Buyers with some huge cash to spend have taken a bearish stance on Netflix NFLX.

And retail merchants ought to know.

We seen this at this time when the trades confirmed up on publicly accessible choices historical past that we monitor right here at Benzinga.

Whether or not these are establishments or simply rich people, we do not know. However when one thing this large occurs with NFLX, it typically means any person is aware of one thing is about to occur.

So how do we all know what these buyers simply did?

At present, Benzinga‘s choices scanner noticed 28 unusual choices trades for Netflix.

This is not regular.

The general sentiment of those big-money merchants is break up between 28% bullish and 50%, bearish.

Out of all the particular choices we uncovered, 9 are places, for a complete quantity of $470,379, and 19 are calls, for a complete quantity of $1,069,300.

Projected Worth Targets

After evaluating the buying and selling volumes and Open Curiosity, it is evident that the most important market movers are specializing in a value band between $250.0 and $950.0 for Netflix, spanning the final three months.

Analyzing Quantity & Open Curiosity

When it comes to liquidity and curiosity, the imply open curiosity for Netflix choices trades at this time is 445.74 with a complete quantity of 5,414.00.

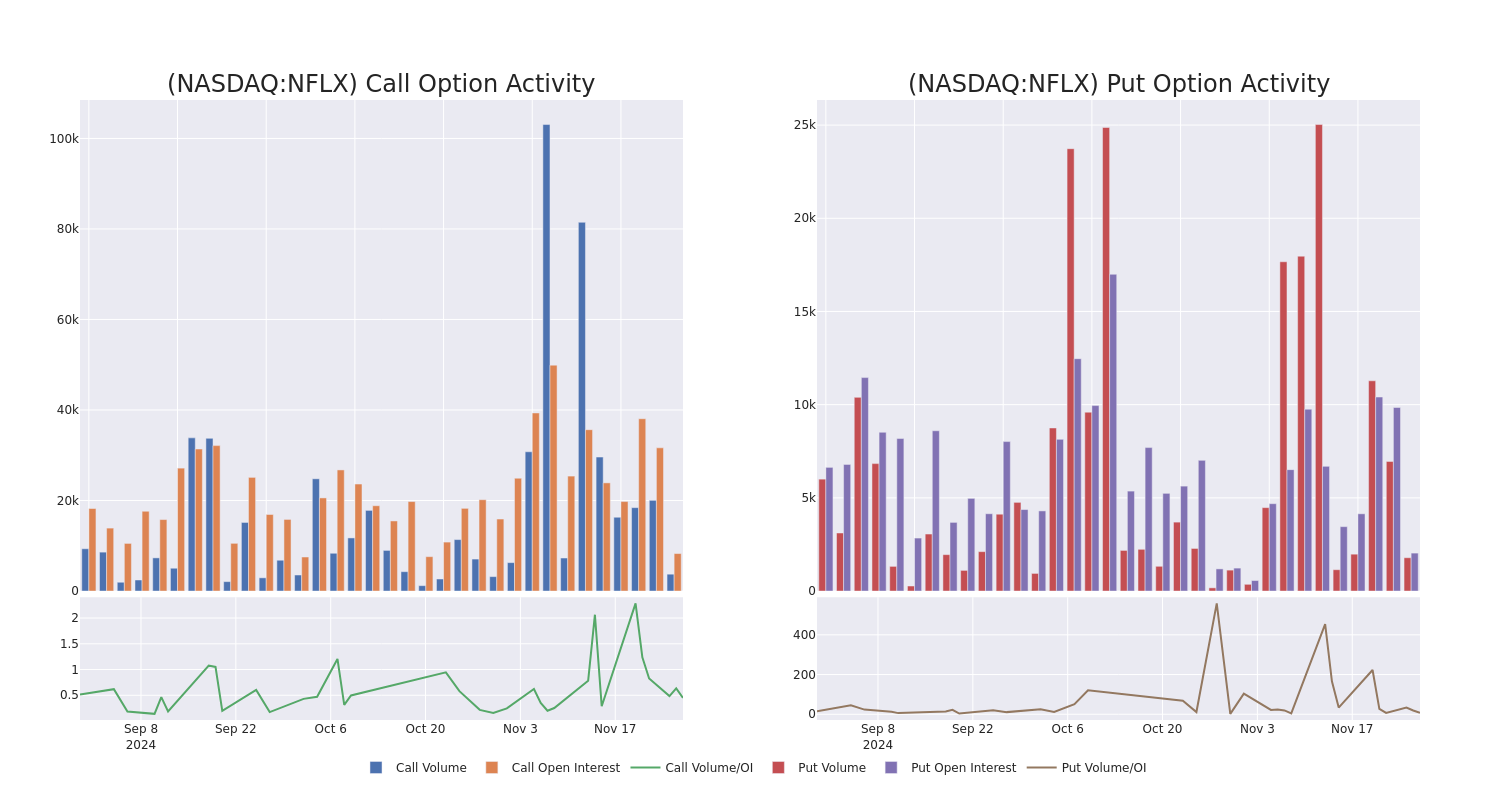

Within the following chart, we’re in a position to observe the event of quantity and open curiosity of name and put choices for Netflix’s large cash trades inside a strike value vary of $250.0 to $950.0 during the last 30 days.

Netflix Possibility Exercise Evaluation: Final 30 Days

Important Choices Trades Detected:

| Image | PUT/CALL | Commerce Kind | Sentiment | Exp. Date | Ask | Bid | Worth | Strike Worth | Whole Commerce Worth | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFLX | CALL | SWEEP | BEARISH | 12/06/24 | $3.4 | $3.1 | $3.1 | $900.00 | $235.6K | 1.4K | 1.6K |

| NFLX | PUT | TRADE | BULLISH | 01/17/25 | $21.7 | $20.0 | $20.3 | $840.00 | $203.0K | 476 | 100 |

| NFLX | CALL | SWEEP | BULLISH | 12/06/24 | $14.0 | $10.3 | $14.0 | $872.50 | $140.0K | 68 | 100 |

| NFLX | CALL | SWEEP | NEUTRAL | 12/20/24 | $2.75 | $2.72 | $2.75 | $950.00 | $77.2K | 2.4K | 484 |

| NFLX | CALL | TRADE | BEARISH | 06/20/25 | $629.75 | $623.65 | $626.0 | $250.00 | $62.6K | 4 | 0 |

About Netflix

