Chainlink is the main middleware, linking on-chain dapps with exterior information securely. Whereas the platform is essential in lots of crypto sectors, particularly DeFi, LINK has just lately struggled for momentum.

LINK Holders Transferring Tokens From Exchanges: Are They Accumulating?

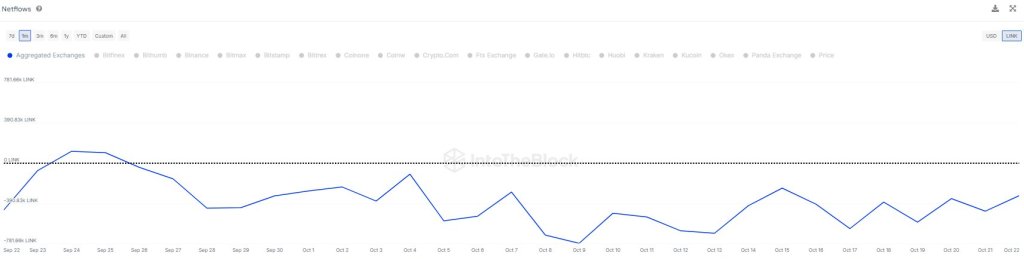

Nevertheless, on-chain streams from IntoTheBlock reveal that extra holders are shifting tokens from high exchanges like Binance and Coinbase. In a put up on X, the analytics platform observes that change move over the previous month has been detrimental, signaling sustained withdrawals.

Often, every time tokens are moved from exchanges, it might point out that homeowners are assured of what lies forward. Since LINK, the ERC-20 token, is supported by many DeFi protocols, it might counsel that holders are excited by partaking with these dapps, probably incomes passive earnings.

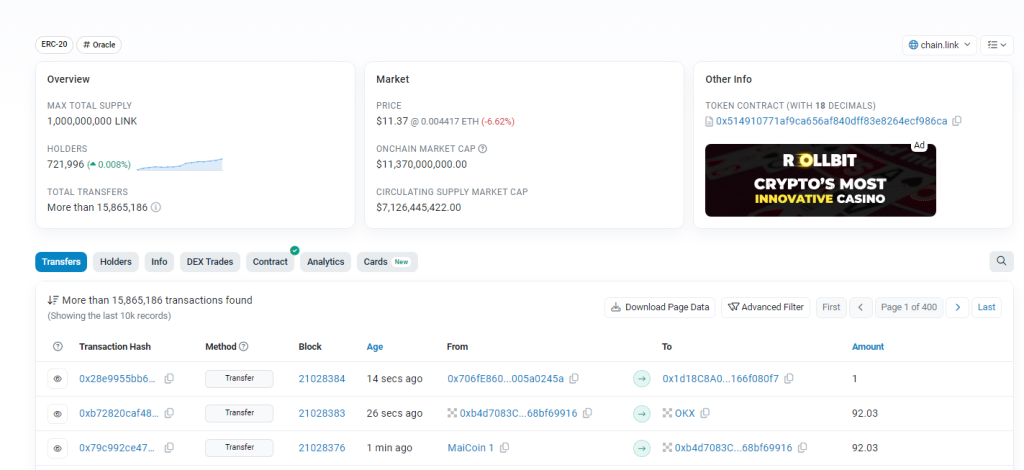

The extra transfers from centralized ramps, the upper the probability of costs increasing in tandem, which is a internet optimistic for LINK bulls. Based on Etherscan, Chainlink has a high provide of 1 billion LINK distributed to 721,996 distinctive addresses when writing on October 23.

These holders have, in flip, moved LINK over 15.8 million instances. A stage deeper, onchain information reveals that Binance controls greater than 4.2% of the full provide. LINK below their management exceeds $479 million at spot charges.

Chainlink Constructing: Will Value Break Above $20?

With IntoTheBlock information pointing to internet outflows from exchanges, there’s a probability that LINK will discover help and resume the uptrend of the previous few buying and selling days. LINK has resistance at $12.3, and a double bar bear formation is printing out following the dip of early in the present day.

Nevertheless, even when costs break larger, rejecting bears, bulls should decisively develop above the double high at round $13. The eventual spike will open the door for LINK bulls to create a stable base for a rally to $20.

The tempo of this progress depends upon how high altcoins, together with Ethereum, carry out. If Ethereum costs get well, hovering above $3,000, it might reinvigorate DeFi and NFT demand, lifting LINK.

Past this, value drivers will embody the staff’s progress. Yesterday, October 22, Chainlink Labs launched the Cross-Chain Interoperability Protocol (CCIP) Non-public Transactions. This characteristic allows information privateness with out violating current legal guidelines guarding cross-chain transactions.

The answer makes use of the middleware’s Blockchain Privateness Supervisor. This fashion, associate banks and different monetary gamers can securely join non-public chains with different ledgers every time they share delicate data.