Bitcoin is exhibiting resilience, holding agency above the $69,000 mark after a slight pullback from current native highs at $73,600. Following weeks of bullish momentum and nearing its all-time excessive, BTC has settled slightly below the essential $73,794 resistance, a key degree that, if surpassed, would push the cryptocurrency into value discovery mode.

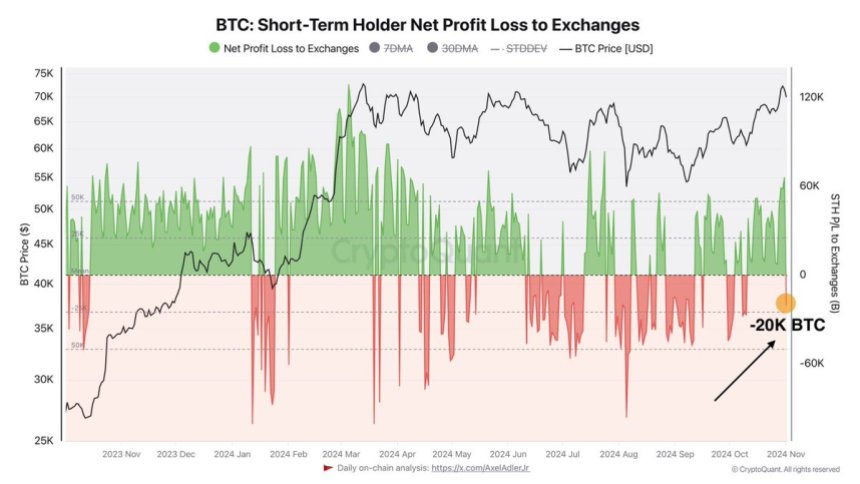

In accordance with information from CryptoQuant, short-term holders are experiencing a internet profit-to-loss of damaging 20 BTC, indicating a wave of panic promoting amongst retail traders. The sort of habits, typically pushed by worry, uncertainty, and doubt (FUD), can precede a big value surge as stronger arms accumulate BTC at decrease costs.

Associated Studying

Traditionally, related sell-offs by retail traders have been adopted by renewed upward momentum as longer-term holders seize the chance to enter or reinforce their positions. If Bitcoin can keep help above $69,000, the chances of a breakout previous its all-time excessive improve considerably.

Market watchers are actually intently monitoring the resistance degree, as surpassing it may set off a wave of shopping for curiosity and push BTC into new highs. The approaching days could show essential, setting the stage for Bitcoin’s subsequent large transfer.

Bitcoin Weak Fingers Promoting

Bitcoin just lately tried a breakthrough to new heights however did not breach its all-time excessive of $73,794, coming into a consolidation part because the market eyes key occasions: subsequent week’s U.S. election and the Federal Reserve’s anticipated rate of interest resolution.

CryptoQuant’s current information, shared by analyst Axel Adler on X, factors to a noteworthy pattern amongst short-term BTC holders. The web profit-to-loss ratio for these holders exhibits a damaging stability of -20 BTC, indicating a wave of panic promoting following Bitcoin’s wrestle to determine new highs. This sell-off amongst short-term traders, who are likely to react extra rapidly to market volatility, suggests some warning amid uncertainty.

Adler emphasizes that in such turbulent occasions, a long-term “HODL” (maintain on for expensive life) strategy might be essentially the most useful technique. Holding robust by means of market noise has traditionally rewarded BTC traders who maintain their positions intact in periods of retracement and heightened volatility.

With Bitcoin’s all-time excessive in sight, a profitable breakout would probably sign the start of a broad market bull run. The approaching days are essential as Bitcoin sits at a pivotal level in its cycle, balancing between robust consolidation and the potential for explosive development.

Associated Studying

The affect of the Federal Reserve’s resolution on rates of interest, paired with potential election outcomes, may create the market situations wanted for BTC to push previous its all-time excessive. If this degree is breached, it will not solely affirm a bullish outlook for BTC however probably set off a rally throughout your entire cryptocurrency market.

BTC Holding Above Key Help

Bitcoin is presently buying and selling at $69,620 following a retrace from its current excessive close to $73,600. Regardless of this pullback, bulls stay in management as BTC holds firmly above the essential $69,000 help degree—a value level that acted as resistance since late July. This degree has now remodeled into robust help, bolstering bullish sentiment out there.

If Bitcoin holds above $69,000, a renewed push above all-time highs appears probably. Breaking this resistance would propel BTC into uncharted territory, doubtlessly sparking a contemporary wave of bullish momentum and value discovery. Nonetheless, if the value dips under this mark, it may sign a necessity for a extra vital correction to assemble sufficient shopping for energy for the subsequent transfer up.

Associated Studying

The $69,000 degree serves as a key indicator of market confidence, as shedding it will indicate that BTC would possibly briefly search decrease help ranges to draw new patrons and stabilize earlier than one other try at new highs. For now, Bitcoin’s value construction stays robust, and so long as this help holds, the market anticipates additional upside momentum within the coming days. Bulls are intently watching this degree, as it could outline the subsequent part of Bitcoin’s bull run.

Featured picture from Dall-E, chart from TradingView