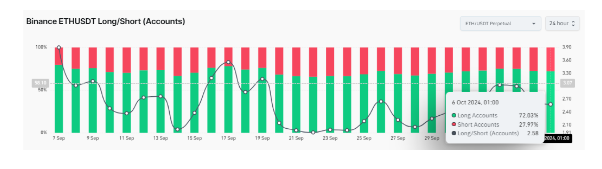

In a current buying and selling exercise on the crypto trade Binance, 72% of ETHUSDT merchants have taken lengthy positions. This attention-grabbing sentiment is revealed by means of the buying and selling analytics platform CoinGlass. This surge in lengthy place is extra notable because it comes after every week of Ethereum trending downwards.

Associated Studying

The robust tilt towards lengthy positions suggests that almost all merchants are assured Ethereum’s value will rebound within the coming week. Then again, 27.97% of Binance merchants are nonetheless holding quick positions on ETHUSDT.

ETHUSDT Lengthy Positions Soar: What’s Behind It?

Based on information from CoinGlass, the ETHUSDT merchants are at present leaning towards a bullish value for Ethereum within the coming weeks. Notably, the info is especially confounded by the ETHUSDT perpetual merchants.

The information reveals that the variety of merchants at present opening lengthy ETH positions on Binance considerably outweighs these opening quick positions by a ratio of two.58, highlighting the bullish sentiment amongst some cohorts of merchants.

In the mean time, it’s unclear why the vast majority of Binance perpetual merchants are going lengthy on Ethereum, apart from only a basic bullish sentiment on the long term, as there are not any expiration dates for his or her positions. 72.03% have lengthy ETHUSDT positions opened up to now 24 hours.

In the meantime, 27.97% of ETHUSDT merchants stay cautious and have taken quick positions throughout the identical timeframe. These merchants could also be skeptical about Ethereum’s value restoration in the long run. Compared, 58.15% of BTCUSDT merchants are going lengthy, whereas 41.85% have quick positions opened up to now 24 hours.

Nonetheless, wanting past Binance and on the wider crypto market, the sentiment seems to be much less bullish. Information from aggregated crypto exchanges reveals that spot merchants are adopting a extra impartial stance on Ethereum, and market individuals are equally break up between patrons and sellers. Notably, the Exchanges ETH Lengthy/Brief Ratio reveals 49.05% of market individuals are patrons, whereas 50.95% are sellers up to now 24 hours.

What’s Subsequent For Ethereum Value?

Whereas the lengthy positions on Binance counsel confidence in a rally, the impartial sentiment amongst spot merchants factors to a extra cautious outlook. On the time of writing, Ethereum is buying and selling at $2,420. Based on information from Coinmarketcap, the altcoin is at present down by 8.38% up to now 24 hours.

Associated Studying

Technical evaluation reveals that Ethereum is retesting a backside trendline and is on the verge of breaking to the draw back. If the bulls are unable to carry this trendline, it might cascade to an additional 10.7% fall in the direction of $2,150. On the constructive facet, a rebound on this trendline might push the crypto to the upside and retest $2,700 as October continues to play out.

Featured picture from Pexels, chart from TradingView