the electrical automobile meeting plant opened there by upstart electric-car maker Rivian. EVs are a step ahead from “utilizing useless dinosaurs” to energy vehicles, Clint Wells says, and he needs to assist that.

However the couple determined to “get what was inexpensive”—of their case, a petrol-engined Honda Accord costing $19,000 after trade-in.

An EV priced at $25,000 would have been tempting, however solely 5 new electrical fashions costing lower than $40,000 have come on to the US market in 2024. The hometown champion’s give attention to luxurious autos—its least expensive mannequin is at present the $69,000 R1T—made it a non-starter.

“It’s simply not accessible to us at this level in our life,” Rachel Wells says.

The Wells are among the many thousands and thousands of Individuals opting to proceed shopping for combustion-engine vehicles over electrical autos, regardless of President Joe Biden’s bold goal of getting EVs make up half of all new vehicles bought within the US by 2030. Final 12 months, the proportion was 9.5 %.

Excessive sticker costs for vehicles on the forecourt, and excessive rates of interest which can be pushing up month-to-month lease funds, have mixed with considerations over driving vary and charging infrastructure to sit back consumers’ enthusiasm—even amongst those that contemplate themselves inexperienced.

Monetary Instances

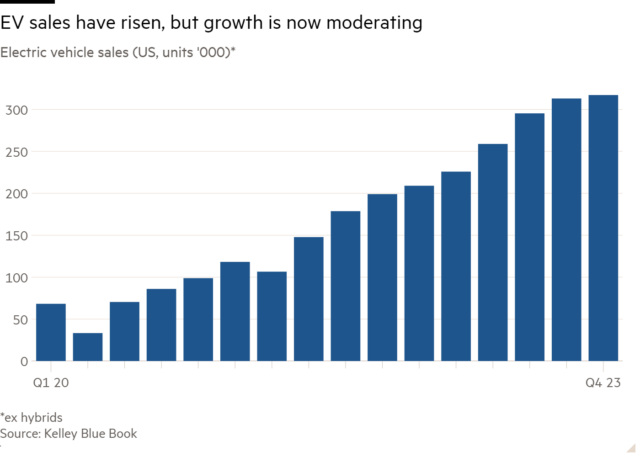

Whereas EV expertise continues to be bettering and the recognition of electrical vehicles continues to be growing, gross sales progress has slowed. Many carmakers are rethinking manufacturing plans, chopping the numbers of EVs that they had deliberate to provide for the US market in favor of combustion-engined and hybrid vehicles.

Electrical autos have additionally discovered themselves on the intersection of two competing Biden administration priorities: tackling local weather change and defending American jobs.

Biden has pledged to decrease US greenhouse fuel emissions to 50-52 % under 2005 ranges by 2030, with widespread EV adoption a major a part of that ambition.

However he needs to realize it with out recourse to imports from China, the world’s largest producer of EVs and a dominant participant in lots of the uncooked supplies that go into them. Washington has set out an industrial coverage that hits Chinese language producers of vehicles, batteries and different parts with punitive tariffs and restricts federal tax incentives for customers shopping for their merchandise.

The thought is to permit the US to develop its personal provide chains, however analysts say such protectionism will lead to larger EV costs for US customers within the meantime. That might stall gross sales and consequence within the US remaining behind China and Europe in adoption of EVs, placing in danger not solely the Biden administration’s targets but additionally the worldwide uptake of EVs. The World Sources Institute says between 75 and 95 % of recent passenger autos bought by 2030 must be electrical if Paris settlement targets are to be met.

Brian Cassella/Chicago Tribune/Getty Photographs

“There isn’t a query that this slows down EV adoption within the US,” says Everett Eissenstat, a former senior US Commerce Consultant official who served each Republican and Democratic administrations.

“We’re simply not producing the EVs the customers need at a worth level they need.”

Incenting customers

The administration is trying to reconcile its industrial and local weather insurance policies by providing tax incentives to customers to purchase EVs and by encouraging producers to develop US-dominated provide chains.

Tax credit of as much as $7,500 can be found to consumers of electrical vehicles. However the full quantity is barely accessible on vehicles which can be made within the US with crucial minerals and battery parts additionally largely sourced within the US.

Which means few vehicles qualify for the utmost credit score. Two years on from the passage of the Inflation Discount Act, which set out Biden’s bold inexperienced transition technique, there are solely 12 fashions that may really rating consumers the total $7,500.

The act additionally supplied a whole lot of billions of {dollars} in subsidies and different incentives to corporations constructing a home clear vitality business. The automotive sector has been one of many beneficiaries of that largesse.

Final month, the Biden administration went a step additional, including steep new tariffs on billions of {dollars} of products imported from China. These included a quadrupling of the tariffs on imported electrical autos, a tripling of the speed on Chinese language lithium-ion batteries to 25 % and the introduction of a 25 % tariff on graphite, which is used to make batteries.

