Bitcoin has noticed a pullback all the way down to the $58,000 stage through the previous day. Right here’s what might be the trigger behind it, in accordance with on-chain knowledge.

Exchanges Have Seen A Giant Quantity Of Tether Withdrawals Not too long ago

In accordance with knowledge from the market intelligence platform IntoTheBlock, centralized exchanges have just lately seen a Tether (USDT) outflow spree exceeding $1 billion.

Associated Studying

Buyers often hold their cash in exchanges after they need to commerce them within the close to future, so them making the transfer to withdraw their tokens doubtlessly implies that they’re keen on holding into the long-term.

For risky property like Bitcoin, alternate outflows can naturally be a bullish signal for that reason. Within the context of the present matter, although, the asset being withdrawn is a stablecoin, so the implication for the market is a bit completely different.

Typically, traders retailer their capital within the type of fiat-tied tokens like Tether after they need to escape the volatility related to cash like BTC. Such holders do finally plan to enterprise again into the opposite facet of the market they usually could use exchanges for doing so.

When holders purchase into property like Bitcoin utilizing their stablecoin, they naturally find yourself boosting their costs. As such, alternate inflows of stables is usually a bullish signal for the sector.

Withdrawals of USDT and others into self-custody as a substitute, nevertheless, is usually a bearish signal for the market, because it reveals the traders don’t consider they’d be making a swap into the risky facet within the close to future.

The newest Tether withdrawals could, subsequently, be why the Bitcoin worth has tumbled. This USDT exiting exchanges may even have represented recent BTC sells, as many traders like to maneuver into self-custody as quickly as they’ve swapped between property.

As IntoTheBlock has identified within the chart, the final two massive USDT alternate outflows additionally had a bearish impact on BTC.

In another information, the cryptocurrency derivatives market as an entire has seen a considerable amount of liquidations on account of the volatility that Bitcoin and different cash have displayed through the previous day.

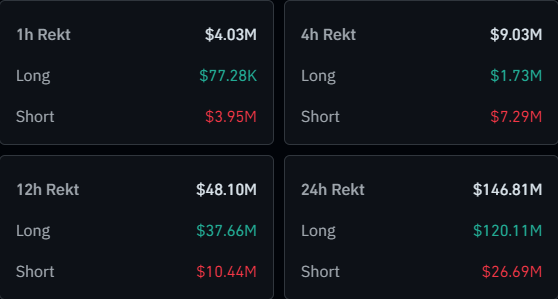

Beneath is a desk from CoinGlass that sums up the liquidations which have occurred within the newest risky market section.

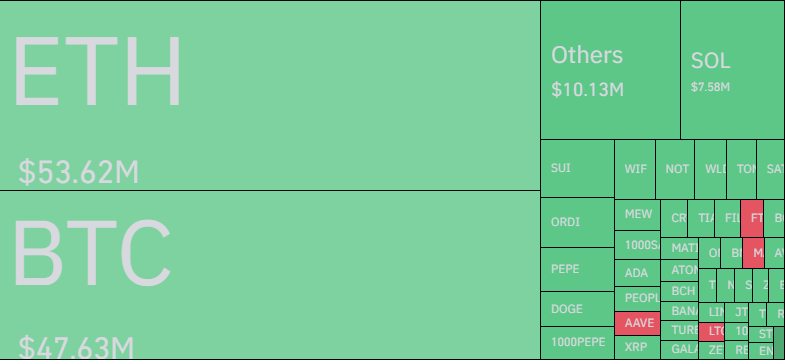

As is seen above, round $146 million in cryptocurrency liquidations have occurred over the previous day, with $120 million coming from the lengthy contracts alone, representing greater than 80% of the full.

Associated Studying

Curiously, Ethereum (ETH) is the image that has contributed probably the most in direction of this derivatives flush and never Bitcoin like is often the case. That mentioned, ETH has solely $6 million extra liquidations than BTC.

BTC Value

On the time of writing, Bitcoin is buying and selling round $58,800, down 4% over the past 24 hours.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com