Netflix’s comparatively easy enterprise mannequin entails just one enterprise, its streaming service. It has the most important tv leisure subscriber base in each america and the collective worldwide market, with greater than 280 million subscribers globally. Netflix has publicity to almost the complete international inhabitants outdoors of China. The agency has historically prevented stay programming or sports activities content material, as a substitute specializing in on-demand entry to episodic tv, films, and documentaries. The agency just lately started introducing ad-supported subscription plans, giving the agency publicity to the promoting market along with the subscription charges which have traditionally accounted for almost all its income.

In mild of the latest choices historical past for Netflix, it is now acceptable to give attention to the corporate itself. We goal to discover its present efficiency.

Current Market Standing of Netflix

- With a buying and selling quantity of 411,189, the value of NFLX is down by -0.7%, reaching $866.45.

- Present RSI values point out that the inventory is could also be overbought.

- Subsequent earnings report is scheduled for 55 days from now.

Professional Opinions on Netflix

Over the previous month, 4 business analysts have shared their insights on this inventory, proposing a median goal value of $968.75.

Uncommon Choices Exercise Detected: Sensible Cash on the Transfer

Benzinga Edge’s Uncommon Choices board spots potential market movers earlier than they occur. See what positions large cash is taking in your favourite shares. Click on right here for entry.

* Constant of their analysis, an analyst from Pivotal Analysis retains a Purchase ranking on Netflix with a goal value of $1100.

* Constant of their analysis, an analyst from B of A Securities retains a Purchase ranking on Netflix with a goal value of $1000.

* An analyst from Guggenheim has determined to keep up their Purchase ranking on Netflix, which presently sits at a value goal of $825.

* Reflecting issues, an analyst from Wedbush lowers its ranking to Outperform with a brand new value goal of $950.

Choices buying and selling presents greater dangers and potential rewards. Astute merchants handle these dangers by regularly educating themselves, adapting their methods, monitoring a number of indicators, and conserving an in depth eye on market actions. Keep knowledgeable concerning the newest Netflix choices trades with real-time alerts from Benzinga Professional.

Market Information and Information dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.