As Bitcoin dips under the $65,000 mark, at the moment buying and selling at $64,886, the cryptocurrency market is witnessing a heightened sense of urgency amongst merchants.

This latest downturn displays a broader development noticed over the previous week, with Bitcoin shedding roughly 2.4% of its worth. The final 24 hours alone noticed a additional decline of 1%, signaling rising market nervousness.

Associated Studying

Ought to You Panic?

Analysts from the blockchain analytics platform Santiment spotlight the continued decline section as a steepest three-day decline in energetic Bitcoin wallets for the reason that peak earlier in March, suggesting a important shift in investor conduct and market sentiment.

Nevertheless, this contrasts sharply with ETH, as Ethereum wallets proceed to extend, indicating divergent investor confidence between the main cryptocurrencies.

The rise in Ethereum wallets suggests a bullish outlook for ETH regardless of the bearish stress on Bitcoin. In the meantime, in keeping with Bitfinex analysts, the continued sell-off has been considerably influenced by long-term Bitcoin holders and whales adjusting their holdings amid the market’s consolidation section.

This conduct is typical of long-term holders who decide to scale back their positions in periods of market uncertainty to capitalize on or mitigate losses.

The Bitfinex analyst reveals that the Hodler Web Place Change metric has persistently proven unfavorable values, indicating that these important gamers are shifting their holdings to exchanges, probably to promote, exerting downward stress on Bitcoin costs.

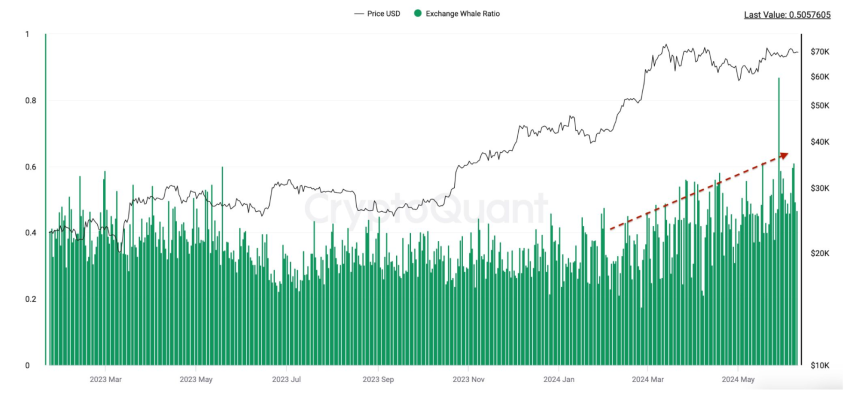

This development is echoed by the rising Bitcoin Trade Whale Ratio, which tracks massive deposits into exchanges relative to general market exercise.

As extra whales switch their Bitcoin to commerce on platforms, the elevated potential provide in the marketplace can result in value drops.

Ought to You Purchase?

Regardless of these pressures, some analysts stay cautiously optimistic a couple of potential rebound. CrediBULL Crypto, a distinguished analyst, advised on X that BTC is perhaps nearing its decrease assist ranges, with the present costs probably front-running a deeper market low that many worry.

There’s an opportunity our $BTC backside is in with this SFP.

Under is what I’m expecting now.

Sure, we are able to nonetheless technically go decrease into the “dream lengthy” zone under, however as I’ve beforehand stated it will not shock me to see that zone entrance run.

That being stated, you promote the… pic.twitter.com/cI6moqbadJ

— CrediBULL Crypto (@CredibleCrypto) June 18, 2024

Funding charges within the crypto derivatives market function a vital indicator of dealer sentiment. Latest knowledge from Coinglass signifies that funding charges are barely constructive, which historically indicators a bullish outlook amongst merchants.

Associated Studying

Notably, constructive funding charges suggest that extra merchants are betting on the value of Bitcoin going up and are prepared to pay a premium to carry lengthy positions in futures contracts.

Funding charges are barely constructive, displaying bullish .

Purchase the dip.

👉https://t.co/iyLrhuoty0 pic.twitter.com/YFfCsGMTni

— CoinGlass (@coinglass_com) June 18, 2024

This metric can typically counterbalance the prevailing market sentiment, suggesting that regardless of the sell-off, a bit of the market is getting ready for a possible value improve.

Featured picture created with DALL-E, Chart from TradingView