Traders with some huge cash to spend have taken a bearish stance on Caterpillar CAT.

And retail merchants ought to know.

We observed this immediately when the trades confirmed up on publicly out there choices historical past that we observe right here at Benzinga.

Whether or not these are establishments or simply rich people, we do not know. However when one thing this massive occurs with CAT, it usually means someone is aware of one thing is about to occur.

So how do we all know what these traders simply did?

Right now, Benzinga‘s choices scanner noticed 18 unusual choices trades for Caterpillar.

This is not regular.

The general sentiment of those big-money merchants is cut up between 33% bullish and 55%, bearish.

Out of the entire particular choices we uncovered, 4 are places, for a complete quantity of $360,704, and 14 are calls, for a complete quantity of $851,386.

Predicted Worth Vary

After evaluating the buying and selling volumes and Open Curiosity, it is evident that the most important market movers are specializing in a value band between $155.0 and $430.0 for Caterpillar, spanning the final three months.

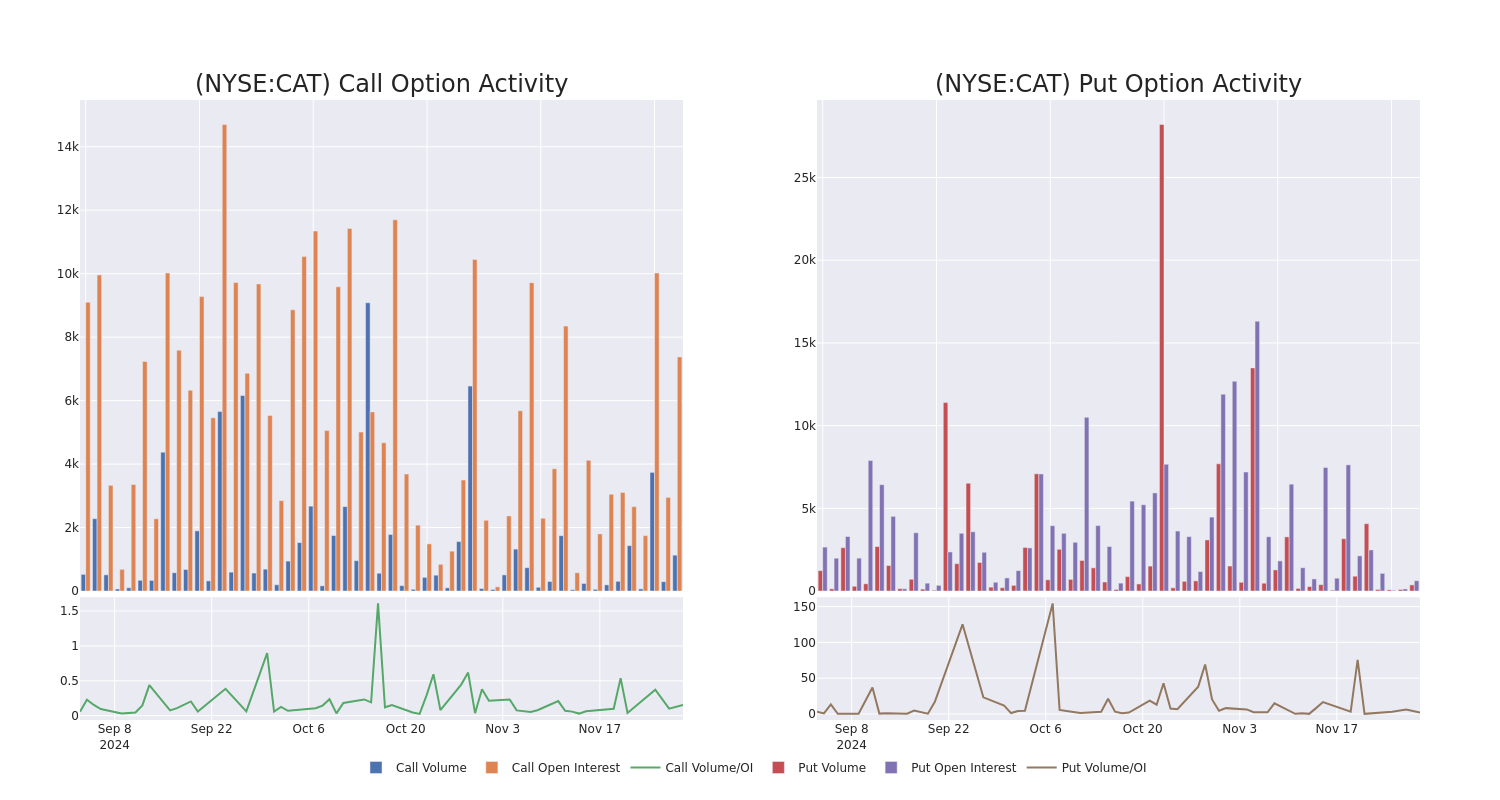

Analyzing Quantity & Open Curiosity

Assessing the amount and open curiosity is a strategic step in choices buying and selling. These metrics make clear the liquidity and investor curiosity in Caterpillar’s choices at specified strike costs. The forthcoming knowledge visualizes the fluctuation in quantity and open curiosity for each calls and places, linked to Caterpillar’s substantial trades, inside a strike value spectrum from $155.0 to $430.0 over the previous 30 days.

Caterpillar Choice Quantity And Open Curiosity Over Final 30 Days

Largest Choices Trades Noticed:

| Image | PUT/CALL | Commerce Kind | Sentiment | Exp. Date | Ask | Bid | Worth | Strike Worth | Whole Commerce Worth | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | SWEEP | BULLISH | 12/06/24 | $4.0 | $3.6 | $4.0 | $410.00 | $200.8K | 92 | 596 |

| CAT | PUT | SWEEP | BEARISH | 12/20/24 | $14.65 | $14.45 | $14.65 | $420.00 | $183.1K | 197 | 126 |

| CAT | CALL | SWEEP | BULLISH | 02/21/25 | $28.0 | $25.8 | $28.0 | $400.00 | $140.0K | 623 | 0 |

| CAT | CALL | SWEEP | BULLISH | 01/16/26 | $47.8 | $46.65 | $47.8 | $420.00 | $109.9K | 373 | 23 |

| CAT | PUT | SWEEP | BEARISH | 01/17/25 | $18.9 | $16.95 | $18.9 | $420.00 | $75.2K | 378 | 80 |