The levies have been an extension of a bundle first imposed by then president Donald Trump as a part of his commerce conflict with Beijing in 2018, and have been below evaluation by the Biden administration because it figures out how to reply to what it says are Beijing’s unfair subsidies to strategic industries.

Mandel Ngan/AFP/Getty Photographs

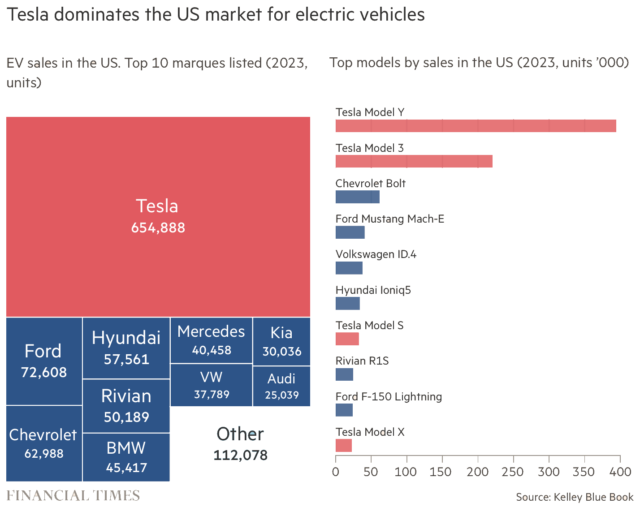

Few Chinese language EVs can be found on the market within the US. Polestar is the one Chinese language-owned carmaker at present lively within the nation and it bought a mere 2,210 vehicles within the first quarter—out of almost 269,000 new EV gross sales. (The corporate plans so as to add manufacturing within the US this 12 months.)

Wendy Cutler, a former commerce official and vice-president of the Asia Society Coverage Institute, describes the pre-emptive levying of tariffs as a brand new growth in international commerce coverage.

“This sends a transparent sign to China: don’t even take into consideration exporting your vehicles to the USA,” she says.

Extra important than the tariffs on Chinese language electrical vehicles are the levies on lithium-ion batteries and the supplies and parts used to make them.

China is a key participant within the provide chain for EV batteries, with corporations equivalent to BYD and CATL growing the nation’s capability over greater than a decade. It dominates the processing of the minerals contained in lithium-ion batteries in addition to the manufacture of battery parts equivalent to cathodes and anodes.

In keeping with knowledge analyzed by the Heart for Strategic and Worldwide Research (CSIS), a Washington think-tank, US-based carmakers have been importing a rising share of their batteries from China. Within the first quarter of 2024, greater than 70 % of imported automobile batteries got here from the nation.

The tariffs will drive up manufacturing prices for carmakers within the US and that value is prone to be handed on to customers as a result of battery supplies and parts are usually not at present accessible in massive portions from any provide chain that excludes China.

US commerce officers draw parallels with the photo voltaic business. The price of photovoltaic panels fell worldwide as Chinese language producers, benefiting from subsidies, decrease labor prices and rising scale, got here to dominate the business.

That has been a boon for customers, however resulted in manufacturing and jobs shifting from the US to China. Washington doesn’t desire a rerun of this course of within the automotive sector.

“The concept we must always simply open our gates and have a bunch of systematic Chinese language financial abuses . . . and that that’s the reply to local weather change is extremely naive and short-sighted,” says Jennifer Harris, a former financial adviser to Biden.

In an election 12 months, the difficulty is politically charged too. Michigan and Ohio, each house to massive numbers of auto employees, are swing states within the presidential election. Each Biden and Republican nominee Donald Trump are attempting to attraction to working-class voters there.

Preserving jobs within the US auto business because it strikes in direction of inexperienced expertise is essentially concerning the provide chain. Greater than half the 995,000 individuals employed within the auto business throughout the US are making components, fairly than assembling autos, in response to the Bureau of Labor Statistics.

EVs already threaten these jobs as a result of their powertrains comprise fewer parts than vehicles with conventional engines and transmission methods. The United Auto Staff union, arguing for a “simply transition” to wash vitality, fought throughout its six-week lengthy strike final autumn to have battery vegetation within the US lined by the identical contracts that shield employees at vegetation making petrol-powered autos, profitable an settlement with Common Motors.

Monetary Instances

Ilaria Mazzocco, chair in Chinese language enterprise and economics at CSIS, says the diminished competitors and rising value of imported battery parts might delay worth decreases for US customers.

“It’s not simply that the identical automobile prices much less in China, it’s that in China you may have a greater diversity,” says Mazzocco. “US automakers could have the leisure of not having competitors, and so they’ll be capable to give attention to making these high-cost vans”—a reference to bigger sedans and SUVs, which have greater revenue margins.

