Bitcoin has skilled a unstable week, with costs oscillating between an area excessive of $69,500 and a low of $65,000. After weeks of pleasure and upward momentum, the market has cooled off, and BTC is at present consolidating under the important $70,000 stage. This consolidation part is essential as merchants assess the subsequent potential transfer for Bitcoin.

Associated Studying

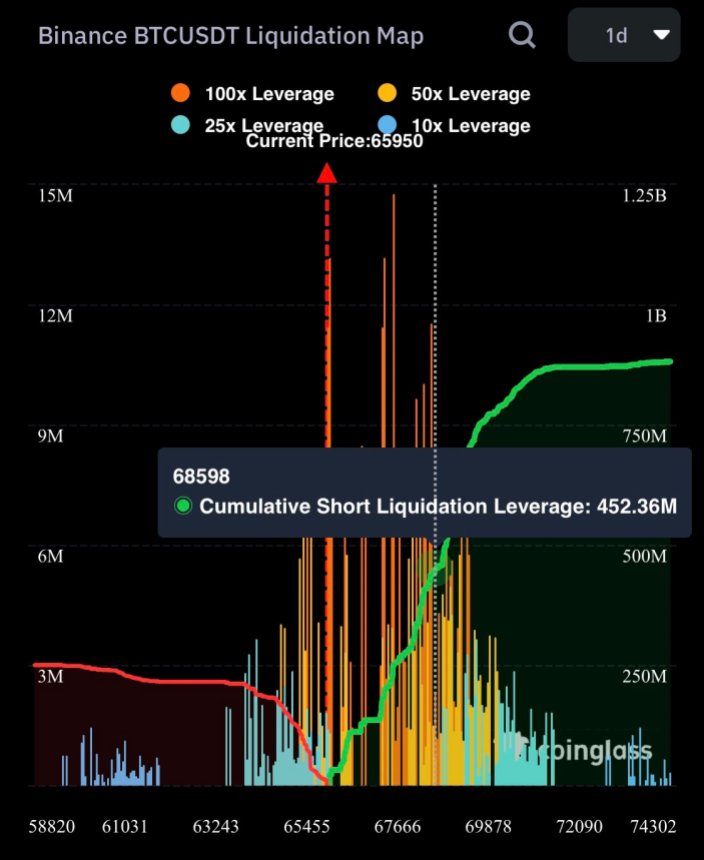

Analyst Ali Martinez has shared vital information from Binance, highlighting the excessive threat for brief positions on the $68,500 mark. When such threat ranges are current, the value usually seeks liquidity, which means that it could gravitate towards provide zones. This conduct signifies that the market is probably focusing on areas the place sellers could also be positioned, which might result in additional fluctuations in value.

The interaction between these resistance and assist ranges will decide Bitcoin’s trajectory. A decisive transfer above these ranges might sign Bitcoin’s subsequent part, making it important for traders to stay vigilant.

Bitcoin Brief Squeeze Looms

Bitcoin is reaching a pivotal second, with the market buzzing with expectations for a possible push towards all-time highs. Martinez not too long ago shared essential information on X, revealing {that a} vital variety of quick positions are vulnerable to liquidation, notably across the $68,598 mark. The cumulative quick liquidation leverage at this value stage is roughly $452.36 million, indicating {that a} substantial quantity of capital may very well be affected if the value continues to rise.

This situation units the stage for a bullish outlook, as overleveraged quick positions recommend that Bitcoin might discover liquidity at provide ranges. This might set off a cascade of shopping for strain. When the value breaks above the important thing $69,000 mark, it might result in a wave of Concern of Lacking Out (FOMO) amongst merchants and traders watching from the sidelines.

The liquidation of those quick positions might propel Bitcoin’s value greater, strengthening the bullish narrative. Market members intently monitor this important threshold, as a decisive break above $69,000 might ignite a surge towards beforehand untested highs.

Associated Studying

Sustaining consciousness of each market dynamics and key value ranges is important for merchants trying to navigate the volatility. The subsequent few days might show essential as Bitcoin approaches this vital second, and the way it reacts to those overleveraged positions might decide its trajectory within the coming weeks.

BTC Liquidity Ranges

Bitcoin (BTC) is at present buying and selling at $67,100 after every week marked by volatility and uncertainty. The worth has pushed above the $66,000 stage, signaling energy and hinting at a possible rally within the coming weeks. This upward motion displays renewed optimism out there, as traders search for indicators of sustained bullish momentum.

Nevertheless, it’s important for BTC to keep up its place above the $65,000 mark. If the value fails to carry this stage, a sideways consolidation might happen, permitting the market to collect liquidity earlier than making its subsequent transfer. This consolidation part might set the stage for a surge in shopping for exercise as merchants look to capitalize on potential alternatives.

Associated Studying

A break above the important thing $70,000 stage would additional strengthen the bullish outlook, probably initiating a brand new uptrend. Such a motion might entice extra funding and pleasure out there, as merchants and traders reply to the breakout.

Featured picture from Dall-E, chart from TradingView