Legendary dealer Peter Brandt, with practically 5 a long time of expertise in buying and selling since 1975, has shared a bullish forecast for the Bitcoin value trajectory in 2025. Taking to X, Brandt acknowledged: “Bitcoin $BTC is now within the candy spot of the bull market halving cycle that ought to high within the $130k to $150K vary subsequent Aug/Sep. I measure cycles in a different way than most.”

How Excessive Can Bitcoin Go In 2025?

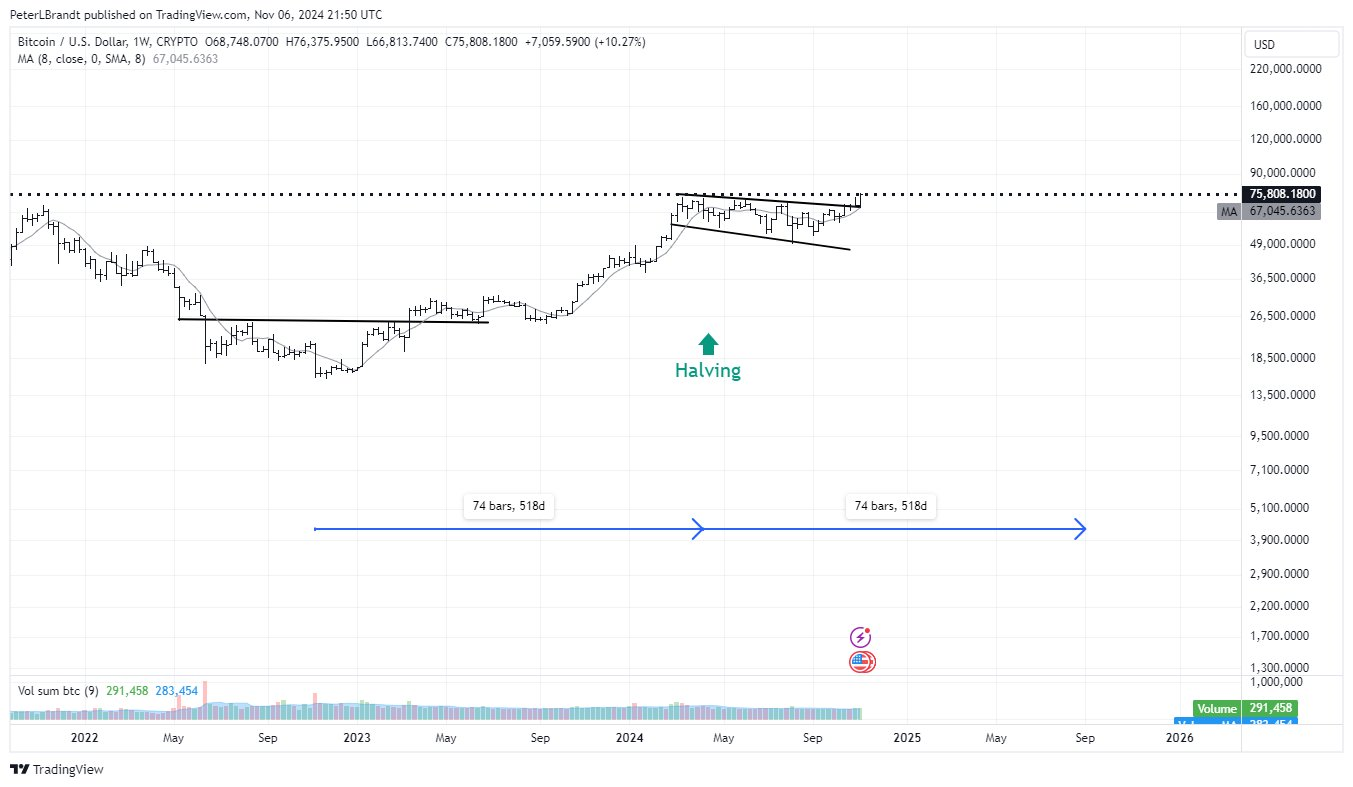

Brandt’s evaluation is rooted within the historic patterns noticed in Bitcoin’s halving cycles. His chart, protecting Bitcoin’s value motion from early 2022 with projections into 2026, highlights two vital intervals of 518 days every. These intervals signify crucial phases in Bitcoin’s market conduct, representing the cyclical nature of its value actions.

A notable technical sample recognized in his chart is the breakout from a broadening wedge. This formation, characterised by diverging help and resistance strains, suggests rising market volatility as costs make progressively greater highs and decrease lows. The profitable breakout from this sample is taken into account a powerful bullish sign.

Associated Studying

In an in depth weblog submit from June titled “The Lovely Symmetry of Previous Bitcoin Bull Market Cycles,” Brandt elaborated on the importance of halving occasions. He noticed that the halving dates have “represented the half-way factors of previous bull market cycles,” displaying an nearly good symmetry inside these cycles. Particularly, the variety of weeks from the beginning of every bull market cycle to the halving dates has been practically equal to the variety of weeks from the halving dates to the next bull market highs.

Based mostly on this symmetrical sample, Brandt posits that if the sequence continues, “the following bull market cycle excessive ought to happen in late Aug/early Sep 2025.” He means that the highs of previous bull markets align effectively with an inverted parabolic curve, and if this tendency persists, “the excessive of this bull market cycle may very well be within the $130,000 to $150,000 vary.”

Associated Studying

Regardless of his optimistic projection, Brandt maintains a cautious stance. He emphasizes that “no technique of study is fool-proof” and admits to avoiding being “dogmatic about any thought.” Whereas this view is his most popular evaluation, he acknowledges it isn’t his solely interpretation. Brandt notes that he continues to position a 25% likelihood that Bitcoin’s value has already topped for this cycle. Ought to Bitcoin fail to make a decisive new all-time excessive and decline under $55,000, he would elevate the likelihood of an “Exponential Decay.”

The crypto neighborhood has been actively participating with Brandt’s evaluation. Standard crypto analyst Astronomer (@astronomer_zero) responded on X, agreeing with Brandt’s high estimation and highlighting the significance of precisely calling the market high. Astronomer remarked: “I feel you’re spot on with that high estimation Peter! As for calling the underside, now it’s our responsibility to name the highest ideally in a single single strive. The terminal value does that very effectively. I’ve 6 different metrics in place. If all of them line up, it’s a promote. Location at $160,000.”

In an extra trade, an X person inquired concerning the implications for the Bitcoin to gold (BTC/GLD) ratio, suggesting it’d indicate a a lot greater value. Brandt responded, “Ultimately, sure. However let’s take one step at a time with out grow to be too dogmatic.”

At press time, BTC traded at $74,940.

Featured picture created with DALL.E, chart from TradingView.com