On-chain knowledge exhibits round 95% of all Bitcoin holders are in revenue following the most recent bullish motion that the asset’s value has seen.

Very Few Bitcoin Addresses Are Nonetheless Underwater

In a brand new publish on X, the market intelligence platform IntoTheBlock has shared an replace on how the Bitcoin holder’s profitability is at the moment trying. The analytics agency has made use of on-chain knowledge to find out this.

IntoTheBlock has gone by the transaction historical past of every tackle on the community to test the typical value at which it acquired its cash. Wallets with a value foundation beneath the present value are assumed to hold some internet unrealized revenue.

Equally, addresses of the alternative sort are thought-about to be loss holders. The analytics agency phrases the previous buyers “within the cash,” whereas the latter are “out of the cash.”

Naturally, the wallets with their common acquisition value equal to the most recent spot value of the cryptocurrency could be simply breaking even on their funding. They’d be stated to be “on the cash.”

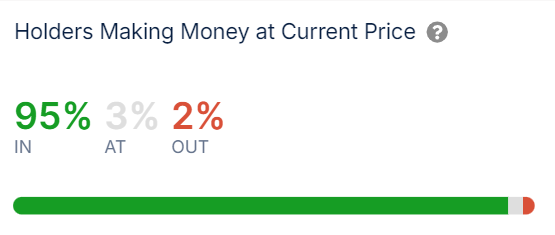

Now, right here is how the tackle distribution on the Bitcoin community is like proper now throughout these three classes:

As is seen above, round 95% of the present Bitcoin holders at the moment have a internet revenue. About 3% of the remaining are at their break-even degree, whereas the remainder 2% are underwater.

Thus, the market distribution is at the moment overwhelmingly skewed in the direction of revenue holders. The rationale behind that is the current value rally the asset has gone by.

“With 95% of Bitcoin addresses now in revenue, market sentiment is booming,” notes IntoTheBlock. “Traditionally, such ranges have signaled sturdy bullish momentum however can even point out a possible overextension.”

Typically, buyers in revenue usually tend to promote their cash at any level, so a considerable amount of them being within the inexperienced can increase the probabilities of a mass selloff occurring with the motive of profit-taking. That is why a excessive profitability ratio can counsel potential overheated circumstances.

An enormous quantity of addresses are within the cash proper now, so it’s potential that one other profit-taking occasion may occur. It stays to be seen whether or not demand could be sufficient to soak up the promoting or if a prime would happen for Bitcoin.

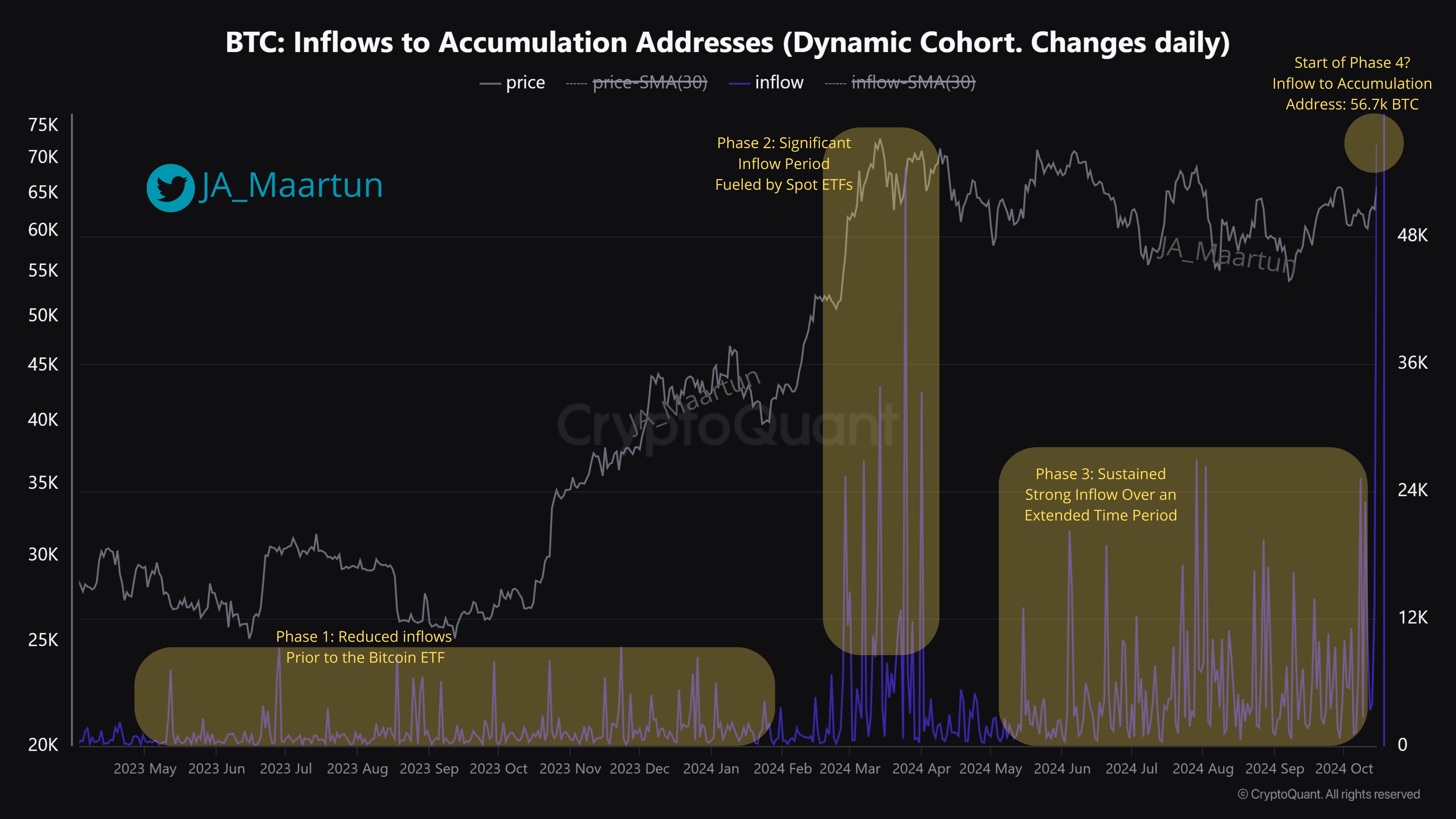

On a extra bullish notice, the Bitcoin inflows to “accumulation addresses” have spiked lately, as CryptoQuant group supervisor Maartunn has identified in an X publish.

The buildup addresses discuss with the wallets that haven’t any historical past of promoting on the community. These perennial HODLers have simply added an enormous 56,700 BTC to their wallets, which may counsel they might be beginning one other part of accumulation.

BTC Value

On the time of writing, Bitcoin is buying and selling round $67,400, up greater than 11% over the previous week.