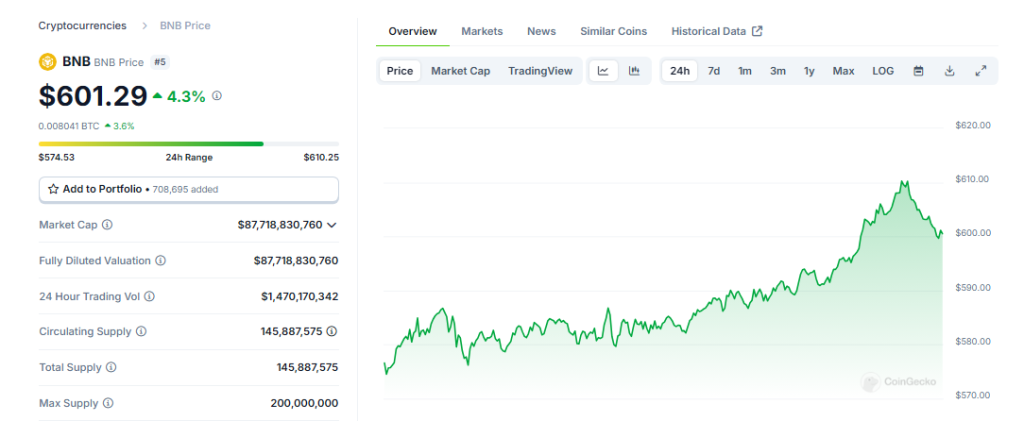

Up to now 24 hours, the value of Binance Coin (BNB) elevated by 5%, which is indicative of a constant upward movement. BNB, which simply broke the vaunted $600 barrier, is attracting the market’s focus on account of indications of bullish momentum.

Associated Studying

Nevertheless, the information at CoinCheckup means that BNB is buying and selling about 20% under its anticipated value for the following month. This undervaluation would possibly thus be an indication of potential for near-term income if this development doesn’t change anytime quickly.

Binance Coin: Combined Sentiment & Cautious Optimism

BNB’s technical figures point out a cautious optimism concerning market sentiment. The Relative Power Index (RSI) is persistently round 50, indicating a balanced sentiment that isn’t topic to important strain from both purchasers or sellers.

This neutrality in itself says that the market will not be overheating and, by extension, BNB may surge both manner with no clear, excellent development. One other essential indicator to observe is the Chaikin Oscillator, and it’s at the moment at -35K. Thus, there’s nearly no shopping for accumulation.

In the meantime, within the absence of a change in market sentiment which will entice extra patrons into the fray, the shortage of capital influx may be the factor that retains BNB from additional rallies.

The buying and selling quantity of BNB rises by 31% inside 24 hours, subsequently the market exercise and curiosity are rising. Investor curiosity is observable by way of the determine for volume-to-market capitalization ratio, which is at 2.46% at the moment, and primarily based on this enhance, however what’s being examined is whether or not curiosity helps the upward transfer of costs.

Quick-Time period Pressures And Buying and selling Volatility

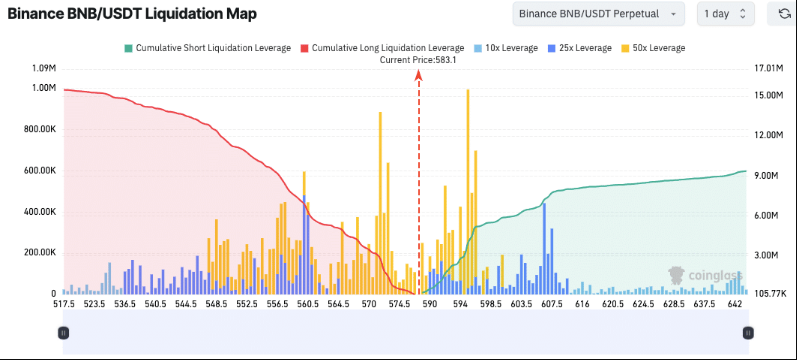

The liquidation map of BNB demonstrates focus zones which will jeopardize value stability within the rapid time period. The potential for value volatility exists if BNB surpasses $590; brief positions are extremely concentrated on the $583 degree.

This may push these brief positions, and subsequently, act like a domino impact which may push costs up greater. Lengthy liquidations are triggered when the value falls under $570. This implies if the BNB value drops, sells will be accelerated because the positions close to their finish.

These ranges are the crucial factors a short-term dealer needs to be watching. Relying on the conduct of the market, the value fluctuations round these ranges can both have dangers or current alternatives.

Associated Studying

Lengthy-Time period Forecast

With projections indicating a potential rise of 60% over the following three months and a subsequent enhance of 30% over six months, BNB’s outlook stays optimistic (though it is very important stay cautious). Moreover, the anticipated development charge of 53% means that the 12-month forecast is powerful, which is promising for buyers.

The current token burn exercise of BNB—resulting in the particular elimination of 1.77 million tokens (that are estimated to be value about $1 billion)—has emerged as the principle cause for this constructive sentiment.

This provide discount is essential for value stability and BNB development for long-term buyers. Every burn will increase the worth of the remaining tokens, however the unstable market makes it unsure how these dynamics will play out.

Featured picture from DALL-E, chart from TradingView