The Bitcoin market seems to have taken an intriguing flip because the asset’s reserves on centralized exchanges have hit the bottom ranges since November 2018.

This growth, highlighted by a CryptoQuant analyst often called G a a h, factors out a notable change in BTC’s investor habits throughout the crypto area and in addition suggests fairly an attention-grabbing development for Bitcoin.

Bitcoin Reserves On Exchanges Attain 5-12 months Low

In line with the analyst, Bitcoin reserves on exchanges have diminished considerably all through 2024, reflecting a shift in the direction of long-term holding methods amongst market contributors.

This development means that buyers more and more switch their belongings to non-public wallets, lowering the provision obtainable for instant sale and contributing to purchasing stress in a market already constrained by provide.

In line with G a a h, this habits signifies a broader sentiment shift, with market contributors displaying elevated confidence in Bitcoin as a retailer of worth amidst “financial uncertainty and rising inflation.”

By shifting Bitcoin away from exchanges, buyers cut back the chance of sudden sell-offs, which may result in elevated value stability. Nevertheless, the lowered provide on exchanges can also result in heightened volatility, particularly if demand continues to develop or stays constant.

The CryptoQuant analyst famous:

With that stated, this situation alerts a probably extra unstable however extra resilient Bitcoin market, with much less promoting stress and a rising dominance of long-term holders, which may open up area for brand spanking new value peaks.

BTC’s Upward Momentum Cools Off

Following an all-time excessive (ATH) of $93,477 on Wednesday, November 13, BTC has confronted fairly a noticeable correction, now down by 4% from this peak. To date, the asset has been unable to proceed its upward momentum and seems to be seeing extra sell-offs.

When writing, Bitcoin trades under $90,000 with a present buying and selling value of $89,779, down by 1.4% prior to now day. This value decline resulted in roughly $49 billion subtracted from its market capitalization valuation on Wednesday.

For context, as of at present, BTC’s market cap sits at $1.775 trillion, an almost 5% lower from the $1.835 trillion valuation two days in the past. Bitcoin’s day by day buying and selling quantity dropped from over $100 billion earlier this week to under $85 billion.

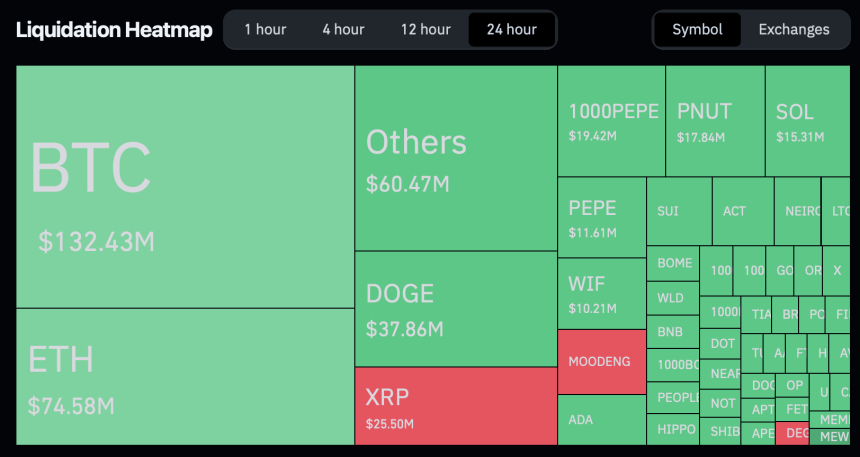

Apart from the implications on its market cap and buying and selling quantity, BTC’s decline has considerably impacted a handful of merchants. In line with knowledge from Coinglass, prior to now 24 hours alone, roughly 170,215 merchants have been liquidated, bringing the full liquidations within the crypto market to $510.13 million.

Out of those complete liquidations, Bitcoin accounts for $132.43 million, with nearly all of the liquidations coming from lengthy positions—those that guess that the upward momentum would proceed.

Featured picture created with DALL-E, Chart from TradingView