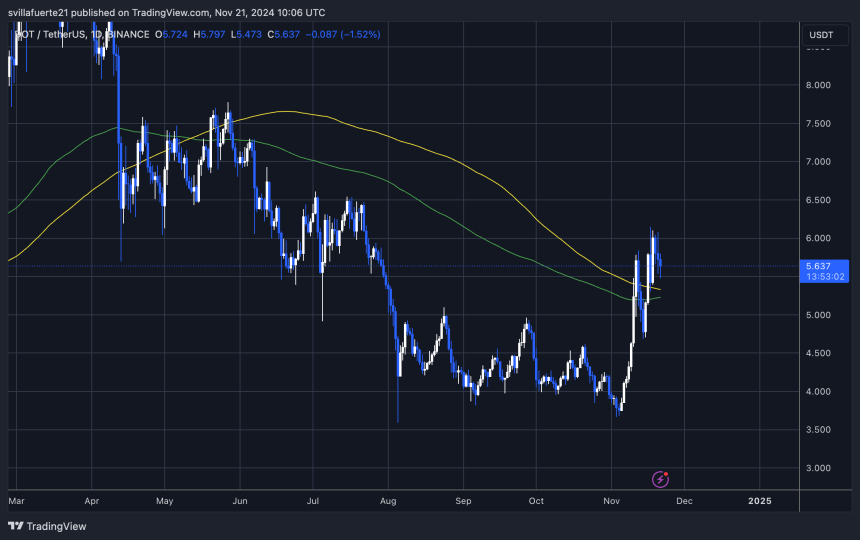

Polkadot (DOT) has entered a consolidation section, buying and selling under the $6 mark after a robust 30% rally since final Friday. This era of sideways motion has introduced some volatility, however market situations counsel DOT could be gearing up for its subsequent main transfer. Buyers watch the asset carefully because it maintains a bullish construction regardless of short-term resistance close to the $6 degree.

Associated Studying

High crypto analyst Ali Martinez has shared a technical evaluation highlighting Polkadot’s resilience. In accordance with Martinez, DOT is holding the agency above a important demand zone, an indication that the asset might put together for a major breakout. His insights level to rising curiosity and optimism round Polkadot, fueled by its potential for an additional bullish leg.

As one of many main blockchain ecosystems with strong interoperability options, Polkadot continues to seize consideration in a market more and more favoring high quality tasks. The subsequent few days will decide whether or not DOT can capitalize on its current momentum to push previous key resistance ranges. All eyes stay on Polkadot’s worth motion because it assessments investor confidence and market energy. If the anticipated surge materializes, DOT might quickly reclaim greater floor, additional solidifying its place within the crypto house.

Polkadot Getting ready For A Breakout

Polkadot seems to be on the verge of a breakout because it maintains bullish momentum regardless of a current pullback from the $6 resistance degree. After a virtually 10% retrace, DOT has discovered stability above the important $5.7 demand zone, signaling patrons are nonetheless firmly in management. This resilience has sparked optimism amongst buyers and analysts, who view the present worth motion as a setup for a major rally.

High crypto analyst Ali Martinez lately shared his insights on X, pointing to Polkadot’s weekly worth chart as proof of its potential. In accordance with Martinez, DOT has proven exceptional energy by holding above the $3.6 help degree, which has served as a basis for its current restoration. He means that if the present momentum continues, DOT might climb to $11 within the coming weeks, representing a considerable achieve from present ranges.

Martinez additionally emphasised that reaching and consolidating above the $11 mark might set the stage for a good larger rally. He predicts that such a transfer would open the door for a surge to $22, aligning with broader bullish expectations for the altcoin market.

Associated Studying

With Polkadot’s fundamentals and technical setup aligning, all eyes are on its capacity to beat key resistance ranges. If these predictions materialize, DOT might reestablish itself as a number one participant within the crypto market.

DOT Worth Motion: Technical Particulars

Polkadot is buying and selling at $5.6, sustaining its place above the important 200-day Transferring Common (MA) at $5.3. Breaking above this key indicator is a robust bullish sign, suggesting that DOT reveals long-term energy as patrons achieve management. The worth can be holding firmly above the $5.6 demand degree, which served as essential help throughout June and July however was misplaced till its current restoration.

This regained demand degree at $5.6 has reignited optimism amongst buyers, as sustaining this zone might present the inspiration for additional bullish momentum. If DOT manages to carry regular above this degree within the coming days, a transfer towards new provide zones is probably going, with the following goal at roughly $6.5.

Associated Studying

The mix of breaking the 200-day MA and reclaiming a major demand degree demonstrates that DOT has the potential to keep up its present upward trajectory. Nevertheless, sustained shopping for stress shall be obligatory to beat resistance and push towards greater targets. For now, all eyes stay on DOT’s capacity to consolidate above $5.6, which shall be a key indicator of whether or not it may possibly proceed climbing within the coming weeks.

Featured picture from Dall-E, chart from TradingView