By Matthew Hayward, Senior Market Analyst at PrimeXBT

Historically, the fourth quarter and October have been sturdy months for cryptocurrencies, notably Bitcoin. Nevertheless, this yr, the good points have been much less spectacular than in earlier years. Presently, Bitcoin has elevated by over 5% this month, offering a glimmer of optimism. So, what has precipitated this underwhelming efficiency, and why haven’t we seen the anticipated rally?

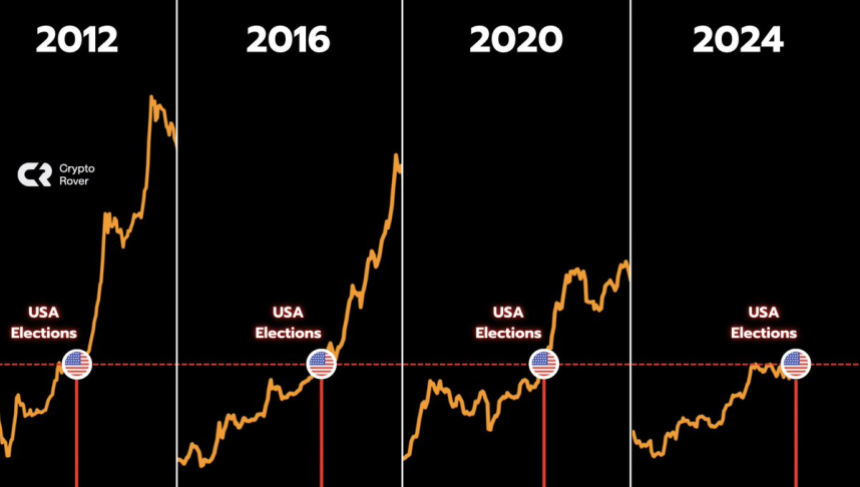

Reflecting on early October, a sequence of bulletins and shifts within the financial panorama contributed to Bitcoin’s preliminary decline, setting a difficult tone for the month. Analysing the infographic beneath exhibits that, throughout a “bull market,” the fourth quarter has traditionally been a interval of serious progress for Bitcoin. With simply two months left within the quarter, will Bitcoin keep its upward momentum?

Supply: Crypto Rover

Present worth actions influenced by political uncertainty

A number of key occasions demand consideration from each political and financial views. On the political entrance, the upcoming U.S. elections are in focus, with current polls indicating a surge in Trump’s reputation. Whereas the ultimate outcomes stay unsure till election day, previous traits present that Trump’s campaigns have typically pushed optimistic momentum in each conventional and cryptocurrency markets. He has additionally voiced help for advancing cryptocurrency adoption if re-elected, sparking questions on whether or not this might drive broader acceptance within the sector. Trying extra intently on the infographic beneath, we will see that the timing of Bitcoin cycles alongside U.S. election cycles has typically resulted in a internet optimistic impression on Bitcoin’s worth following elections.

Supply: Crypto Rover

Ongoing uncertainty within the macroeconomic panorama

In September, the Federal Reserve made a major transfer by lowering rates of interest by 0.5%, marking a considerable shift after an prolonged interval of stability. This daring fee reduce takes us again to the final main rate of interest reduce, the place the FED additionally reduce rates of interest by 0.5%, which occurred proper earlier than the inventory market crash that triggered the 2008 monetary disaster.

Supply: Reuters

Supply: Reuters

Following the announcement of the rate of interest determination, Non-Farm Payroll information got here in considerably greater than anticipated, contrasting with earlier stories. The Federal Reserve had beforehand emphasised its intent to help the labour market, and because the elections method, it seems to be succeeding. Nevertheless, the query stays: how substantial will subsequent yr’s revisions be if these outcomes are certainly inflated?

May inflation proceed to rise sooner or later?

Within the mild of the Federal Reserve’s 0.5% rate of interest discount and unexpectedly sturdy job stories, consideration has turned to inflation issues. The Fed reiterates decreasing inflation to its 2% goal; nonetheless, merchants are actually involved concerning the potential threat of inflation growing following the speed reduce. Latest CPI figures confirmed a slight uptick, touchdown at 2.4%, slightly below the earlier month’s fee of two.5%. Ought to inflation proceed to rise whereas U.S. GDP information stays stagnant or decreases, the financial system might face the specter of “stagflation.”

Supply: Reuters

May an financial downturn be looming forward?

Traditionally, Bitcoin and the broader cryptocurrency market have but to face a protracted interval of main financial uncertainty. Since Bitcoin’s launch within the late 2000s, it has existed solely within the post-2008 monetary disaster setting. This brings up an essential query: how may the danger of a possible “Black Swan” occasion impression its worth traits and disrupt established cycle theories?

Supply: Seekingalpha

What impression do these developments have on cryptocurrencies and the broader markets?

As cryptocurrency adoption will increase and extra institutional traders enter the market, conventional indicators are prone to have a higher affect on buying and selling methods for threat belongings like cryptocurrencies. The 2 charts beneath illustrate how the markets are anticipating these information releases and their impression on Bitcoin’s worth actions. Notably, previous to the rate of interest reduce, the value of Bitcoin started to rise sharply. It’s because, in an setting of rate of interest cuts, threat belongings like cryptocurrencies sometimes carry out higher. The charts show how this optimistic sentiment was already mirrored within the pricing, resulting in an upward motion following the announcement.

Within the second situation, we will see that the newest CPI information launch was not beneficial for the pricing of threat belongings, as uncertainty grew relating to the potential of rising inflation. If inflation have been to start out growing, the chart beneath illustrates how the market was already pricing in a damaging response to that information launch.

How one can Commerce Key Financial and Political Occasions with PrimeXBT

As financial uncertainties enhance, new buying and selling alternatives could emerge. PrimeXBT stands out as a premier cryptocurrency and CFD dealer, providing a strong buying and selling platform for purchasing, promoting, and storing cryptocurrencies. The platform grants entry to greater than 100 standard markets, together with Crypto Futures, Copy Buying and selling, and CFDs throughout Cryptocurrencies, Foreign exchange, Indices, and Commodities. Customers can commerce with each fiat and cryptocurrency funds, making it a versatile choice for adapting to the altering macroeconomic setting.

PrimeXBT allows buying and selling by decreasing boundaries to entry and offering safe, user-friendly entry to monetary markets. The platform supplies top-tier buying and selling circumstances and progressive instruments, making it simpler for each novice and seasoned merchants to discover a various array of funding alternatives.

Commerce key occasions with PrimeXBT

Disclaimer: The content material offered right here is for informational functions solely and isn’t meant as private funding recommendation. Previous efficiency will not be a dependable indicator of future outcomes. The monetary merchandise provided by the Firm are advanced and include a excessive threat of dropping cash quickly as a result of leverage. Digital belongings are inherently unstable and topic to vital worth fluctuations, which might end in substantial good points or losses. These merchandise will not be appropriate for all traders. Earlier than participating, you need to take into account whether or not you perceive how these leveraged merchandise work and whether or not you may afford the excessive threat of dropping your cash. PrimeXBT doesn’t settle for purchasers from Restricted Jurisdictions as indicated in its web site.