Bitcoin has surged previous the $99,800 mark, setting a brand new all-time excessive because it inches nearer to the psychological $100,000 barrier. Whereas the milestone indicators outstanding power, the worth has but to assert this key stage, leaving buyers in suspense. Market demand stays strong, fueling optimism that Bitcoin will quickly break above the $100,000 threshold.

Associated Studying

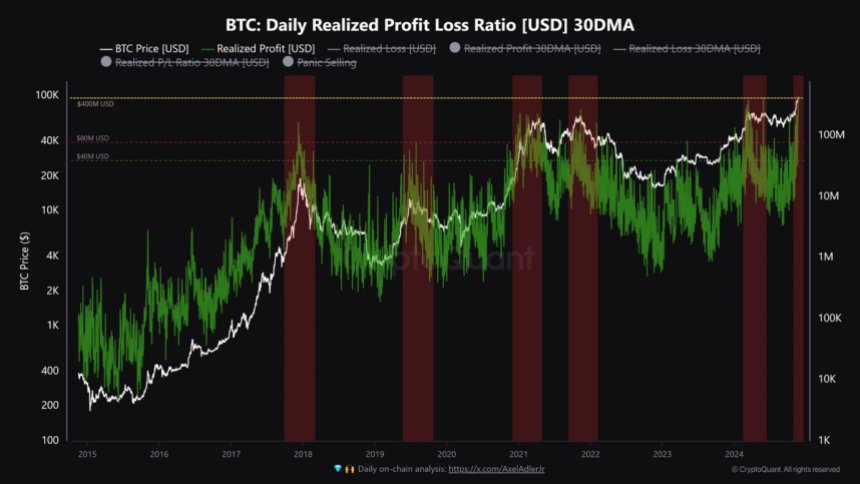

Key knowledge from CryptoQuant reveals that Bitcoin’s Realized Revenue has reached an all-time excessive of $443 million in every day positive aspects. This highlights important shopping for strain available in the market as merchants and long-term holders lock in unprecedented income. Nonetheless, this record-breaking profit-taking can be sparking considerations amongst some buyers. They worry the rally may stall, deciphering the surge in realized income as a possible sign of an area high situation.

Regardless of these blended indicators, the general market sentiment leans bullish. Bitcoin continues to carry above essential help ranges, suggesting that demand stays robust sufficient to drive the following leg up. With the cryptocurrency simply shy of a monumental breakthrough, the approaching hours and days might be essential in figuring out whether or not Bitcoin’s momentum can maintain a decisive transfer past $100,000 or if a brief consolidation is on the horizon.

Bitcoin Rally May Proceed Above $100K

Bitcoin’s rally from $66,800 to $99,800 has marked a novel and surprising bullish section in 2024. As costs strategy the elusive $100,000 milestone, many buyers who doubted Bitcoin’s potential to hit this stage this 12 months at the moment are revising their expectations. The surge has been pushed by robust demand and market confidence, making a breakout above $100,000 appear inevitable. Ought to this happen, analysts broadly anticipate a bullish continuation for Bitcoin, additional solidifying its dominance within the crypto house.

Associated Studying

Nonetheless, market dynamics recommend the journey to $100,000 will not be with out hurdles. Corrections throughout this section aren’t solely doable however is also useful for market well being. A pullback would supply a possibility for consolidation, doubtlessly giving altcoins the house to get better and provoke their very own rallies.

Crucial insights from CryptoQuant analyst Maartunn make clear the aggressive nature of this rally. Information reveals Bitcoin’s Realized Revenue just lately hit an all-time excessive of $443 million every day, reflecting important profit-taking exercise. Whereas this confirms strong shopping for strain, it additionally raises considerations amongst cautious buyers who interpret the spike in income as a possible signal of an area high.

Regardless of these considerations, there’s room for progress in Bitcoin’s trajectory. Sustaining help above $95,000 would maintain bullish momentum, however a wholesome correction from present ranges may also present the gas wanted for a stronger push past $100,000 within the close to future.

BTC Testing Essential Provide

Bitcoin is at present holding robust above the $97,000 mark, sustaining bullish momentum because it eyes a push above the $100,000 milestone. This stage represents a big psychological and technical barrier, and market sentiment stays optimistic about Bitcoin’s potential to interrupt it. With demand staying strong, many buyers are making ready for an explosive surge that might outline Bitcoin’s trajectory within the coming weeks.

Nonetheless, there are rising considerations about the potential for Bitcoin setting an area high. If this situation materializes, the worth may enter a consolidation section, doubtlessly lasting a number of weeks because the market digests latest positive aspects. Analysts recommend that holding above the $98,000 stage within the subsequent few days would maintain bullish momentum intact and pave the way in which for a breakout above $100,000.

Associated Studying

Alternatively, if Bitcoin fails to carry the $97,000 mark, it may sign the beginning of a wholesome correction. On this case, the worth could retrace to the $92,000 stage, a key demand zone that may probably act as robust help. A pullback to this stage would enable Bitcoin to regroup and construct the inspiration for an additional push larger, reinforcing its long-term bullish pattern.

Featured picture from Dall-E, chart from TradingView