The conflict which broke out in Israel final 12 months is only one enviornment of geopolitical battle worldwide in recent times. Previous to October 7 there was in fact the beginning of the Russia-Ukraine conflict and as well as there are mounting considerations in East Asia over an ever-strengthening China. Consequently many international locations are rising their protection budgets and protection corporations are benefitting from rising demand whereas creating options and merchandise to fulfill altering wants. A survey of the protection sector latest carried out by analysts at funding financial institution Oppenheimer noticed that geopolitical, technological and army modifications worldwide are essentially the most vital and speedy seen previously 85 years.

Oppenheimer says that international locations like China, Russia, Iran and North Korea are figuring out alternatives to vary the world order. The funding financial institution sees the change as structural and that if the US and its allies need to stay the dominant drive on the planet, they are going to be compelled to speculate very massive assets in expertise to fortify their army benefit.

Israeli protection corporations traded on the Tel Aviv Inventory Alternate have been benefitting from this development and the monetary reviews that they printed in latest weeks revealed $1 billion in new contracts in Israel and overseas. Working in varied sectors of the protection trade, a few of these corporations are having fun with a protracted growth in enterprise.

Elbit Programs Ltd. (Nasdaq: ESLT; TASE:ESLT)

$930 million in new contracts

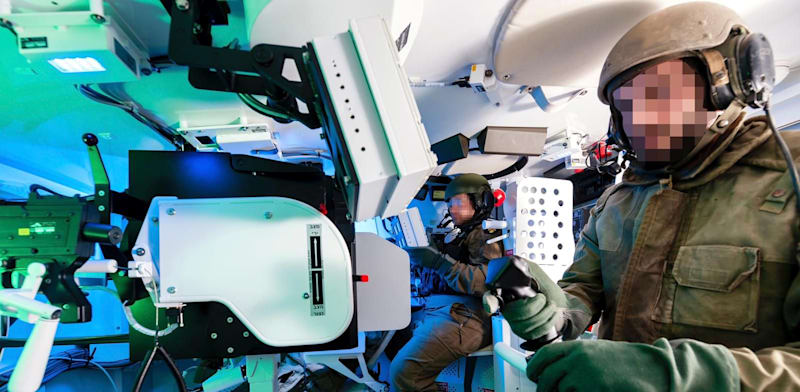

Elbit Programs is the most important Israeli protection firm traded on the TASE. The corporate develops and produces protection programs and weapons to be used at sea, within the air and on land and has loved report orders over the previous 12 months, together with over the summer time. On the finish of July, Elbit reported a $190 million contract to provide Iron Sting precision guided mortar munitions to Israel’s Ministry of Protection and subsequently reported a $340 million contract to provide ammunition to the Ministry of Protection. Contracts had been signed with abroad prospects: a $270 million deal to provide rocket artillery and a $130 million deal for Iron Fist protection programs to a European nation.

But regardless of Elbit’s unprecedented backlog of orders, the corporate’s share value has risen negligibly this 12 months as a consequence of stress on traders to promote the inventory from anti-Israeli organizations and comparatively low money stream that doesn’t replicate the leap in orders. Elbit presently has a market cap of $9.1 billion.

Imagesat Worldwide (TASE: ISI)

RELATED ARTICLES

$84.5 million in satellite tv for pc and evaluation companies offers

The Yehud-based satellite tv for pc companies firm has signed two big contracts in latest weeks: the corporate introduced that it’ll present a buyer in Asia with two satellites and associated services, for $30 million over a three-year interval. In July, the corporate reported a service contract value $54.5 million within the area of analytics primarily based on satellite tv for pc intelligence. ImageSat’s share value has risen 6.5% over the previous 12 months and it has a market cap of NIS 784 million.

Ashot Ashkelon Industries Ltd. (TASE:ASHO)

$23.5 million order to fabricate and provide elements

Ashot manufactures jet engine shafts, transmissions, gears and gearboxes, touchdown gear elements and tungsten merchandise for the aerospace and protection industries together with for armored autos and tanks just like the Merkava and Namer. Based in 1967, the corporate has 440 staff in Israel and the US and prospects embody main plane producers.

In August, the corporate reported receiving new orders from the Ministry of Protection, for the manufacturing and provide of assemblies that embody spare components and system refurbishment value NIS 86.4 million ($23.5 million in keeping with the present alternate charge), for supply over two years. The corporate has reported that the tempo of latest orders from the Ministry of Protection has elevated considerably because of the conflict, together with merchandise that weren’t beforehand ordered from it. The conflict has boosted Ashot Ashkelon with its share value rising 101% over the previous 12 months, giving it a market cap of Nis 816 million.

Aryt industries (TASE: ARYT)

$218 million to provide fuzes

Aryt Industries, which is predicated in Sderot on the Gaza border has acquired massive quantity orders all year long and manufactures drones and army digital merchandise. In August, it acquired an order from the Ministry of Protection to provide NIS 80 million ($21.8 million in keeping with the present alternate charge) value of fuzes by 2025. The corporate that due to this and former orders from the Ministry of Protection, it’s increasing its manufacturing strains and workforce. Aryt is among the greatest performing shares over the previous 12 months on the TASE with a return of 134%, which has boosted its market cap to NIS 465 million.

IMCO Industries (TASE: IMCO)

$7 million contract for a subsidiary

IMCO has been one of the crucial excellent shares on the TASE over the previous 12 months with its share value skyrocketing $176%. The Haifa-region primarily based firm manufactures digital, mechanical and electro-mechanical merchandise for army use and is traded with a market cap of NIS 134 million. The corporate’s US subsidiary not too long ago acquired a brand new order value $7 million to fabricate and provide elements for a US protection firm for supply between 2025 and 2027.

Orbit Applied sciences (TASE: ORBI)

$6 million contract for satellite tv for pc communications programs

Netanya primarily based Orbit Applied sciences supplies communication and audio administration in airborne programs, and terminals for airborne and marine satellite tv for pc communication. Final month Orbit introduced $6 million in orders to provide satellite tv for pc communications programs for brand spanking new naval army platforms. The orders got here from an integrator in Asia and will likely be delivered between 2025 and 2030. After a leap of 16.2% in its share value within the final 12 months, Orbit is traded at a market cap of NIS 586 million.

PCB Applied sciences (TASE: PCBT)

$6 million contract for an Israeli buyer

Two weeks in the past PCB Applied sciences reported an order to provide printed circuits that can then be assembled as a part of a safety undertaking for a buyer within the protection trade in Israel. The contract is value $5.6 million. This week the corporate introduced a follow-up order value $7.4 million for the provision of digital gear merchandise and printed circuits for a protection undertaking in Israel. With contracts reported totaling $49 million for the reason that begin of the 12 months, PCB’s share value has jumped nearly 92% previously 12 months to offer a market cap of NIS 398 million.

NextVision Stabilized Programs (TASE: NXSN)

$1.1 million for particular stabilized cameras

The Ra’anana-based firm develops and manufactures stabilized day and night time cameras, that are primarily used for drones. Its answer helps to stabilize the picture even in tough flight circumstances. The corporate’s prospects are within the protection sector, nevertheless it additionally has business prospects. Amongst its prospects are the Ministry of Protection, Elbit Programs and Israel Aerospace Industries. The corporate has introduced over the previous month an order value $1.1 million for the acquisition of cameras and different merchandise for supply this 12 months. NextVision’s share value has soared 114% over the past 12 months, giving a market cap of NIS 3.8 billion.

Printed by Globes, Israel enterprise information – en.globes.co.il – on September 5, 2024.

© Copyright of Globes Writer Itonut (1983) Ltd., 2024.