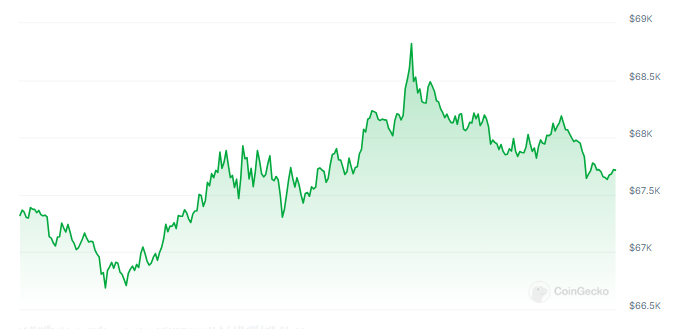

Microsoft is making ready for a essential shareholder assembly on December 10, throughout which the way forward for Bitcoin as a possible funding will likely be a heated subject. At current, Bitcoin is buying and selling at roughly $68,115, which represents a rise of roughly 1.22%.

The rise in curiosity aligns with fixed debates across the cryptocurrency as an inflation hedge, which some Microsoft buyers discover interesting.

Associated Studying

Microsoft’s Place On Bitcoin

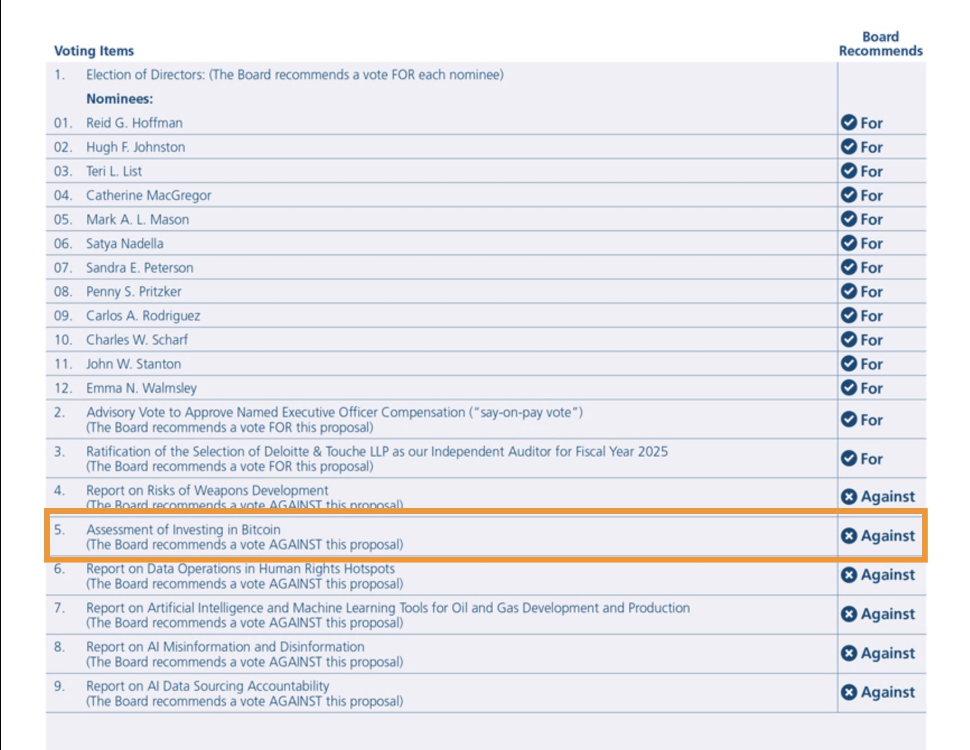

Microsoft revealed in a latest software to the US Securities and Alternate Fee that it’ll suggest evaluating Bitcoin funding through the forthcoming convention.

The Nationwide Heart for Public Coverage Analysis (NCPPR) says that Bitcoin has executed higher than conventional investments and might be a great way to shield in opposition to inflation.

JUST IN: Per an SEC submitting, Microsoft can have a proposed board decision for an “Evaluation of Investing in Bitcoin”.

The board is recommending that shareholders vote AGAINST the proposal. pic.twitter.com/0WveygitH9

— TFTC (@TFTC21) October 24, 2024

Microsoft’s board, then again, desires shareholders to vote in opposition to this plan as a result of the corporate has already checked out a variety of investable property, together with cryptocurrencies.

Based on a spokesperson for the corporate:

“Volatility is among the essential points for all of the investments in cryptocurrencies for company treasury”

This emphasizes the cautious technique that Microsoft has adopted so far as the administration of its company treasury is worried in addition to for the good thing about enhancing the shareholders worth for the long run.

The board is of the opinion that the requested public appraisal is pointless, as they already monitor tendencies and developments within the cryptocurrency sector.

Large-Wig Stockholders

Microsoft’s main shareholders embody plenty of main institutional buyers, akin to Vanguard, BlackRock, and State Road. These organizations personal a big proportion of the corporate and have appreciable energy to have an effect on its coverage route.

Though some shareholders are advocating for Bitcoin investments, others could also be extra according to the board’s cautious stance.

It is very important be aware that BlackRock has been actively rising its Bitcoin holdings by way of its ETFs. BlackRock’s iShares Bitcoin Belief ETF has registered inflows to the tune of over $317 million in a 24-hour timeframe, based on latest stories.

This development implies that there’s an rising institutional curiosity in Bitcoin, regardless of Microsoft’s reluctance to implement comparable measures.

The Highway Forward

Because the December convention will get prepared, the talk about Bitcoin’s significance in Microsoft’s funding plan will get extra intense.

The NCPPR argues that companies ought to commit a minimum of 1% of their complete property to Bitcoin to assist to cut back inflation dangers. Regardless of this undertaking, Microsoft insists that its current company treasury distribution insurance policies are enough.

Associated Studying

Bitcoin has skilled an almost twofold improve in worth up to now 12 months and has recorded a exceptional 414% improve over the previous 5 years. Though Microsoft will not be utterly ready to spend money on cryptocurrency investments at the moment, the rising curiosity from institutional buyers akin to BlackRock means that the discourse surrounding Bitcoin is much from over.

Microsoft’s upcoming shareholder assembly would be the focus of all consideration, and it’s unsure whether or not the tech big will alter its place on cryptocurrencies or preserve its dedication to stability in its funding technique.

Featured picture created with Dall.E, chart from TradingView