Solana is testing an important provide degree round $160 following a powerful 15% surge since final Friday. The crypto market is experiencing heightened volatility as optimism grows, rising token costs.

In current weeks, Solana and different main cryptocurrencies have been on a rollercoaster journey, and the approaching weeks promise continued uncertainty as volatility reveals no indicators of slowing down.

Associated Studying

Key metrics from DefiLlama reveal that Solana’s whole worth locked (TVL) has reached a brand new yearly excessive, now at round $6 billion, its highest degree since September 2022. This TVL enhance indicators confidence in Solana’s ecosystem and decentralized finance (DeFi) choices.

Buyers and merchants are intently watching the market, with Solana’s efficiency prone to function a key indicator for broader market sentiment. As Solana assessments this important resistance degree, the subsequent few days will decide whether or not the token continues its upward momentum or faces one other spherical of volatility.

Solana Testing Essential Resistance

Solana is flirting with a 5% surge, poised to problem native highs and probably affirm a long-term uptrend. Because the broader crypto market experiences a shift, traders and merchants are eagerly looking for indicators that Solana is able to break into new highs.

Key knowledge from DefiLlama reveals that Solana’s whole worth locked (TVL) has reached a brand new yearly excessive of $6 billion. TVL measures the whole worth of belongings deposited right into a blockchain venture and is a key indicator of consumer confidence and engagement.

A rising TVL means that extra customers are locking their funds into Solana’s decentralized functions, an indication of rising belief in its ecosystem.

This enhance in TVL additional helps the bullish outlook that many traders maintain for Solana. The platform’s increasing DeFi choices and stable infrastructure make it a powerful contender within the altcoin area. As Solana continues to push towards new highs, such elementary knowledge reinforces optimism about its future worth motion.

Associated Studying

A confirmed surge above key resistance ranges may start a sustained upward pattern for Solana, positioning it as one of many prime performers out there. Buyers are watching intently to see if the present worth motion can translate right into a longer-term rally.

Key Ranges To Watch

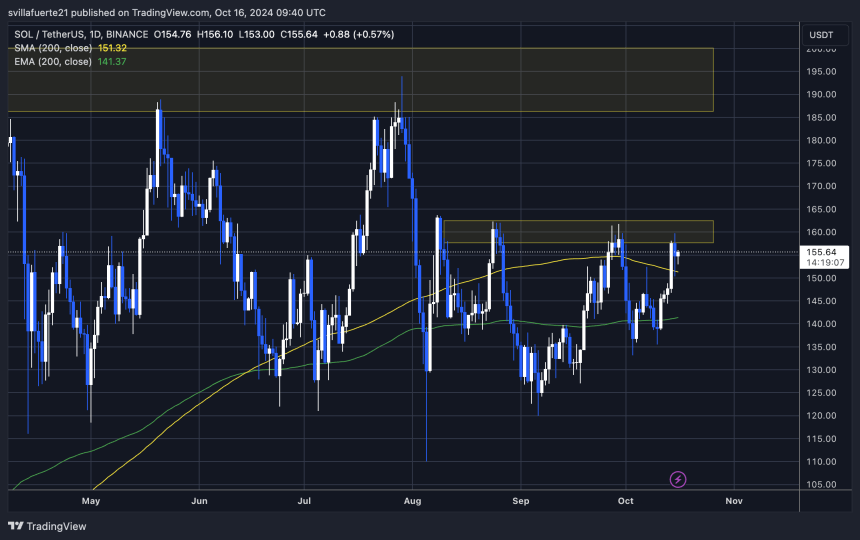

Solana is at the moment buying and selling at $155 after a risky session yesterday. The worth efficiently retested and now holds above the 200-day shifting common (MA) at $151, signaling robust assist for the asset. This degree has been a key indicator for merchants, and sustaining it’s essential for sustaining the present bullish momentum.

For bulls to maintain the momentum going, SOL should keep above this 200-day MA and break by the $160 degree. Such a transfer would possible affirm a bullish pattern and propel Solana to check its yearly highs round $210. This might mark a major upward transfer, reflecting optimism out there and rising confidence amongst merchants and traders.

Nevertheless, the bullish momentum may weaken if the worth fails to shut above $160 and holds above the 200-day MA. On this case, a retracement is probably going, with the worth probably dropping to decrease demand ranges round $140.

Associated Studying

This correction would function a consolidation part earlier than any additional upward strikes. Merchants are intently watching these key ranges as they may dictate Solana’s subsequent main transfer out there.

Featured picture from Dall-E, chart from TradingView