Defunct Bitcoin alternate Mt. Gox has lastly introduced the ultimate date to start refunding Bitcoin and Bitcoin Money (BCH) to affected clients, beginning as early as this week.

This eagerly awaited announcement has raised issues inside the cryptocurrency group relating to the potential contribution of those clients to ongoing promoting strain within the Bitcoin market.

Specialists Assured In Absorbing Potential Mt. Gox Promote-Off

Whereas some analysts categorical apprehensions about potential losses in Bitcoin, they typically agree that any sell-off issues associated to Mt. Gox will probably be contained and short-lived.

Lennix Lai, chief business officer (CCO) of crypto alternate OKX, believes that a lot of Mt. Gox’s early customers and collectors are long-term Bitcoin lovers who’re much less more likely to promote their total Bitcoin holdings instantly.

Drawing comparisons to earlier sell-offs associated to regulation enforcement actions, such because the Silk Highway case, Lai highlights that they didn’t lead to sustained catastrophic worth drops.

Associated Studying

Specialists, together with Jacob Joseph, a analysis analyst at CCData, counsel that the markets have adequate liquidity to soak up any doable mass-market sell-off.

Joseph explains that a lot of Mt. Gox’s collectors might choose to obtain early compensation by accepting a ten% discount on their holdings, which would cut back the general promoting strain.

Latest worth actions point out that the non permanent affect of Mt. Gox repayments might already be factored into the market, additional supporting the view that the potential promoting strain may very well be mitigated.

Different Recipients And Time Ingredient

Alex Thorn, head of analysis at Galaxy Digital, believes that fewer cash can be distributed than anticipated, leading to much less promote strain than anticipated.

Nonetheless, Thorn acknowledges that even when solely 10% of the distributed Bitcoin is bought, it might nonetheless have a market affect. Thorn factors out that the majority particular person collectors deposit their cash straight into buying and selling accounts, making them simply sellable.

Vijay Ayyar, head of client progress for Asia-Pacific at crypto alternate Gemini, means that the general affect of the Mt. Gox disbursement is more likely to be dissipated as a result of assorted recipients of the funds.

Particular person holders will obtain their Bitcoin instantly, whereas a major quantity can be disbursed to claims funds, which is able to then be distributed to their restricted companions. Ayyar mentions that this course of might take time, including a time ingredient to the affect on worth.

Bitcoin Value Predictions For July

Because the cryptocurrency market enters the month of July, analysts are providing insights into Bitcoin’s worth prospects based mostly on historic traits and technical evaluation.

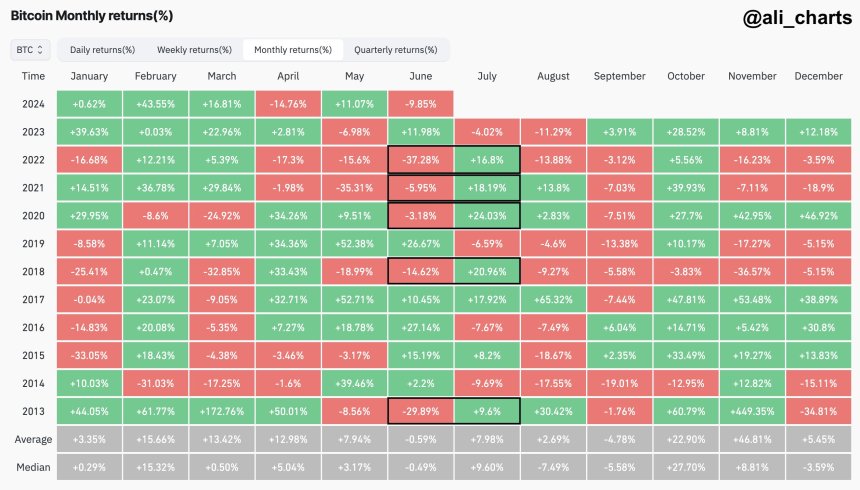

Notably, Ali Martinez suggests that Bitcoin has traditionally exhibited a robust rebound in July following a damaging efficiency in June. Martinez highlights that in this month, Bitcoin has proven a median return of seven.98% and a median return of 9.60%.

Martinez additionally emphasizes that Bitcoin at present demonstrates sturdy assist at $61,100, which might function a vital stage for worth stability. However, the analyst identifies $64,050 and $66,250 as a very powerful resistance areas.

Breaking by means of these resistance ranges is pivotal for Bitcoin’s potential to retest its all-time excessive of $73,700 in March of this 12 months.

Associated Studying

Supporting this view, one other technical analyst, Rekt Capital, suggests that Bitcoin reveals favorable worth motion to type a cluster on the Vary Low of $60,600. This clustering impact, in keeping with the analyst, might develop all through July.

This cluster formation goals to arrange for a possible rally again to the Vary Excessive at $71,500.

When writing, the biggest cryptocurrency available on the market trades at $62,630, up 2% within the 24-hour time-frame.

Featured picture from DALL-E, chart from TradingView.com