The upper-than-anticipated US core Shopper Value Index (CPI) studying was adopted by a decline in Bitcoin (BTC) value because it tumbled virtually 1.5% to $56,168 at press time.

US Headline CPI Matches Forecast, Core CPI Exceeds It

US headline CPI, the metric sometimes used to evaluate the inflation charge within the nation, got here in in response to expectations at 0.2% month-over-month (MoM), and a couple of.5% year-over-year (YoY) for August 2024. Nevertheless, core CPI (MoM) printed 0.3%, barely larger than the 0.2% forecasted by economists.

For the uninitiated, the distinction between the headline CPI and core CPI is the constituents of the basket of things they assess. Whereas the headline CPI measures all merchandise classes, together with housing, transportation, companies, medical care, meals, and power, core CPI excludes meals and power costs to offer a extra steady view of underlying inflation tendencies.

By eradicating the worth of unstable gadgets from its calculation, core CPI is commonly thought of a extra correct indicator of long-term inflation.

Following the sudden core CPI print, BTC witnessed a fast decline in value because it fell from round $57,000 to $56,168 on the time of writing. The broader crypto market displayed comparable tendencies as Ethereum (ETH), Binance Coin (BNB), Solana (SOL), and Ripple (XRP), that are down by 2.1%, 1.3%, 4.6%, and a couple of.4%, respectively.

With the CPI information for August 2024 launched, it appears all however sure that the US Federal Reserve (Fed) will start its rate-cut cycle with a 25 foundation factors (bps) reduce in September. In a be aware, Capital Economics’ Paul Ashworth mentioned:

On stability, we nonetheless assume the Fed will start its charge reducing cycle with a extra modest 25 bps reduce. The three.2% annual core CPI was largely because of a 5.2% improve in shelter costs, whereas the three-month annualized core CPI rebounded solely to 2.1% from a weak 1.6%.

Associated Studying

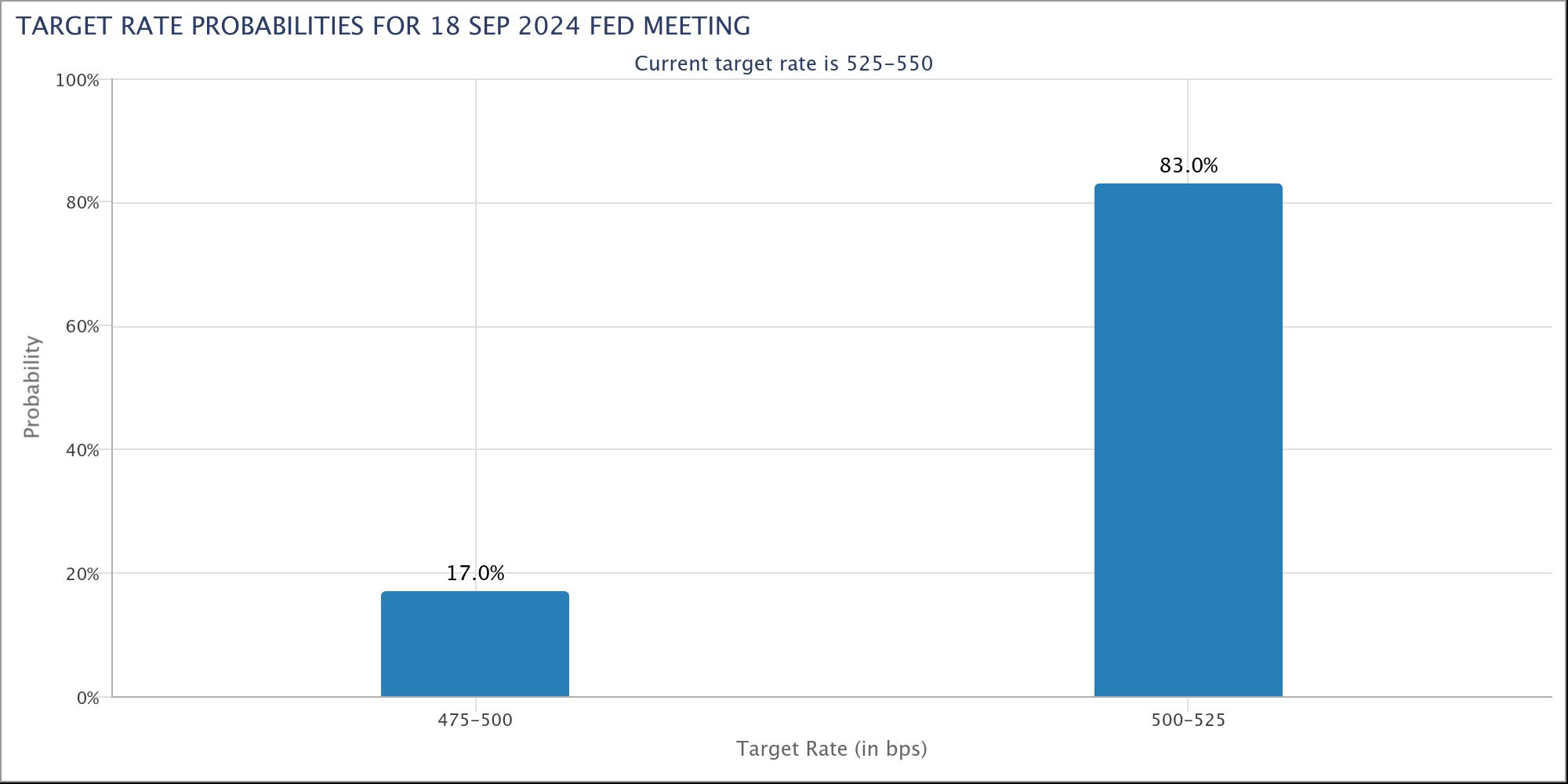

Certainly, following the CPI information launch, the chance of the Fed slashing charges by 25 bps subsequent week has jumped to 83%, per information from CME FedWatch. Assuming the Fed reduces charges by 25 bps, it ought to instill some confidence in crypto and inventory markets, fearing a 50 bps reduce might sign the Fed not being totally assured in its capability to sort out inflation.

What Lies Forward For Bitcoin?

As BTC stays loosely range-bound between $52,000 to $70,000 on the every day chart, analysts are speculating on the longer term trajectory the main digital asset’s value might take.

Some analysts opine that BTC’s present value motion is harking back to the same value consolidation in 2023. If the identical situation performs out in 2024, we might see a brand new Bitcoin all-time-high (ATH) value.

It’s going to even be fascinating to see the influence of the US Presidential Elections scheduled to occur in November 2024. Curiously sufficient, some election-agnostic analysts have said that regardless of who wins the election later this yr, BTC is slated to win in the long run.

Associated Studying

On the time of writing, Bitcoin trades at $56,168 whereas the full cryptocurrency market cap sits at $1.94 trillion, down 2.3% previously 24 hours.

Featured Picture from Unsplash.com, Charts from cmegroup.com and TradingView.com