Ethereum, mirroring the efficiency of Bitcoin and different prime altcoins, is again above $3,000, days after the autumn beneath $2,800. Because the second most dear coin recovers, injecting optimism amongst crashed token holders and merchants, an in depth above $3,200 will likely be essential in catalyzing demand.

Ethereum Rising: Will Bulls Push Above $3,200?

In keeping with IntoTheBlock on July 10, if Ethereum edges above the $3,200 degree, it is going to be an enormous improvement for merchants. When this occurs, an estimated two million entities who traded ETH at this worth level will likely be within the cash.

Due to this fact, if costs retest this degree, those that went lengthy can exit at break even. Alternatively, different “diamond palms,” anticipating extra features on the horizon, can double down and journey the anticipated leg up.

Associated Studying

To date, there are hints of energy. Nevertheless, although sellers are nonetheless in management, a breach of $3,300 will likely be essential within the brief to medium time period. The $3,300 degree, trying on the ETHUSDT candlestick association within the every day chart, is earlier assist, however it’s now resistance.

A breakout, ideally with rising quantity, will probably function a base for extra features, lifting the coin in the direction of a key liquidation degree at $3,700 and later $3,900.

Conversely, if sellers take over, reversing current features and aligning with the July 4 and 5 losses, a drop beneath $2,800 will sign development continuation. candlestick preparations, Ethereum will dump to new multi-week lows in that occasion, even dropping to $2,500.

Eyes On Spot ETFs, Whales Accumulating As ETH Turns into Scarce

Total, analysts are optimistic, anticipating Ethereum to drift larger. The anticipated launch of spot Ethereum exchange-traded funds (ETFs) within the coming days is a giant catalyst behind this bullish outlook.

Like spot Bitcoin ETFs opened the floodgates for institutional publicity on the planet’s most dear coin, the identical influx will probably be seen in ETH. With institutional demand, helps suppose ETH will tear larger, breaching $4,100 and registering new 2024 highs within the coming months.

Associated Studying

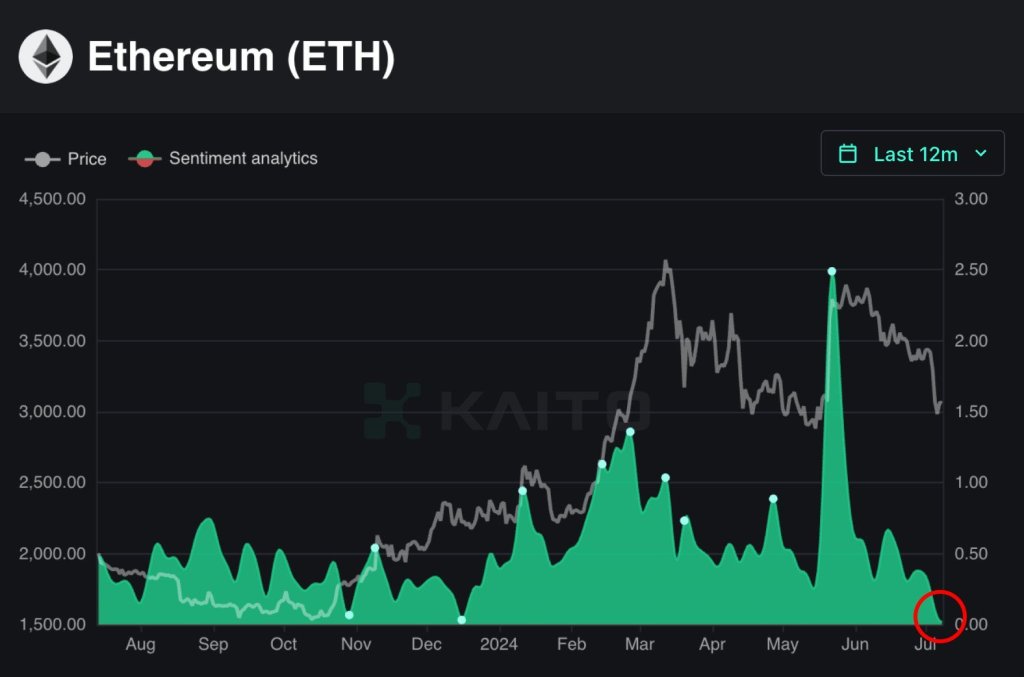

Curiously, even the spot Ethereum ETF launch expectations don’t appear to alter merchants’ outlook. On-chain knowledge reveals that bullish sentiment is at a one-year low, pointing to warning amongst ETH holders.

In the meantime, as on-chain knowledge illustrates, ETH outflows from exchanges have elevated lately. All exchanges, together with Binance and Coinbase, management 10.17% of ETH in circulation. Parallel knowledge additionally reveals that one other chunk, representing 28% of all ETH in circulation, is staked.

Function picture from DALLE, chart from TradingView