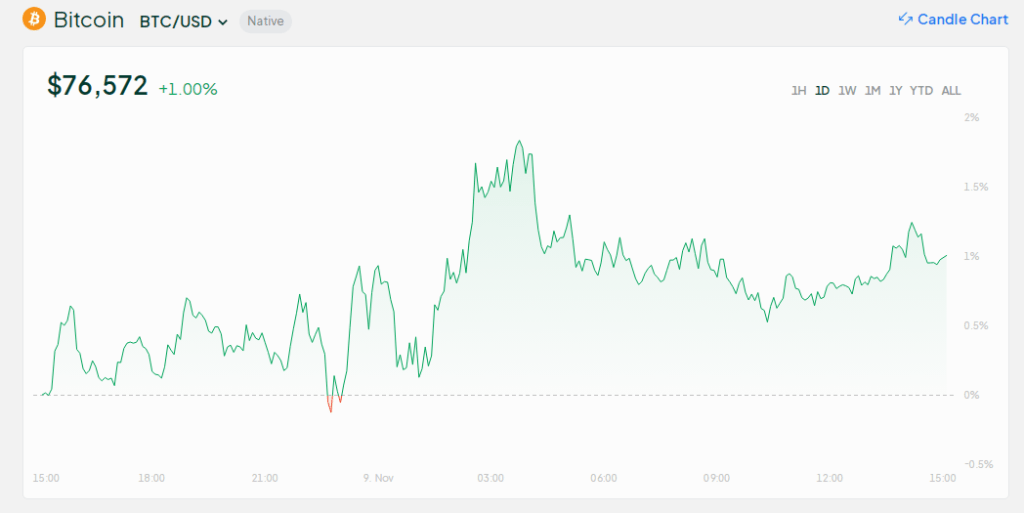

The momentum is on Bitcoin and crypto’s facet, and it wouldn’t be shocking if the worth surge continues till the tip of the 12 months. One of many greatest drivers of the present efficiency of Bitcoin is the election of Republican Donald Trump.

Associated Studying

Trump’s rhetoric and pleasant pronouncement on crypto helped propel the asset’s worth previous $76k, beating this 12 months’s March report.

Now, many market analysts stay bullish days after the US elections. Thomas Lee, CNBC contributor and the CIO of Fundstrat Capital, even pushed a bolder declare, saying that Bitcoin might commerce in six digits by 12 months’s finish. Lee states that the present market and political surroundings favor the highest coin and expects extra upside for digital property.

Trump’s Election Boosts Crypto Business

This Friday, the Fundstrat Capital CIO shared his ideas on Trump’s elections and BTC’s future at CNBC’s Squawk Field. In the identical dialogue, Lee shared that Bitcoin and most altcoins may have a worth rally within the brief time period.

“It’s going to be very troublesome to repair the deficit with simply adjustments in taxes and spending,” says @fundstrat‘s Tom Lee. He says bitcoin is “probably a Treasury reserve asset. If Bitcoin rises in worth, it truly helps offset the liabilities, which is the deficit.” pic.twitter.com/tVrnE37dhS

— Squawk Field (@SquawkCNBC) November 8, 2024

Lee shared that proper earlier than the elections, the worldwide markets confronted loads of uncertainties. Nevertheless, with Trump profitable the US elections and his favorable proposed insurance policies on Bitcoin, the crypto trade can count on higher days.

Lee added that adjustments in laws and pro-crypto insurance policies might energy the digital asset’s brief run. He additionally credit Trump for his expertise as a former president, which might help him higher navigate future challenges. With

Trump’s help and a good market surroundings, Lee displays on his preliminary goal of $150k for BTC, saying that is potential.

Bitcoin, Digital Property Can Assist Offset US Debt

One in all Trump’s marketing campaign guarantees is to chop the nation’s rising funds deficit, which now stands at greater than $35 trillion. Lee defined that it’s troublesome for Trump to chop taxes and spending to deal with the deficit.

As an alternative, Lee sees Bitcoin as the important thing to fixing the nation’s rising funds deficit. He sees the potential in BTC as a future Treasury asset, noting its rising market worth through the years.

Curiously, Trump has additionally explored the concept, saying that as president, he can organize the nation’s funds woes by handing “a Bitcoin verify.”

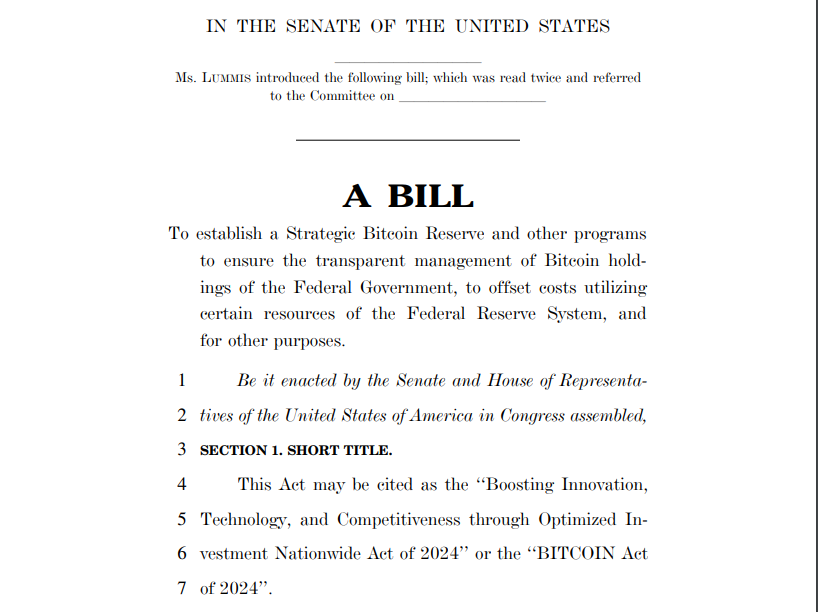

Bitcoin Act Gaining Momentum After The US Elections

Earlier than Lee’s feedback, there had been discussions on Bitcoin’s rising function within the nation’s monetary system. Senator Cynthia Lummis filed a invoice, the Bitcoin Act, to legitimize the crypto asset as an financial asset.

Associated Studying

In line with Senator Lummis, Trump’s win will favor the push to make Bitcoin an asset to assist fight financial uncertainties. One of many invoice’s suggestions was to carry as much as 1 million BTC over 5 years as a hedge towards inflation.

Featured picture from UpFlip, chart from TradingView