Beginning subsequent Monday, First Mover Americas will turn into Crypto Daybook Americas, your new morning briefing on what occurred within the crypto markets in a single day and what’s anticipated through the coming day. Publishing at 7 a.m. ET, it’s going to kickstart your morning with complete insights. You will not wish to begin your day with out it.

CoinDesk 20 Index: 3,278.83 +4.32%

Bitcoin (BTC): $$93,338.67 +1.05%

Ether (ETH): $3,462.51 +3.99%

S&P 500: 6,021.63 +0.57%

Gold: $2,652.77 +1.2%

Nikkei 225: 38,134.97 -0.8%

Prime Tales

Bitcoin ticked up following Tuesday’s drop beneath $91,000. BTC rose to over $93,800 and is at the moment buying and selling round 1.8% increased within the final 24 hours. Bitcoin ETFs noticed their second consecutive day of internet outflows on Tuesday, dropping nearly $123 million. This was considerably lower than Monday’s outflows of just about $440 million. BTC is underperforming the broader digital asset market, as measured by the CoinDesk 20 Index, which is up by over 4.8%. XRP, ADA and AVAX all made double-digit beneficial properties.

Ether continued its constructive worth motion, gaining 4.6% in 24 hours to tease a return to $3,500. The ETH-BTC ratio sits simply above 0.037, having elevated by over 10% within the final week. Spot ether ETFs within the U.S. registered internet inflows each days this week whereas their BTC equivalents have seen outflows. Exercise within the ether choices market listed on Deribit can be selecting up, with over 2 million contracts energetic, or open, probably the most since late June. In notional phrases, the open curiosity stands at $7.33 billion, in response to Deribit Metrics.

Merchants are piling into derivatives tied to ether, betting on increased costs for the world’s second-largest cryptocurrency. Cumulative open curiosity in perpetual and commonplace futures contracts has surged to a report 6.32 million ETH, price over $27 billion, a 17% month-to-date achieve, in response to knowledge supply CoinGlass. The hole between three-month ETH futures and spot costs has expanded to an annualized 16%. That is noteworthy as a result of an elevated premium might generate better curiosity in money and carry trades used to seize the value differential between the 2 markets.

Chart of the Day

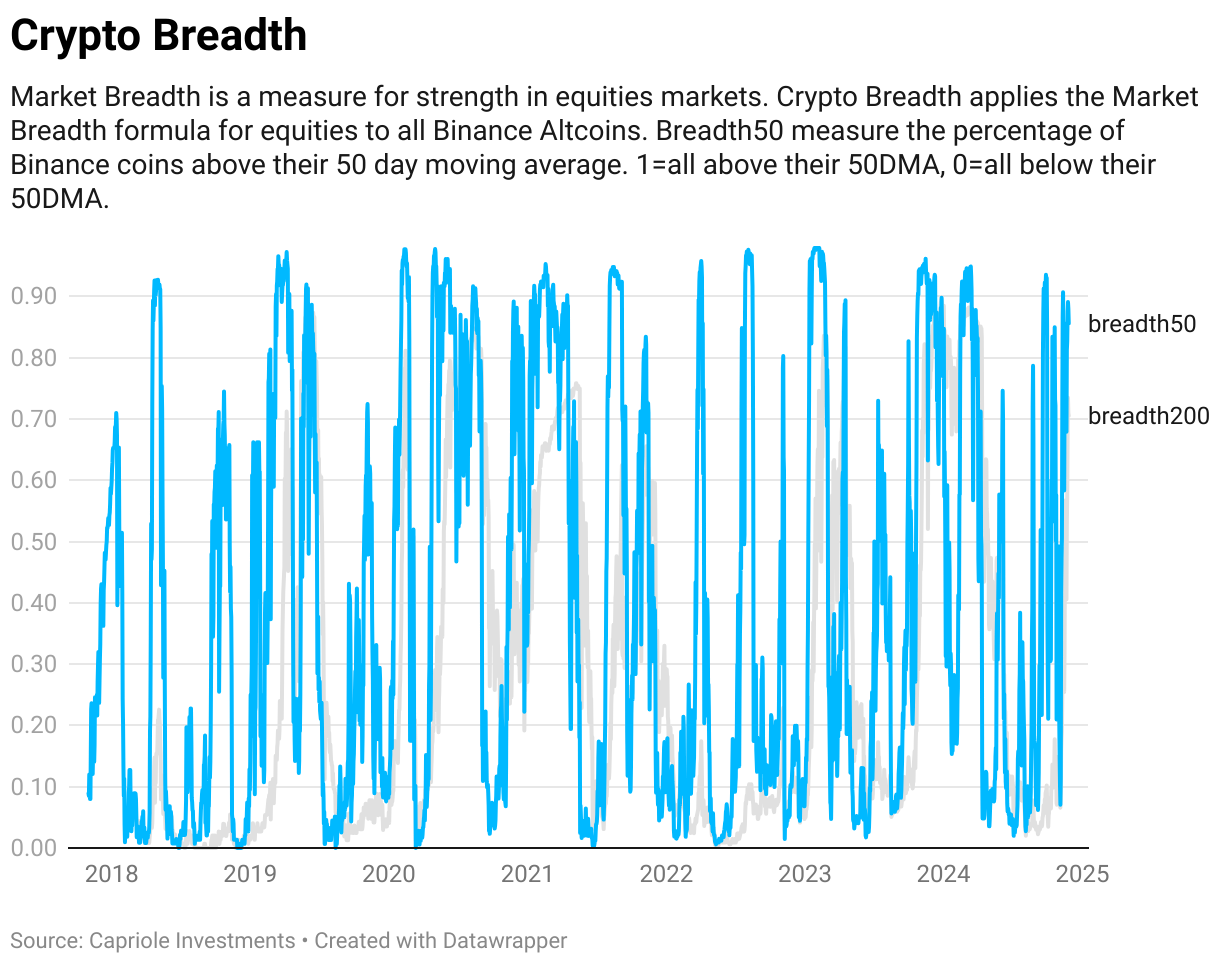

The broader market is collaborating within the bitcoin rally, with the proportion of the Binance-listed various cryptocurrencies buying and selling above their respective 50-day easy transferring averages (in blue) nearing 90%.

The variety of altcoins sitting above their 200-day SMA (in grey) has topped 70%.

Supply: Capriole Investments

– Omkar Godbole

Trending Posts

Twister Money Sanctions Overturned by U.S. Appeals Court docket; TORN Soars Over 500%

Ripple Drops One other $25M Into Crypto PAC to Sway 2026 Congressional Races

MicroStrategy Retail Buyers Caught Out On the Fallacious Facet of MSTR Commerce