Aave (AAVE), the main decentralized finance (DeFi) lending protocol, has captured the highlight with a rare surge of over 200% since November 5. Outperforming the broader market, AAVE has reached its highest ranges since 2021, marking a exceptional restoration and reaffirming its dominance within the DeFi ecosystem.

Associated Studying

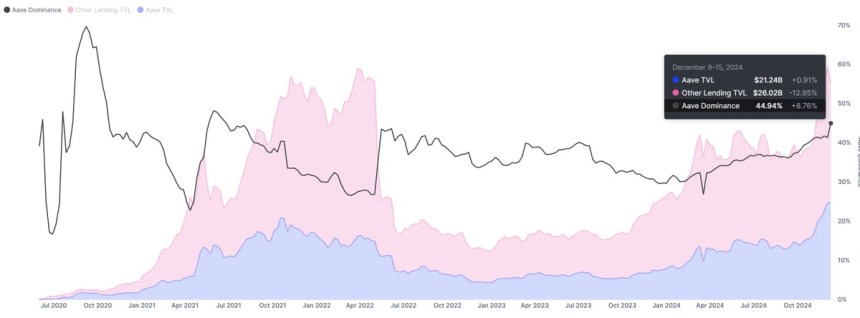

Key metrics from IntoTheBlock underscore AAVE’s unmatched place within the lending sector. With a powerful 45% market share, it stays the best choice for customers in search of decentralized borrowing and lending options.

With AAVE buying and selling at multi-year highs and on-chain knowledge suggesting sturdy exercise, the altcoin’s trajectory stays a focus for traders and analysts alike. The query is whether or not the value can maintain this momentum and attain new all-time highs within the coming months.

AAVE Retains Rising

Aave (AAVE) has proven constant development over the previous 12 months, solidifying its place as a market chief within the DeFi lending sector. Recognized for its revolutionary method to creating non-custodial liquidity markets, Aave permits customers to earn curiosity on provided and borrowed belongings at variable rates of interest. This method has made Aave a go-to protocol for decentralized borrowing and lending.

For years, Aave has been on the forefront of DeFi innovation, regularly enhancing its platform and consumer expertise. Its success is clear in its market dominance. Metrics from IntoTheBlock spotlight Aave’s unmatched management, boasting a powerful 45% market share within the DeFi lending house.

This dominance is additional emphasised by Aave’s staggering whole worth locked (TVL), which stands at $21.2 billion—nearly equal to the mixed TVL of all different lending protocols.

Associated Studying

Such figures underline Aave’s essential position within the DeFi ecosystem. Its established presence and sturdy infrastructure place it as a key participant within the occasion of a broader DeFi resurgence. Ought to the sector warmth up within the coming weeks, Aave is more likely to entice vital consideration from traders and merchants.

Worth Targets Contemporary Provide Ranges

Aave (AAVE) is at the moment buying and selling at $366, following a surge to a multi-year excessive of $396 simply hours in the past. The altcoin continues its upward momentum because it approaches the essential $420 resistance degree, a threshold final held in September 2021. This mark is seen as a pivotal space for AAVE’s subsequent section of value motion, with many analysts anticipating a big response as soon as examined.

If AAVE manages to carry its present ranges and maintain the bullish momentum, the following logical goal can be the $420 resistance zone. Breaking above this degree may sign a continuation of its multi-month rally, setting the stage for even larger value targets as investor confidence builds.

On the draw back, failure to take care of help above the $320–$340 vary may result in a broader correction. A transfer beneath this zone may push the value decrease, erasing a few of its latest positive factors and dampening bullish sentiment within the brief time period.

Associated Studying

AAVE stays in a robust place for now, however merchants are carefully monitoring its value motion close to these key ranges. Whether or not it may maintain its upward trajectory or faces a pullback will depend upon its capacity to interrupt and maintain above vital resistance zones.

Featured picture from Dall-E, chart from TradingView