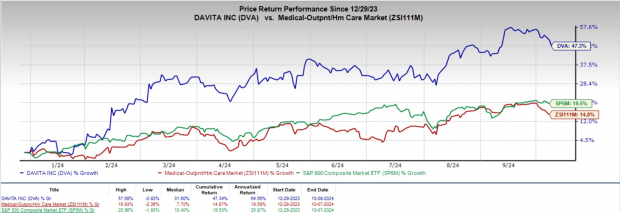

DaVita, Inc. DVA has witnessed robust momentum yr thus far, with its shares up 47.3% in contrast with the trade’s progress of 14.8%. The S&P 500 composite has risen 19.5% in the identical interval.

DaVita, carrying a Zacks Rank #2 (Purchase) at current, is witnessing an upward development in its inventory value, prompted by the corporate’s enterprise mannequin. The optimism, led by a stable second-quarter 2024 efficiency and the acquisition of dialysis facilities, is predicted to contribute additional.

DaVita is a number one supplier of dialysis providers in america to sufferers affected by persistent kidney failure, also referred to as end-stage renal illness (ESRD). The corporate operates kidney dialysis facilities and gives associated medical providers, primarily in dialysis facilities and contracted hospitals throughout the nation. Its providers embody outpatient dialysis providers, hospital inpatient dialysis providers and ancillary providers reminiscent of ESRD laboratory providers and illness administration providers.

Picture Supply: Zacks Funding Analysis

Catalysts Driving DaVita’s Progress

The rally within the firm’s share value might be attributed to the power of its dialysis and associated lab providers. The optimism led by a stable second-quarter 2024 efficiency and sturdy enterprise potential are anticipated to contribute additional.

DaVita is experiencing vital progress pushed by its patient-centric care method, leveraging its kidney care providers platform to supply a variety of therapy fashions and modalities. The growing prevalence of value-based partnerships in kidney well being allows nephrologists, physicians, and transplant applications to collaborate extra successfully, enhancing the understanding of particular person affected person wants and facilitating improved care coordination and early interventions.

A key aspect of DaVita’s progress technique is the acquisition of dialysis facilities and associated companies, as evident from the latest extension of its pilot section for a provide and collaboration settlement with Nuwellis. Upon completion of this section, which ends on Aug. 31, 2024, DaVita might lengthen the settlement for the continued provision of inpatient and outpatient ultrafiltration providers for as much as 10 years.

The corporate’s international market share can be on the rise, with latest agreements to develop operations into Brazil, Colombia, Chile and Ecuador.

Within the second quarter of 2024, DaVita reported outcomes that exceeded expectations, showcasing a optimistic development in each income streams and affected person providers. The sequential improve in each day United States dialysis remedies and the opening of latest facilities, together with acquisitions abroad, signifies a powerful progress trajectory.

Moreover, DaVita has raised its earnings projections for fiscal 2024, now forecasting adjusted EPS within the vary of $9.25 to $10.05, up from the prior vary of $9 to $9.80, which is more likely to appeal to additional curiosity from traders.

Danger Issue

DaVita faces a threat of decreased profitability if sufferers shift from business insurance coverage to authorities applications, as authorities reimbursement charges are considerably decrease. This shift might be triggered by rising unemployment, impacting DaVita’s revenues and revenue margins.

A Have a look at Estimates

The Zacks Consensus Estimate for DaVita’s 2024 and 2025 backside line tasks an 18% and 14.4% year-over-year enchancment, respectively, to earnings of $9.99 and $11.42 per share.

Up to now 30 days, the Zacks Consensus Estimate for the corporate’s 2024 earnings has remained fixed at $9.99 per share.

Revenues for 2024 and 2025 are anticipated to rise 5.4% and 4%, respectively, to $12.8 billion and $13.3 billion on a year-over-year foundation.

Different Key Picks

Another top-ranked shares within the broader medical house are Rockwell Medical RMTI, Quest Diagnostics DGX and RadNet RDNT. Whereas Rockwell Medical carries a Zacks Rank #1 (Sturdy Purchase), Quest Diagnostics and RadNet carry a Zacks Rank #2 every at current.

Rockwell Medical earnings surpassed estimates in every of the trailing 4 quarters, with the common being 87.9%.

RMTI’s shares have gained 79.7% in contrast with the trade’s 10.7% progress yr thus far.

Quest Diagnostics has an estimated long-term progress charge of 6.8%. DGX’s earnings surpassed estimates in every of the trailing 4 quarters, with the common being 3.3%.

Quest Diagnostics has gained 7.9% in contrast with the trade’s 14.9% progress yr thus far.

RadNet’s earnings surpassed estimates in every of the trailing 4 quarters, with the common shock being 98.2%.

RDNT’s shares have gained 93.7% yr thus far in contrast with the trade’s 14.8% progress.

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.