About Caterpillar

Caterpillar is the highest producer of heavy tools, energy options, and locomotives. It’s at present the world’s largest producer of heavy tools. The corporate is split into 4 reportable segments: development industries, useful resource industries, vitality and transportation, and Cat Monetary. Its merchandise can be found by a vendor community that covers the globe with about 2,700 branches maintained by 160 sellers. Cat Monetary gives retail financing for equipment and engines to its clients, along with wholesale financing for sellers, which will increase the probability of Caterpillar product gross sales.

Caterpillar’s Present Market Standing

- With a buying and selling quantity of 1,961,635, the worth of CAT is up by 0.61%, reaching $406.16.

- Present RSI values point out that the inventory is could also be approaching overbought.

- Subsequent earnings report is scheduled for 66 days from now.

What The Specialists Say On Caterpillar

Within the final month, 4 specialists launched scores on this inventory with a median goal value of $348.75.

Uncommon Choices Exercise Detected: Sensible Cash on the Transfer

Benzinga Edge’s Uncommon Choices board spots potential market movers earlier than they occur. See what positions massive cash is taking in your favourite shares. Click on right here for entry.

* Reflecting issues, an analyst from Evercore ISI Group lowers its score to Underperform with a brand new value goal of $365.

* An analyst from UBS persists with their Promote score on Caterpillar, sustaining a goal value of $295.

* An analyst from Baird persists with their Underperform score on Caterpillar, sustaining a goal value of $300.

* An analyst from Citigroup has determined to keep up their Purchase score on Caterpillar, which at present sits at a value goal of $435.

Choices are a riskier asset in comparison with simply buying and selling the inventory, however they’ve greater revenue potential. Critical choices merchants handle this danger by educating themselves each day, scaling out and in of trades, following multiple indicator, and following the markets intently.

If you wish to keep up to date on the most recent choices trades for Caterpillar, Benzinga Professional provides you real-time choices trades alerts.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.