“That’s simply what the Biden administration feels they should do on the political entrance, as a result of they should prioritize jobs,” she provides.

Worth and infrastructure

Electrical autos face different boundaries to mass adoption. Affordability, lack of charging infrastructure and vary nervousness all stay considerations for mainstream US automobile consumers.

The worth for a brand new EV averaged simply lower than $57,000 in Might, in contrast with a mean of just a little greater than $48,000 for a automobile or truck with a standard engine.

The beginning worth for a Tesla Mannequin Y, by far the most well-liked electrical automobile within the US, was simply lower than $43,000 through the first quarter. The Ford F-150 Lightning, the electrified model of the best-selling pick-up truck within the US, was teased at $42,000 when it went on sale in Might 2022 however now begins at $55,000—greater than $11,000 above the petrol-powered F-150.

Used EVs are cheaper, with a automobile lower than 5 years previous costing about $34,000, in response to Cox Automotive. However they continue to be costlier than used vehicles with conventional engines, which common about $32,100—and so they make up simply 2 to three % of used automobile gross sales.

Brandon Bell/Getty Photographs

Ford and Stellantis, which owns manufacturers equivalent to Dodge, Ram and Jeep, are promising $25,000 EVs for the US market within the subsequent few years. Common Motors plans to revive the Chevrolet Bolt as “probably the most inexpensive” EV in the marketplace. Tesla chief Elon Musk additionally advised traders in April that Tesla would launch “extra inexpensive fashions” this 12 months or early in 2025.

However these fashions will nonetheless face obstacles like a dearth of charging infrastructure. In a single day charging at house is the popular technique of replenishing an EV, however that is solely actually an choice for individuals who can set up a charger on their property. These dwelling in house complexes in states like California, the place a larger share of individuals drive EVs, are extra reliant on public charging services.

Whereas there are about 120,000 petrol stations nationwide, in response to the US Division of Power, there are solely 64,000 public charging stations within the US—and solely 10,000 of them are direct present chargers, which may replenish a battery in half-hour fairly than a number of hours. Charging stations additionally could be inoperative or have lengthy strains when drivers arrive, forcing them to go elsewhere.

Potential consumers additionally fear their EV might not journey as far on a single cost as they require. Whereas electrical autos are nicely suited to the quick journeys that make up most driving, many Individuals additionally use their vehicles and vans for longer distances and fear that charging en route might add to their driving time, and even go away them stranded. Chilly climate and towing a load can each diminish an EV’s vary.

“What we’re seeing is the tempo of EV progress is quicker than the speed of publicly accessible charger progress,” says John Bozzella, chief government of US auto commerce group the Alliance for Automotive Innovation.

Two methods

Many international carmakers are making huge investments in US manufacturing vegetation, in response to the federal government’s incentives. However within the mild of slowing EV gross sales progress they’re shifting that funding in direction of hybrid autos, which use battery energy alongside a standard engine.

Final month, executives from GM, Nissan, Hyundai, Volkswagen and Ford all mentioned that tapping into demand for hybrids was a precedence. Ford chief government Jim Farley advised traders at a convention “we must always cease speaking about [hybrids] as a transitional expertise,” viewing it as a substitute as a viable long-term choice.

Hyundai mentioned it was contemplating making hybrids at its new $7.6 billion plant in Georgia. US competitor GM mentioned in January that it will reintroduce plug-in hybrid expertise to its vary, although chief government Mary Barra not too long ago affirmed she nonetheless noticed EVs as the longer term.

Bozzella says that even with the tariff safety measures and US subsidies in place, he was uncertain how lengthy it will take for the US auto business to provide EVs that might compete with closely sponsored Chinese language autos on pricing.

“There isn’t a query that EVs constructed within the US now, and constructed by American corporations now, are completely aggressive with EVs all over the world,” he says, citing Tesla.

“If what you imply is aggressive at worth factors . . . nicely that’s a unique matter totally, and my reply to that’s: I’m unsure.”

Van Jackson, beforehand an official within the Obama administration and now a senior lecturer in worldwide relations at Victoria College of Wellington in New Zealand, says electrical vehicles nonetheless have to fall in worth if the market is to develop considerably.

“How do you deliver employees alongside and improve their wages, and have a progress marketplace for these merchandise, given how costly they’re?” he asks. “I’m an upper-middle-class particular person and I can’t afford an EV.”

He’s skeptical about whether or not shutting the world’s dominant producer of EVs and associated componentry out of the US market will scale back the worth of the vehicles and encourage uptake.

“The tariffs are shopping for time,” he says. “However in direction of no explicit finish.”

© 2024 The Monetary Instances Ltd. All rights reserved. To not be redistributed, copied, or modified in any approach.